Every quarter, earnings season kicks off with aluminum kingpin, Alcoa (AA). Investors from all walks tune in and celebrate the “opening day” of earnings season. And, as you can imagine, the news coverage is overboard and adds a lot of noise to our trading days.

Every quarter, earnings season kicks off with aluminum kingpin, Alcoa (AA). Investors from all walks tune in and celebrate the “opening day” of earnings season. And, as you can imagine, the news coverage is overboard and adds a lot of noise to our trading days.

Well, earnings season is officially here: Alcoa earnings missed tonight and the stock is down 3 percent in after hours. So should we care?

Besides the noise, there are plenty of reasons why investors will blow off Alcoa earnings. It’s market cap is only $16 Billion and its products don’t capture our collective imagination. In short, Alcoa isn’t the first name we think of when logging into our trading accounts.

But, perhaps Alcoa earnings are more important than we think to the overall setup for earnings season. After all, they are a global manufacturer of a metal that has several uses worldwide. And the following stock market performance data may support this.

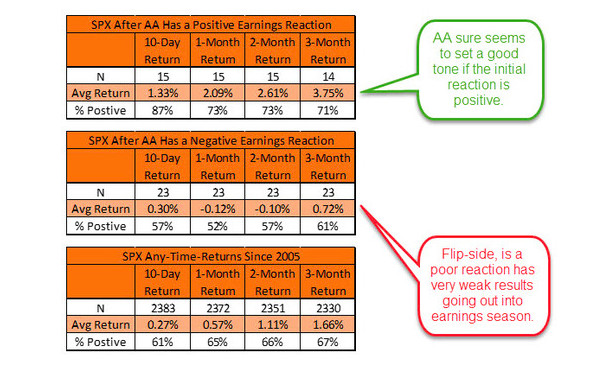

Last spring, Ryan Detrick put together a study on how the S&P 500 performs after “positive” and “negative” Alcoa earnings reactions 10 days, 1 month, 2 months, and 3 months out. Although it should be noted that the data is through last year, it is worth another look. The market tends to trade better after a “positive” reaction. See the table below and note that tonight’s reaction would be filed under the “negative” category.

If the market holds true to form, it wouldn’t be too surprising considering the S&P 500’s choppy start to 2015.

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.