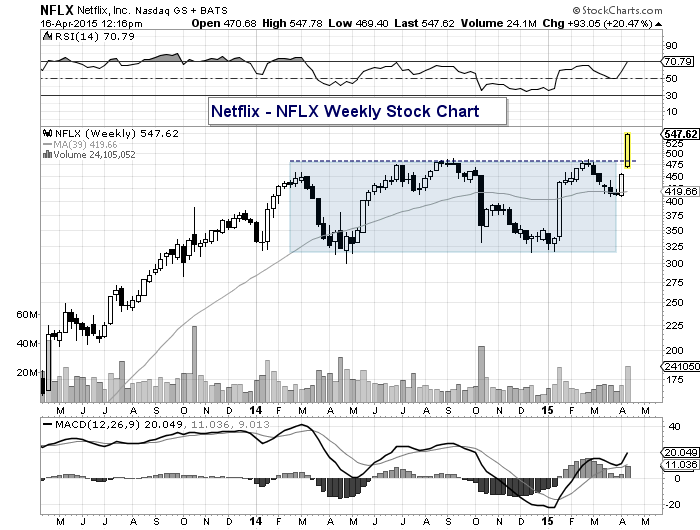

For much of the past year, Netflix (NFLX) stock has traded sideways in a wide range (150 points!). The size of that range probably made it difficult for longer term investors to hold on, but those who did were rewarded by Netflix earnings report last night.

It wasn’t so much then earnings and revenue that wowed investors, as Netflix earnings report was mostly in-line with analyst expectations (they reported 0.77 earnings on 1.57 Billion in revenue). So what got investors so excited? Subscriber growth. According to Reuters reporting, Netflix net subscriber additions rose 22 percent year over year. This shows that their plan is working and more people are migrating to their platform. This bodes well for the future.

So the stock is trading 15 percent (or 70 points) higher near mid-day today. And this surge has propelled Netflix (NFLX) stock out of year long consolidation. Although it may be wise to wait for a pullback before getting in or adding to NFLX, this breakout bodes well as it indicates another leg higher for the stock.

Netflix (NFLX) Weekly Chart – Big breakout on Netflix earnings

The recent pivot lows near $410 proved to be an important turn. As long as the stock stays above $450, it should be in good shape longer term.

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.