Precious metals present a difficult trading scenario. While we believe they probably will reach for somewhat higher prices this summer, there is increasing risk that they will not. Traders may wish to wait for the picture to resolve before stepping back into this market. Today we’ll look at Gold prices – and specifically Gold futures.

Of the two most likely paths for Gold futures, we still believe the most likely is a move upward to complete a correction that may have begun in December. In that view, price needs to trace out the counterpart to the sharp advance we saw at the end of last year.

The most likely resistance levels in our primary scenario include $1,283 and $1,318, corresponding to square-of-nine levels. In that view, we would expect Gold futures to reverse near one of those levels and head for new lows in 2016.

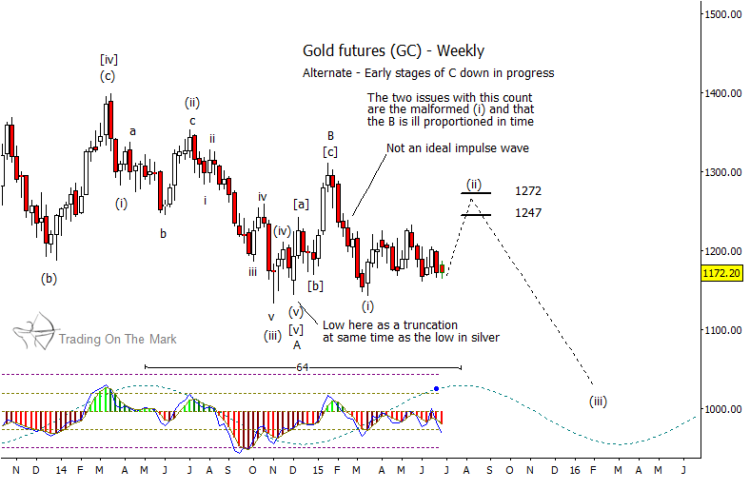

The alternate scenario has gold futures trading an impulsive move down from the late 2014 high, with the last three months of sideways action representing part of wave (ii) of that five-wave move. The alternate view would allow for wave (ii) to reach retracement targets near $1,247 or $1,272 – areas that are not far from the targets in our primary scenario. After that, we would expect to see a downward reversal – also similar to our primary scenario.

Readers might wonder, if both the primary and alternate scenarios call for an advance from the present area, then why isn’t this a good place to enter a long trade on Gold futures? The biggest risk is that the alternate scenario is working, with recent action being part of a corrective wave (ii). However, there is no requirement that wave (ii) must reach as high as the targets we showed, even though that would be the standard expectation. The up-down-up pattern that began in March and ended in May fulfills the requirement for the form of a wave (ii) correction, so it is possible that the advance is entirely over for the year. We regard this as relatively less likely, but the prospect colors the risk/reward evaluation of an upward trade.

Receive timely notifications on trading opportunities by visiting our site and requesting examples of our work.

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.