Another earnings season is ready to kick off and that means that investors are ready to consume another Alcoa (NYSE: AA) earnings report. But this one may be more telling than the past several for Alcoa stock (and global markets).

With the Chinese stock market down 30 percent over the last month and another Greek crisis brewing, investors are getting concerned about the global economy. Could we be headed into another recession?

Nobody knows for sure but perhaps the Alcoa earnings report will provide some clues. And some much needed insights into the company’s prospects for Alcoa stock investors.

Alcoa Earnings Expectations

According to Estimize, Wall Street is expecting earnings to come in at $0.23 on revenue of $5.82 billion. The Estimize community is expecting slightly better at $0.26 earnings on $5.87 billion.

Alcoa Stock (AA) Technicals

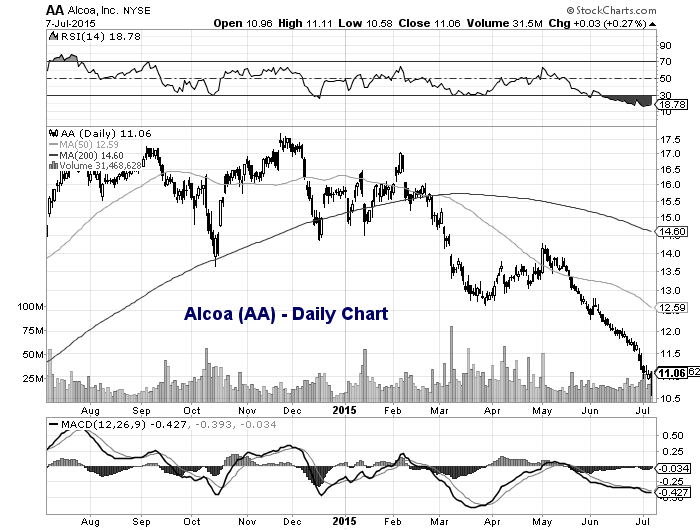

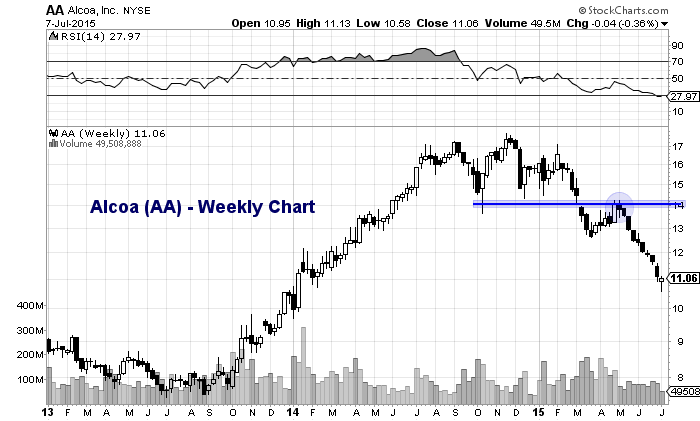

The stock has been mired in a multi-month pullback and has closed lower for 9 weeks in a row. It has also broken key Fibonacci retracement levels (of the 2013-2014 rally) along the way: .382 (13.90), .500 (12.72), and .618 (11.53). This has pushed the weekly Relative Strength Indicator (RSI) down to 27.97 and the daily RSI to 18.78. Readings under 30 is considered very oversold.

On one hand, Alcoa stock could be setting up for a tradable rally. The stock is trading 24 percent below its 200 day moving average and any bit of good news could spur a rally back to the 50 day moving average (12 percent away).

On the other hand, the recent price action highlights how out of favor Alcoa stock has become. And if its earnings are anywhere near as bad as its recent price action, then the company (and the global economy) may worse off than investors once thought.

Alcoa (AA) Daily and Weekly Charts

If the price action is correct, the company may readying for a disappointing earnings report. But any ray of light will likely be met with an oversold rally. Trade safe and thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.