If the Federal Reserve raises rates this year, it will be one of the worst policy mistakes made be any Central Banker (in my opinion). The Fed hasn’t raised rates in the face of a slowing economy despite their rhetoric to the contrary. Remember, the Fed MUST talk up the economy because if they don’t, consumers may stop spending and that could cause a recession.

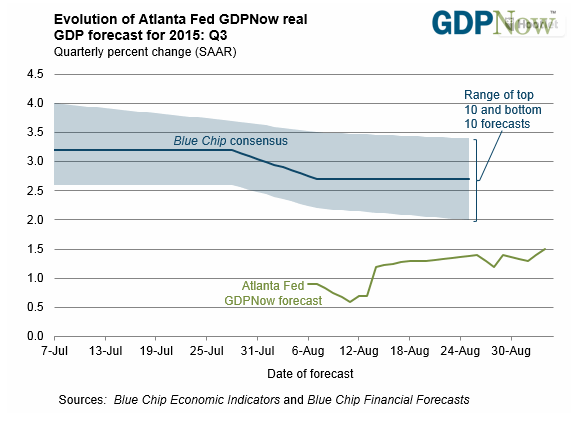

They have to talk up the economy but the numbers tell the real story. And here is what the Atlanta Fed (which has been very accurate of late) is saying:

The Atlanta Fed is predicting Q3 US GDP to be 1.5%. The ‘Blue Chip’ consensus (those talking heads on TV) are still predicting that Q3 GDP will be between 2 and 3.5%. In other words, the street is positioned for much greater growth than the Atlanta Fed is predicting. IF the Atlanta Fed is correct, then the stock markets (i.e. the S&P 500) may continue to struggle as it becomes more apparent…and bonds could continue to move higher (i.e. TLT – the 20+ year treasury bond ETF).

This is just one of the research tools I use…but all of the tools that I use globally are all pointing to the same thing: a slowing global economy (and slower growth at home).

I do not take this lightly—I get up every day and closely track what is going on in the global financial markets. In short, I am not basing my portfolio allocation on what happens to stocks from day-to-day, but on the underlying trends that ultimately will determine the direction of stocks and bonds.

And until I see some substantial changes, I will be staying in cash and US Treasuries… and believing that a Fed rate hike isn’t (shouldn’t) be in the cards until at least next year. Thanks for reading.

Twitter: @JeffVoudrie

Author carries exposure to mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.