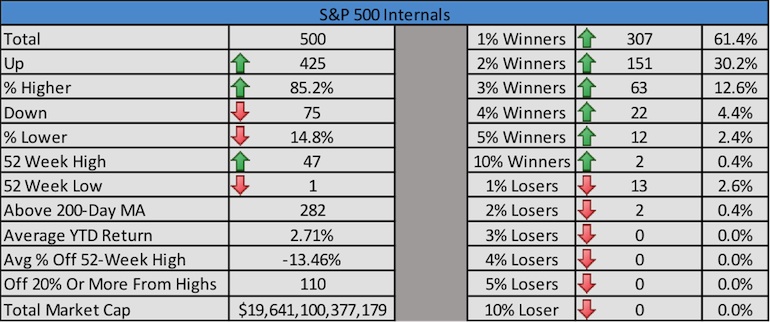

If you guys follow me on Twitter and StockTwits, then you know I’ve been working on what I call my Detrick Daily Scorecard. It is a spreadsheet that tells you anything and everything you need to know about what happened today. I have everything in it from global markets, to currencies, to bonds, to top and bottom performing stocks in the S&P 500, to 50 sectors, to S&P 500 internals.

Here is a sample of it:

Daily Scorecard. Added commodities. Also avg stock % off 52-week high and how many stocks down 20% or more. $SPY

— Ryan Detrick (@RyanDetrick) Aug. 10 at 09:46 AM

What I want to focus on is the S&P 500 Internals. You can see that as of Monday afternoon, 47 components were making new highs, while just one was making new lows.

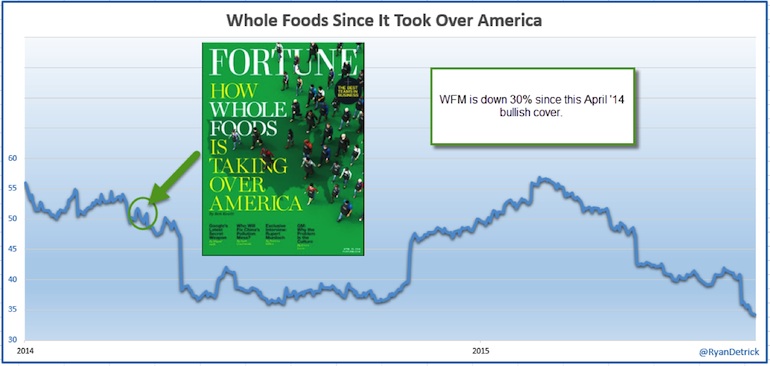

So who was making that new low? It was healthy grocery giant Whole Foods Market (WFM). That right there tells us something is wrong, if it is making new lows when no one else is. Here’s what I find fascinating about WFM, everyone loves it. I live in Ohio and we have a few here and people swear by them. I’ve been there a few times and the store is always crowded. But here’s a little secret: Great companies don’t always make great stocks to own. Sometimes expectations simply get too high and it is nearly impossible to reach that high bar.

Last April, Fortune had a bullish cover on the company. The title was “How Whole Food Is Taking Over America”. That is pretty over-the-top in terms of bullishness. Remember, once everyone loves something, it probably means they have already bought – so only sellers are left. Below is a chart of what happened to Whole Foods and how great companies don’t always equate to great stocks.

This doesn’t mean that some magazine covers can’t be right, but as an investor be very aware that once a company is on a magazine cover it could mean the good times are over.

Thanks for reading and good luck out there.

Twitter: @RyanDetrick

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.