The SPDR Consumer Discretionary ETF (XLY) dropped 0.9 percent last week, to $77.20, and looks poised to come under pressure medium-term. On a weekly chart, there have been back-to-back doji candles – as well as in four of the past five weeks. On a monthly chart, March through June produced additional dojis. Bulls and bears are battling it out on this consumer stocks ETF.

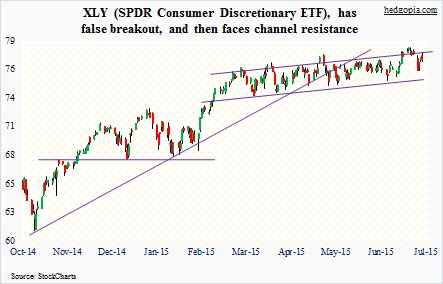

Two weeks ago, the ETF broke out, but turns out it was a false break. It has now fallen back into the channel it has been in for over a year now. Post-failed breakout, the upper end of that channel has provided resistance.

However, a rather bearish outlook in the medium-term for consumer stocks does not necessarily have to be as bearish in the near-term. This is where options come in.

Hypothetically, I have written about being involved with XLY for over a month now. So let’s continue to play that trade scenario out.

A refresher: On June 1, the June 5th weekly 76.50 naked calls were written for $0.47, resulting in effective short at $76.97. Subsequently, two weekly 77 short puts – June 26th and July 2nd – earned a cumulative $0.55, effectively raising the price XLY was shorted at to $77.52.

Depending on what comes out of Greece and how market participants react to it, this week could go either way for the consumer stocks ETF. In an up scenario, a short collar comes to mind. For instance, in the July 10th weekly, a long 77.50 call will cost $0.57, which can be financed with a short 77 put fetching $0.65. The trade – for a credit of $0.08 – is in combination with the existing short position. Should the ETF rally this week, the long call will benefit.

But, once again, Greece may very well dictate things this week. This creates nothing but uncertainty. So rather than doing a short collar, a short put probably suits the current circumstances better.

July 10th 77 puts fetch $0.65. If the ETF rallies, this now becomes an effective short at $78.17 – just under XLY’s all-time high of $78.31, which was reached late June. If it drops below the strike, then the short position effectively gets covered for a profit of $1.17 overall.

Thanks for reading!

Twitter: @hedgopia

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.