There is no better reality show for market junkies than the monthly obsession over the ‘critically important jobs number’ or the ‘most significant Federal Reserve decision this year’.

Every few weeks we are tortured by the buildup to releases/decisions that are transmitted in seconds leaving investors to wonder if their stocks just got voted off the island or if there’s a rose waiting for them from Wall Street.

I don’t want to add to this perpetual fascination, but I must say regarding this December 16th decision – This is the most important Federal Reserve decision in at least a generation. I feel better now (sort of).

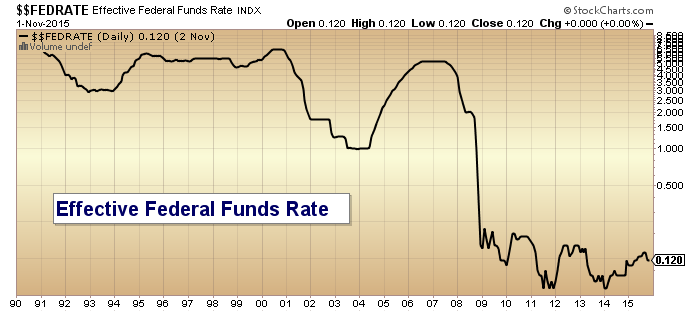

Without doubt, this is easily the most anticipated rate hike on record. The multi-year buildup of ‘when is the Fed going to act?’ has been well-documented, and the singular act of officially ending the Fed’s Zero Interest Rate Policy (ZIRP) will make history in itself. Amid all the hoopla, anticipation, jockeying and pontificating though, the Federal Reserve decision boils down to this: Credibility vs. Prudence and this is where real history will eventually be made.

If they do not act at a time when there is almost universal market expectation for a rate hike, Federal Reserve credibility will likely have never sunk to a lower level. On the other hand, are they truly being prudent hiking rates in the midst of bubbles already bursting (oil, junk bonds, China), amid mixed economic data, and potentially throwing gas on a fire when just the kindling has started to burn? Are they willing and ready to coordinate a move that increasingly is looking more like an attempt to remain credible with Wall Street than it is a move to put the brakes on an overheating economy?

There are three potential outcomes to the upcoming Federal Reserve decision that I see as most probable.

First, they hike rates and the market undergoes substantial turbulence to the downside (a smaller than anticipated hike is also a low-probability option but would likely lead to the same result).

Second, they do not hike rates and the market undergoes substantial turbulence to the downside, although given the market’s most recent slide, a ‘no move’ may actually lead to a short-lived relief rally.

Third, and the decision I think is most likely to play out, will be a hike accompanied by overly dovish comments, and excessive cheerleading about how positive this speaks of our economy. This scenario would likely correspond with a substantial stock market move to the upside. I believe that outcome also has the potential to result in a massive long-bond rally leading the 10-year Treasury on a path back under 2.0% yet this year.

If option three occurs and we do get a large stock market move toward the upside, I don’t expect it be lasting (probably enough to push shoppers to free up their wallets through a critical time), but over the next few weeks/months, reality will set in that not only was the Fed imprudent in raising rates, but given where the economy traverses to in 2016, they may have also sacrificed their credibility.

Make no mistake, this meeting and decision is the day many have referenced when they talked of the Fed painting themselves into a corner. The Federal Reserve’s credibility is on the line. Regardless if Door #1 or Door #2 is chosen, this Federal Reserve rate decision will go down in history.

Thanks for reading.

Heart Capital does not offer investment advice via this medium. Under no circumstance whatsoever do these postings, opinions, charts, or any other information represent a recommendation or personalized investment, tax, or financial planning advice.

Twitter: @HeartCapital

Any opinions expressed herein are solely those of the author and do not in any way represent the view or opinions of any other person or entity.