In this new weekly column you will find information regarding all the Initial Public Offerings (IPO) scheduled to price and start trading in the upcoming week, with one of the most interesting or “hot” deals being highlighted with more details. Also in this column will be comments on the current state of the IPO market and tidbits on what to look out for when trading and investing in IPOs.

The IPO market offers unique opportunities in trading and investing, and as companies are required to disclose a tremendous amount of information regarding their business at the IPO, mainly through the SEC sanctioned offering prospectus, following the IPO market closely is a great way to educate yourself about the economics of a wide range of businesses and trends, established and emerging.

Among all the IPOs coming to market are what will turn out to be the leaders of the market in the next 5 or 10 years.

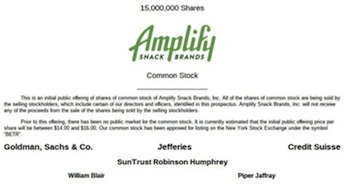

This week’s deal of the week: Amplify Snack Brands (NYSE: BETR)

This week’s deal of the week: Amplify Snack Brands (NYSE: BETR)

Amplify Snack Brand (NYSE: BETR) is the maker of the Skinny Pop brand of popcorn that has been extremely successful and literally exploded in the last 3 years riding the trend of increased consumer demand for better and healthier snacks.

Revenues for the company has grown from $16 million for the year 2012 to $132 million for the year 2014, and are $91 million for the 1st half of 2015, some very impressive numbers by any metric. And the Skinny Pop brand is now ubiquitous as the product can now be found on most grocery store shelves.

This very fast growth will come at a price as it will translate into very high demand from investors for the deal. 75,000,000 shares will be outstanding at the IPO, at the upper end of the pricing range $16, a $1.2 billion valuation or about 6.5 times sales (2015) ratio which is not cheap by any stretch of the imagination. And it will probably be even more expensive when investors bid up shares on the start of trading. But investors don’t get a lot of opportunities to buy into high growth ventures in the CPG (Consumer Packaged Goods) market so they tend to trade at an extra premium valuation, the recent IPO of Blue Buffalo Pet Product (BUFF) being a good example of that.

On a longer term angle, while the trend toward healthier lifestyles and healthier food and snacks will remain a strong tailwind for the business, to maintain this valuation Amplify will have to demonstrate that they can keep delivering the same growth and probably the ability to branch out in more categories with the brands they have built, as the space becomes more crowded and competition intensifies.

All the shares sold in the IPO are sold by the selling shareholders, mostly private equity firm TA Associates, other PE firms and management, and no cash will be raised by the company.

This is a very fast turnaround for a private equity deal (one of the fastest I have ever seen). TA Associates purchased a controlling interest in the holding company of Amplify in July 2014 for $320 million, a $59.8 million special dividend was paid out by the company in December 2014, and another one of $22.3 million in May 2015. In the IPO, TA Associates will be selling 14,116,647 million shares, assuming a $16 price, about $226 million. If you add all that up, in one year TA Associate will have cashed out almost their entire initial investment of $320 million while retaining a 58% stake in a company valued at more than $1.2 billion, a stellar private equity deal.

The founders of the Skinny Pop are still involved with the company as board members and advisors and will retain an 8% stake after the IPO.

Amplify Snack Brands is brought to the market by a solid group of underwriters led by Goldman Sachs, so I expect the demand for this deal to be very high, making this a “hot” deal – the deal will likely price above the initial $14-$16 IPO pricing range. (Sidenote: “Hot” deal doesn’t necessarily mean a good investment, it only means the demand from investors at the IPO price is very high and that they will likely push price higher when it first opens for trading; what happens from that price point on and longer term is a different thing.) I also expect Amplify to trade at a premium when it first opens for trade.

Amplify Snack Brands is scheduled to price Tuesday (08/04) evening and start trading Wednesday (08/05) on the NYSE under the symbol BETR.

OTHER IPOs scheduled for the week of August 3rd:

Aimmune Therapeutics (Nasdaq: AIMT) – Clinical-stage biopharmaceutical company advancing a new therapeutic approach, including the development of proprietary product candidates, for the treatment of peanut and other food allergies.

Shares to be outstanding post IPO: 39,012,871

Price range: $14.00 – $16.00 – Pricing scheduled for Wednesday night, trading Thursday.

GC Aesthetics (Nasdaq: GCAA) – Aesthetic/breast implant surgery supplies. GC Aesthetics focuses on the breast implant market outside of the United States, including pre- and post-breast implant surgery products globally.

Shares to be outstanding post IPO: 17,311,118

Price Range:$13.00 – $15.00 – Pricing scheduled for Wednesday night, trading Thursday.

Philadelphia Energy Solution (NYSE: PSEC) – Refining and refining logistics in the Philadelphia refining complex.

Shares to be outstanding post IPO: 79,765,565

Price Range:$15.00 – $18.00 – Pricing scheduled for Wednesday night, trading Thursday.

Planet Fitness (NYSE: PLNT) – One of the largest and fastest-growing franchisors and operators of fitness centers in the United States by number of members and locations, with a highly recognized national brand.

Shares to be outstanding post IPO: 98,709,740

Price Range:$14.00 – $16.00 – Pricing scheduled for Wednesday night, trading Thursday.

Riverbanc Multifamily Investors (NASDAQ: RMI) – Acquisition and management of a diverse portfolio of structured investments in multifamily apartment communities.

Shares to be outstanding post IPO: 6,600,000 shares and 1,500 LTIP units

Price Range:$19.00 – $20.00 – Pricing scheduled for Thursday night, trading Friday.

Sunrun (Nasdaq: RUN) – Residential solar energy service provider.

Shares to be outstanding post IPO: 96,973,895

Price Range:$13.00 – $15.00 – Pricing scheduled for Tuesday night, trading Wednesday.

Zynerba Pharmaceuticals (Nasdaq: ZYNE) – Specialty pharmaceutical company focused on developing and commercializing proprietary next-generation synthetic cannabinoid therapeutics formulated for transdermal delivery. Applications include: epilepsy, fibromyalgia and peripheral neuropathic pain

Shares to be outstanding post IPO: 8,733,963

Price Range:$13.00 – $15.00 – Pricing scheduled for Tuesday night, trading Wednesday.

______________________

IPOs offer a lot of opportunities but also come with their own set of risks and are generally riskier than stocks with a long history as a public company. One should expect very wide trading ranges, lower liquidity and much higher volatility from IPOs than the rest of the market. In my opinion, one should always factor that into your assessment before trading or investing in IPOs.

For complete information on this week’s IPOs refer back to each company’s SEC offering prospectus: https://www.sec.gov/search/search.htm

Thanks for reading and have a great week.

Twitter: @JFinDallas

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.