As we move into the 4th quarter, investors are in a tricky spot. The current corrective action in stocks has begun to consolidate as investors await the next catalyst and/or market trends to emerge.

Will the basing continue? And ultimately, will the market break higher or lower into year end?

Inquiring minds want to know. Let’s dig into emerging market trends and themes to get a better picture of what we are up against.

Here’s what I am watching as we move into the 4th quarter and towards the end of the year.

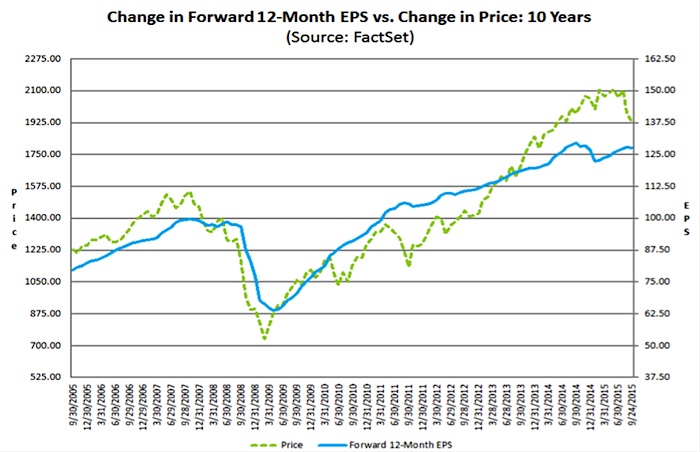

1. Continued deterioration of earnings and expectations

The S&P 500 is estimated to see Q3 earnings decrease of -4.5% year over year. If that were to happen, it would mark the first back to back quarterly earning declines since 2009 (per FactSet). Of course, the important question is are these estimates too pessimistic or positive?

2. Falling Rates – or a steepening yield curve?

We’re seeing clear toppy behavior on the short end of the treasury rate spectrum.

The two year treasury yield saw a massive failed breakout around the September Fed meeting. It can bounce here around the 200 day moving average, but eventually looks lower.

The 10 year treasury yield has failed to break it’s downtrend from the 2007 high. Now, resistance has strengthened. However, the long term moving averages are trying to

Much like the 10 year treasury yields, 30 year yields have found resistance strengthening.

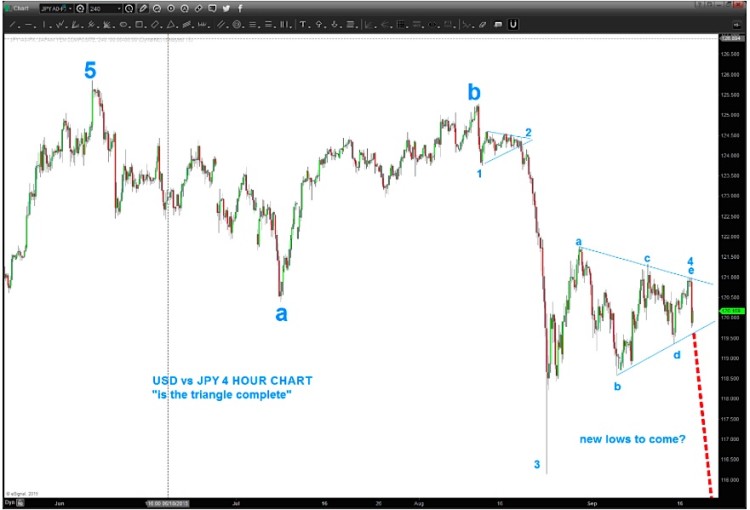

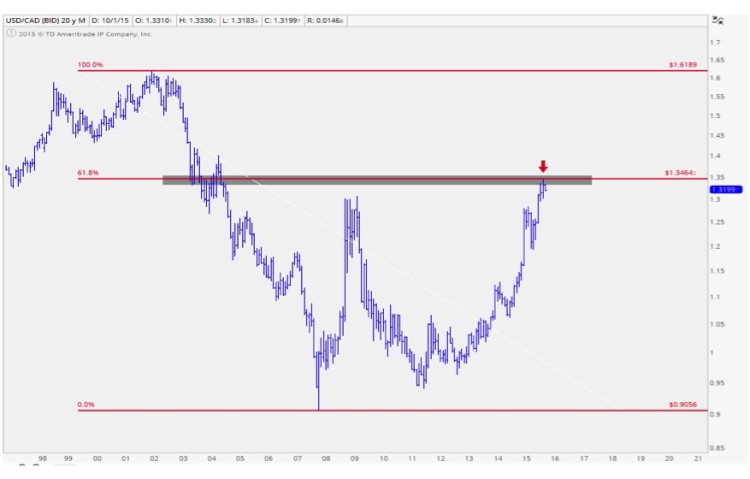

3. Major Trading Opportunities in currencies

@BartsCharts is looking for a major move lower in the US Dollar / Yen pair.

@allstarcharts notes the major pivot area in the Canadian Dollar / US dollar pair.

continue reading on the next page…