When looking across the global equity markets, it’s easy to get caught up in the day to day news. But when looking at longer term trends and the health of the market, none may be more important than the German DAX right now. The German stock market index had an amazing run from October to early April (up 48 percent from the low to high). But as I wrote about back in mid-March, there have been warning signs.

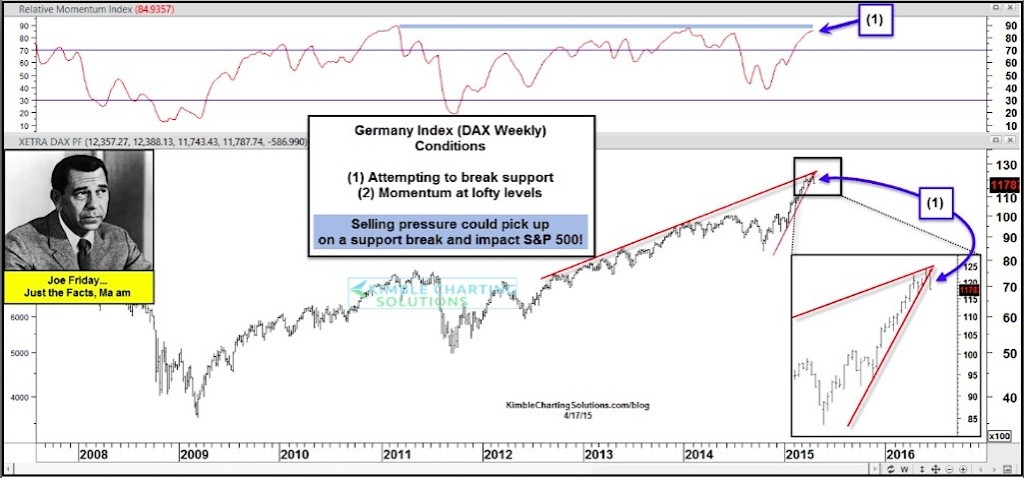

Well those warning signs came to life this week, with the index falling 4.4 percent in the past two trading days, and 5.5 percent for the week. Below is a chart showing how the German DAX has also slipped out of a rising wedge formation. This should be respected over the near-term by investors, as this may lead to more selling.

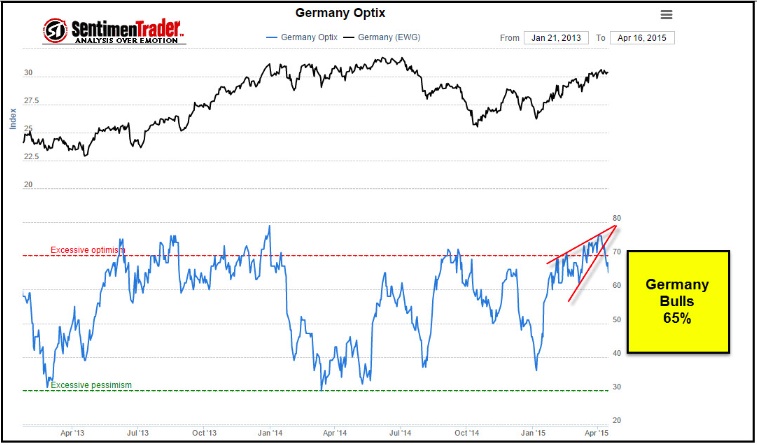

Another point of interest is sentiment. There were simply too many German DAX bulls lined up near the top this month. Check out the chart below with some added color per SentimentTrader. This is another reason that investors should be cautious… at least until the index proves itself once again.

Typically, when market leaders begin to show cracks, it’s the markets way of telling investors that something is happening. It’s probably not a bad idea to tighten up your risk management as this could spill over into other markets, including the S&P 500. Trade safe and have a great weekend.

Follow Chris on Twitter: @KimbleCharting

Author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.