Volatility Rising as 2015 Headwinds Linger Into 2016

2016 Stock Market Outlook Summary

- Growth remains stable with a bias toward acceleration as recovery participation broadens

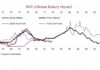

- Inflation moving toward trend

- 2015 Redux: Elevated valuations and investor illiquidity still represent risks for stocks

- Market Volatility rising as historically normal fluctuations return

- S&P 500 could reach 2250 by year-end, but sailing may not be smooth

- Fed rate hikes produce higher, flatter yield curve. 10-year T-Note yield could move toward 3.0%

Highlights:

- Gradual Rise in Interest Rates Not Necessarily Headwind for Stocks

- Wage Gains Suggesting Broadening in Economic Recovery

- Elevated Valuations Tend to Dampen Forward Returns

- Households Holding Lots of Stock, Little Cash

- Presidential Election Year Brings More Noise, Volatility

- Clock Is Ticking for Lagging Broad Market to Catch-Up to Popular Averages

All photographs are accurate. None of them is the truth. – Richard Avedon

Context helps turn accuracy into truth. Context is also what turns data and information into knowledge. Too often, and too easily, it is the missing ingredient as we slice and dice our way through signals and indicators. Instead, we latch on to phrases that sound robust (“Risk Management” is widely used right now) but are really just vessels for our own bias, our own pre-conceptions. Computing power is such that we can back-test our way to support almost any view on the stock market – but that does not mean such an outcome is likely. It is easy to hide behind a fancy façade, relying on the appearance of statistical robustness to believe what we want to believe, seeing only the evidence that fits our narrative. Amid all the noise and information we lose track of context. And getting distracted, we leave ourselves vulnerable to unforeseen outcomes.

It is a curious vulnerability that we can find more comfort in complex approaches than relatively simple ones. There is an almost reflexive view that gives great credence to elaborate constructions. We easily become too confident in our ability to predict the future and/or account for all possible outcomes. Thus begins the slippery slope from a modest effort to categorize risks and influences to more elaborate schemes that seem to provide all the answers.

Enough is enough. We tend to be too quick and too certain that we have gotten to the crux of the matter. Truth is, we do not know what the future holds. The time spent formulating and formatting an outlook will likely be directly correlated to the degree to which you are beholden to the views expressed therein. We want to push back against the neatly wrapped, fancily packaged outlook pieces that are laden with fancy graphics, interesting scenarios and multiple solutions. These can layer certainty upon certainty and incoming data is filtered only through the lens of the initial outlook. Not everything can be circumscribed. The future, while hinting at the past, will ultimately follow its own unique path.

The challenge for investors is to remain flexible and see the relevant context in the 2016 stock market outlook. The best setting for this is usually in quiet reflection. Truth and context are more likely to be revealed in the whisper than in the noise, and we usually notice them at the margin. We encourage, and do our best to offer, quiet meditation amid the din and glamour. Without discipline we risk being misled by our whims and distracted by our bias. But complexity breeds overconfidence, and overconfidence increases risk. We use our weight of the evidence approach to filter the news, follow trends and try to capture the relevant developments.

This is our modest effort to offer reflections on what has been (2015) and thoughts on what we might see next (in 2016). While we offer these observations and thoughts now, what matters more is how things develop as we go forward. We apologize in advance that we have more questions than we have answers. We are doing our best to be honest. Over time, successful investment is about having guide posts to lean on more than finding goal lines to cross.

Going into 2015, the biggest risks for stocks were overvaluation and a lack of investor liquidity. A year later, the story is much the same as we look at the 2016 stock market outlook. We learned again in 2015 that earnings forecasts are about as reliable as economic forecasts, which is to say, not very. Earnings were forecast to grow by double digits in 2015, but what has actually been seen was a decline of around 5%. It is difficult to get valuation relief when earnings fall more than prices. We continue to believe that elevated valuations will provide resistance for stock prices as we move into 2016 (and perhaps beyond). Household asset allocation figures show that despite professed nervousness and caution, investors remain fully invested in stocks. The lack of available cash on the sidelines has helped contribute to the bumpy ride experienced by many in 2015, and more of the same appears likely in 2016.

As we look toward 2016 we are chewing on three macro-related questions. Time (not this outlook) will provide the answers or perhaps just let us know that they were not questions worth asking.

- What, if anything, is weakness in the energy sector disguising (or telling us about) in the rest of the economy and stock market? There are two schools of thought here: weakness in energy is a harbinger of broader weakness or excluding the effects from the energy sector, growth and earnings are not in such bad shape. We would tend to favor the latter, but are watching for evidence in either direction.

- Can the economy gain sufficient traction that sales growth will accelerate, allowing improved earnings to provide valuation relief? Companies remain highly profitable, so it might not take much better top-line growth to see earnings recover, but getting consistent enough economic growth to realize this has been a struggle.

- Can the Federal Reserve preserve its credibility as it raises interest rates in an effort to “normalize” but not necessarily “tighten” monetary policy? We hope that we see less uncertainty (and maybe a diminished impact) from monetary policy in 2016, but a string of weaker-than-expected growth figures or hotter-than-expected inflation data points could put the Fed back on the hot seat.

There will be other questions worth asking and we should do so as necessary. But we need to do our best to avoid overemphasizing the noise at the expense of keeping in mind what is truly newsworthy. As a starting point, pay less attention to the headlines, and avoid being swayed by day-to-day fluctuations in the financial markets. Do not let market volatility in stocks let you lose focus on longer-term strategies and goals.

Federal Reserve Policy: Coming into 2015, we leaned against consensus and suggested that dollar strength, commodity weakness and global uncertainty could keep the Federal Reserve on the sidelines. At the time, median projections from FOMC participants saw a year-end 2015 Fed Funds rate near 1.5%. While those factors did guide the FOMC decision making process, it also became evident early in the year that Fed Chair Janet Yellen was interested in beginning to normalize monetary policy, starting with a gradual rise in interest rates.

They will likely take the first step on that path at the December 2015 FOMC meeting, where a 25 basis point hike in the Fed Funds rate is almost fully discounted by the market. All along Yellen has de-emphasized the timing of the initial rate hike, suggesting it is the path over the course of the tightening cycle (which the Fed has emphasized will be measured and gradual) that matters more. History agrees with this assessment, and in previous instances in which the Fed has pursued a slow tightening cycle, stocks have held up well.

continue reading on the next page…