The German stock market (DAX) is an integral part of the global finance ecosystem. In short, Germany is arguably the strongest representative of the financial state of Europe, and as such it bears importance on a global scale. And at this juncture, with the western markets trying to find their footing, it will likely be a driving directional force for markets around the world including the S&P 500 (SPY).

This global market leader currently finds itself at very important price zone, which could become a very high-risk level.

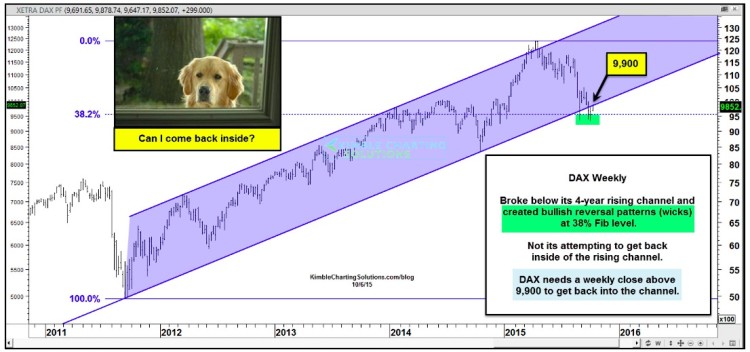

If you look at the chart below, you’ll notice that the German DAX has remained inside of tight rising channel since the lows in 2011. After touching the top of its channel earlier this year, the DAX failed to break out and proceeded to decline over 20%. The decline had so much momentum that the DAX actually closed below its rising channel for the first time in 4-years.

Now the German DAX is attempting to climb back inside the rising channel. And, as it stand, the DAX is bumping up against the underside of that old support (and the old support has become a new German DAX resistance level).

This German DAX resistance comes into play around the 9,900 level (give or take) on a weekly basis.

I shared this chart because I believe that the DAX is important in both the short and intermediate term. And how this level shakes out on a weekly basis could determine the direction of global stocks near-term: Either it will firmly climb back into the channel or it will fail right around that German DAX resistance line in the coming days.

Which ever it does will likely have a large influence on the U.S. stock market Indices. Stay tuned friends, I don’t think this is your average test of resistance. Thanks for reading.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.