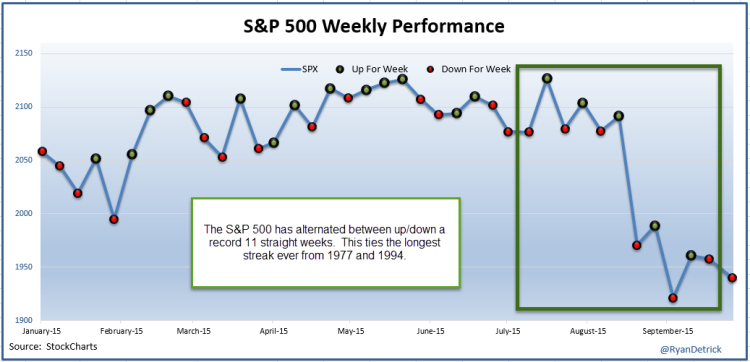

Although the bears have wrestled control over the general short-term direction of stocks of late, would you believe we are actually navigating through a historically choppy market? Turns out, the S&P 500 has alternated between up/down a record 11 straight weeks (after last week’s small loss). This all comes amidst the latest uptick in market volatility.

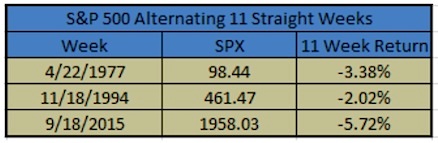

There were just two other times going clear back to 1928 that the S&P 500 alternated 11 straight weeks.

Once was in 1977 and the other was in 1994.

As you can see below, the previous two times this happened, each sported a negative return during the chop. This recent chop is actually the weakest yet though.

What does it mean? Well, for starters I would like a bounce this week to set the record. Who doesn’t like new records? Now, I noted recently that this week is historically very bearish, but still, historical studies aren’t gospel – only a potential guide.

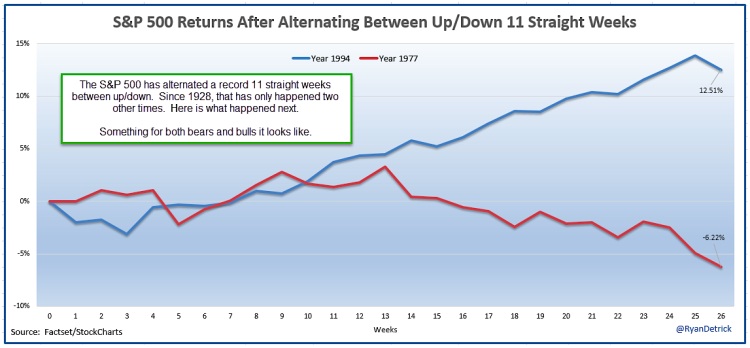

Lastly, here is what the S&P 500 did the next six months after the two previous record periods of choppiness and market volatility. Wouldn’t you know it, something for both bulls and bears alike.

Thanks for reading and good luck out there.

Twitter: @RyanDetrick

Read more from Ryan on his tumblr.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.