After a period of sideways price action, active investors are hoping that earnings season provides some clarity. Yesterday, I wrote a post about the importance of this week’s bank earnings and how the financial sector is an importance gauge of market health. Today, I’ll look at the consumer and highlight why consumer stocks are also at important juncture.

Investors received a bit of a surprise in the April Jobs Report, as the employment numbers came in well below expectations. Although this very well could be an outlier, it does mesh with the ongoing theme of an uneven recovery. And with a stronger dollar and stagnant wage growth, the resiliency of the consumer is being tested.

To get a better idea of how this dynamic is playing out in the stock market, we’ll want to focus on the consumer sector and some consumer stocks and compare them to the broader market.

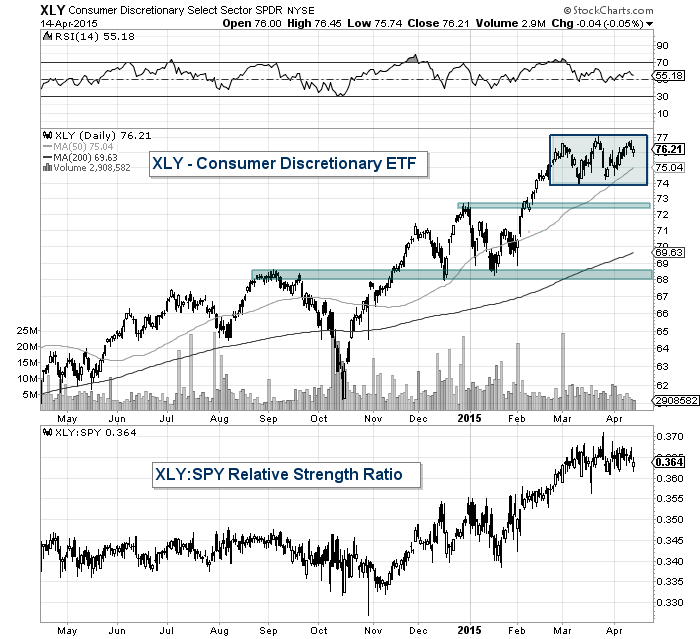

Let’s start with a top down approach, looking at the Consumer Discretionary ETF (XLY) first. Keep in mind that discretionary spending is when consumers buy things that they don’t necessarily need… so if this sector is doing well, it indicates that the consumer has some extra spending money (and is healthier). In the chart below, you can see that consumer stocks have faired well over the last 6 months. They have also been outperforming the S&P 500 ETF (SPY) during this time.

But if we look at the past two months (shaded blue box), you’ll note that the “consumer” has been moving sideways. How this consolidation resolves will be an important factor in the market’s next move. Note that a break below $74 would be a red flag.

Resistance: $77

Support: $74, $72, $69

Consumer Discretionary (XLY) Chart

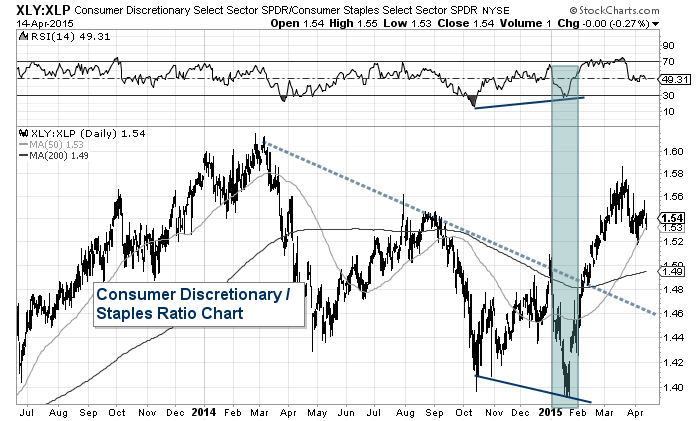

Another gauge of internal consumer strength, is the ratio of the Consumer Discretionary ETF (XLY) to the Consumer Staples ETF (XLP). I used the following chart back in February when I asked: “Is The Consumer Ready For A Comeback In 2015?“. Note the positive divergence (shaded blue) when price reached a lower low in January while the RSI made a higher low. This set up the rally and helped to fuel the broader stock market rally.

But XLY hasn’t been as strong over the past month, underperforming its “Staples” counterpart. If the bulls want another leg higher, they’ll need the consumer (and consumer stocks) to show some resilience.

XLY:XLP Ratio Chart

Next, let’s look at the charts for 3 of the largest consumer stocks holdings within the discretionary ETF: Walt Disney (DIS), Home Depot (HD), and Amazon (AMZN). Since all three stocks have different products, this should give us a diversified look.

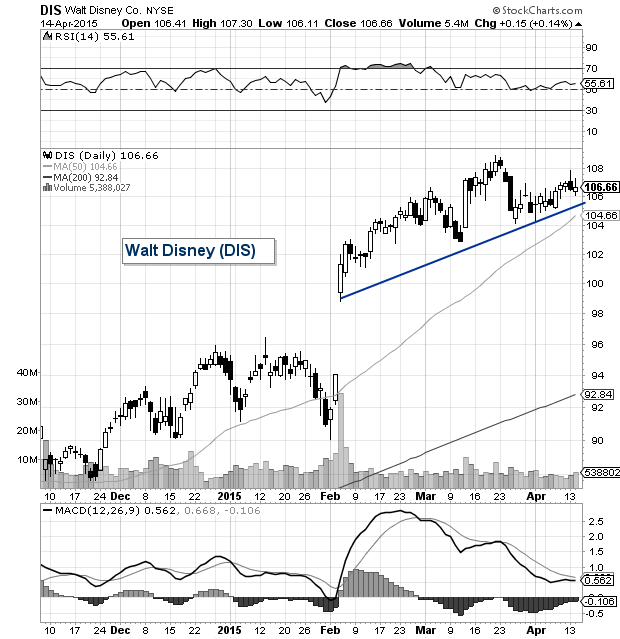

Walt Disney (DIS)

Disney is one of the most visible brands and consumer stocks within the sector. When looking at the chart below, the one thing that stands out is the huge gap higher in early February on Disney’s earnings “beat”. Disney’s momentum is slowing but it is still above its 50 day moving average. That said, if the bulls don’t get Disney’s stock going soon, it could be in jeopardy of a correction. And although that big open gap seems far away, it can act like magnet if price breaks down. Note that Disney is scheduled to report its earnings on May 5th.

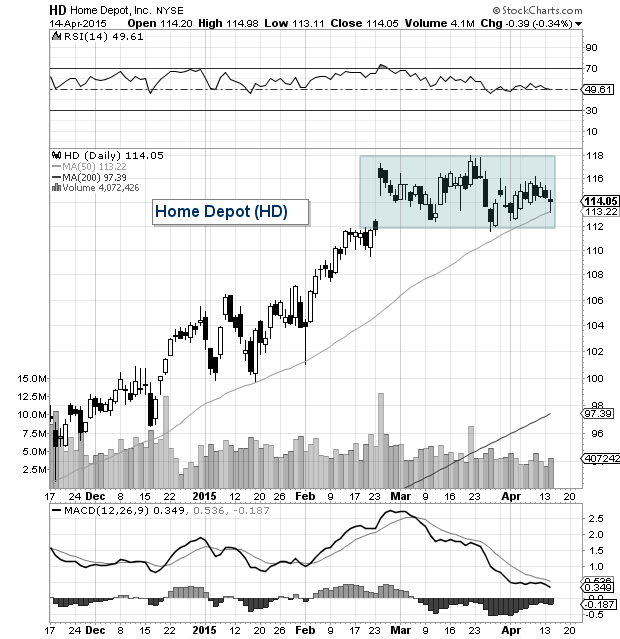

Home Depot (HD)

HD’s stock price pattern looks similar to the XLY. It’s currently holding just above its 50 day moving average and within a consolidation “box”. How it breaks out of this consolidation will be important. Support at $112 and resistance at $118. Note that Home Depot is scheduled to report its earnings on May 19th.

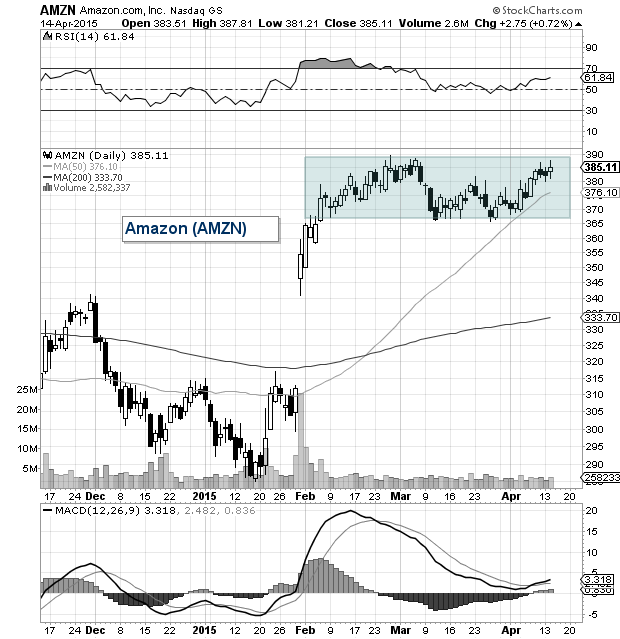

Amazon (AMZN)

A similar theme here as Amazon (AMZN) broke out higher earlier this year and has been consolidating for the past 2 months. The 50 day moving average is finally catching up to the stock and the bulls will need it to be supportive. Similar to Disney, Amazon has a big open gap that could attract attention if its price rolls over. Note that Amazon is scheduled to report its earnings on April 23rd.

On the surface, all three consumer stocks are healthy (above their 50 day ma’s and consolidating). However, the period of consolidation is getting long in the tooth and earnings will likely be a catalyst for the sectors next move. Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.