I got crushed last week. The accounts that I manage (for the most part) suffered losses and were down for the week. It is painful. So, what happened and what am I going to do about it?

First, we need to keep things in perspective. Last week was a bad week for those who are mainly invested in assets that do well in a slowing or deflationary environment. Examples of investments that do well in that environment are U.S. Treasury Bonds, Healthcare, Consumer Staples, REITs and other stocks that act like bonds. But those investments have done well so far this year—especially when looked at on a risk-adjusted return basis. In other words, look at the choppiness of the lines in the following charts.

Let me start with the 5-day chart of the two US Treasury bonds ETFs that I have been invested in—the iShares Barclays 20+ Year Treasury Bonds (TLT) and Vanguard Extended Duration (EDV):

Bonds ETF Performance Chart: EDV vs TLT

The Vanguard Extended Duration (EDV) is the more aggressive of the two exchange traded bond funds and it suffered a decline of 7.71% for the week while the iShares Barclays 20+ Yr Treas.Bond (TLT) fell 5.29%. The decline accelerated on Friday when the jobs report came out showing substantial job gains.

Last week, equities were negatively correlated to bonds so the chart of the major stock indexes is almost a mirror image opposite that of bonds. Here is that chart:

Equity Indexes Performance Last Week (wk of February 2 2015)

For the week the S&P 500 was up 3.04% , the NASDAQ was up 2.29% and the Dow Jones Industrial Average was up 3.83%. So, there is no doubt about it, stocks trounced bonds last week.

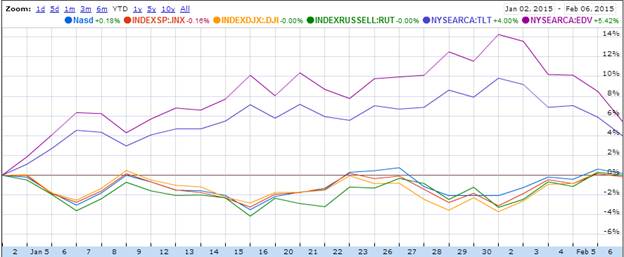

Now let’s expand our time-frame to try to identify whether last week was part of an intermediate trend or whether or not it was a short-term counter trend within a longer term trend. Here is a chart showing the 4 major stock market indexes year-to-date:

Major Stock Market Indexes YTD Performance Chart (through February 6)

The first thing we can notice is that the stock market has been very volatile so far this year. We have seen 6 up and down swings in as many weeks; swings of roughly 3-4% each way. You can clearly see that the markets dropped 3-4% in early January, then recovered before dropping 3-4% again about a week later, then it recovered, and dropped again at the end of January. Even after that roller coaster ride, those who remained invested in the S&P 500 would be down for the year at negative .16%; whereas the NASDAQ would be up less than one-fifth of one percent.

Bonds, on the other hand, have done very well year-to-date even after last week’s decline. The iShares Barclays 20+ Yr Treas.Bond (symbol TLT) is still up 4% and the Vanguard Extended Duration (symbol EDV) is up 5.42%. Here is a chart that illustrates these two bond ETFs relative to the 4 major stock indexes. It doesn’t take a genius to realize that bonds have been much better than stocks so far this year.

Stocks vs Bonds Performance Chart YTD (through February 6)

My belief is that the underlying economic situation has not changed over the last week. The jobs report is an important economic indicator, but it is a lagging indicator, not a leading indicator. That means that hiring and firing decisions by employers historically lag the economic trend. So it isn’t unusual for the job numbers to continue to go up for several weeks after the economy has started to slow. What isn’t widely reported is the large number of company earnings reports that are showing slowing growth.

In my weekly commentary last week, I said:

“The problem is that investing in the stock market is as uncertain as lining up on the 1-yardline with only seconds left in the game. The unexpected can and will happen. The markets are very complex. Think of it as currents, undercurrents and crosscurrents being possible at the same time, and all in the same wave. And waves constantly come in and go out. So just because bonds have been on a tear doesn’t mean that it will continue forever. It is probable that they can retreat after such a strong run, but there’s no way to be certain. Until the economy starts to improve, though, it is likely that the overall trend of declining interest rates will continue. So I expect to add to that position when the retreat happens”

The retreat clearly happened last week, and I added to those bond positions just like I said I would. I may have been a couple days early, but I believe that what we experienced last week was a counter-trend or a retreat in the midst of an ongoing trend in a declining interest rate environment.

There are few guarantees in this world – death and taxes come to mind, and it is possible that I am wrong. But that’s why I have risk management processes and procedures in place across all my accounts.

With volatility and uncertainty increasing worldwide; with governments struggling to navigate ever-increasing debt loads and with the Federal Reserve trying to force investors into higher risk assets, I am comfortable taking a different path. There may be weeks when we don’t do well in bonds, but the risk and volatility overall should be much less compared to being significantly exposed to stocks. Thanks for reading.

Follow Jeff on Twitter: @JeffVoudrie

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.