With all the chaos in the Energy space and select energy stocks (Oil, Oil services, Natural Gas, etc…), I’ve been giving a look into Master Limited Partnerships (MLPs) this week.

Simply put, this is a time where the actual valuation of the businesses is superseded by fear and other considerations.

We’ve seen a major panic in energy stocks. And, in particular, take a look at Kinder Morgan (KMI). It’s no longer an MLP, but it’s still the largest psychological anchor of the group. Also, we’re in the middle of tax loss selling season.

It’s worth looking for some bounce trades in Master Limited Partnerships and related stocks and ETFs as they test panic and reach into a the price discovery bag.

Wall St. Jesus noted some large put selling in Alerian MLP ETF (AMLP) earlier this week. Could this be a sign that a bottom is coming soon for select Master Limited Partnerships like AMLP?

$AMLP 5X NORMAL VOLUME TODAY, LED BY HUGE JAN PUT SELLING

— JE$US (@WallStJesus) December 15, 2015

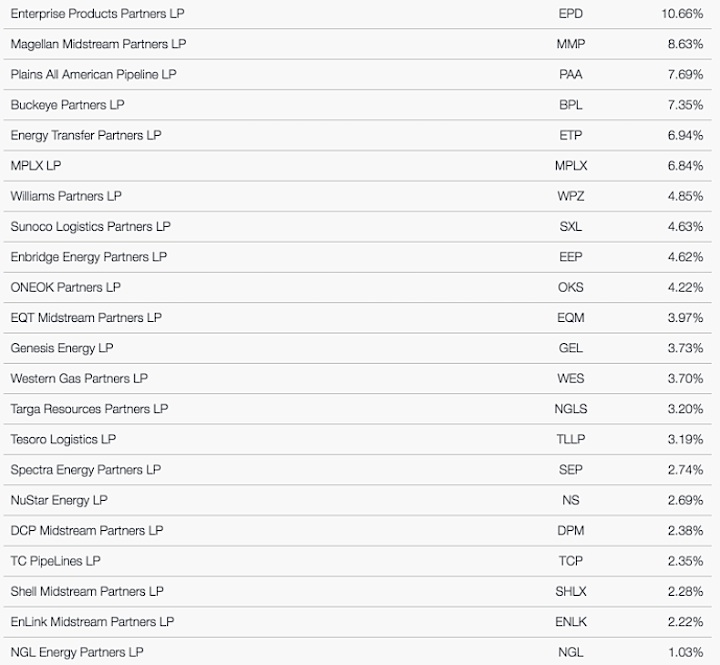

Here’s a list of AMLP’s holdings:

Here’s a look at the daily charts via FinViz (through 12/17):

Like at most bottoms, there isn’t much to be excited about technically. But the selloff may be nearing a countertrend rally (or relief rally). With this in mind, the Alerian MLP ETF (AMLP) might be a solid play for disciplined (and patient) traders.

Trade ’em well and thanks for reading.

Twitter: @ATMcharts

Read more from Aaron on his blog.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.