For the better part of 2015, Yahoo, Inc (YHOO) shares have based just above the 200 day moving average (MA) between 42 and 45. Now Yahoo stock is challenging the top of it’s base. So it’s a good time to dig into some charts and highlight some key support and resistance levels for Yahoo stock.

Yahoo (YHOO) Daily Stock Chart – 2015 Consolidation?

On the most recent low, momentum started to diverge as price touched the 200 day MA support.

That said, note the falling 50 day MA and upper bollinger band confluence around 46. This resistance area may put a lid on shares for a while as they finish basing out.

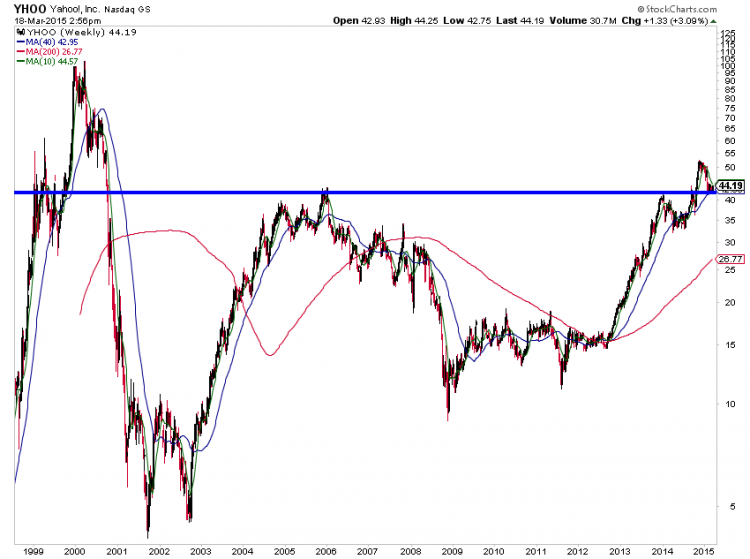

Looking to a chart dating back to the tech bubble (below), we can see how important the low 40’s area has been over time. It also appears that Yahoo stock simply backtesting the base breakout from 2014.

Yahoo Long-Term Stock Chart – Low 40’s Important!

The strength of the Internet Portfolio ETF (PNQI) may provide a tailwind for the sector (and potentially YHOO). PNQI has broken a 1 year wedge to the upside. A break over the recent highs could prove to be a very positive sign for the top holdings in the space like Facebook (FB), Amazon (AMZN) and eBAY (EBAY).

All of this suggests it’s probably a good time to put Yahoo on your radar. The setup: Investors could consider a long position in Yahoo stock versus the recent lows (41.97 – where stops would be placed). Even if it doesn’t work out, we have a pretty clear point of knowing where we are wrong.

Thanks for reading!

Follow Aaron on Twitter: @ATMcharts

No positions in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.