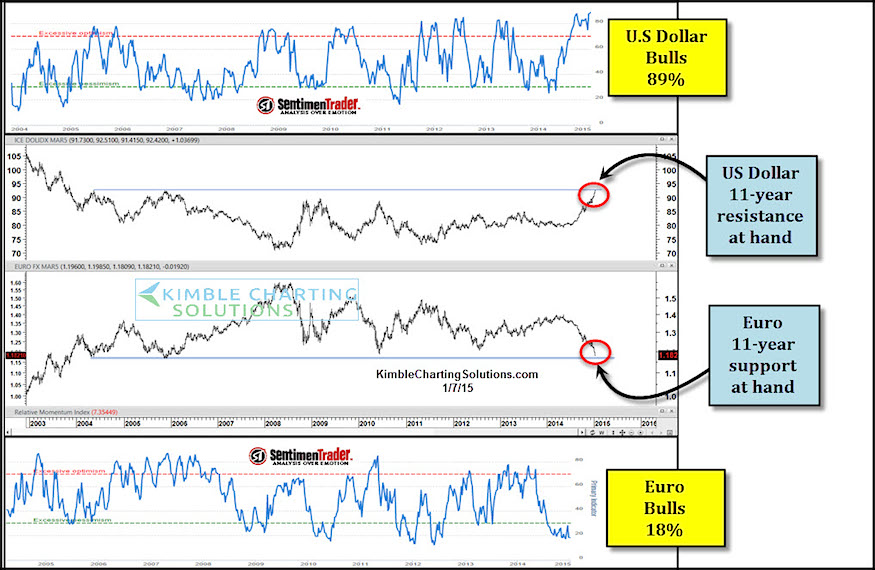

There has been a lot of currency chatter around the US DOLLAR and EURO of late. Why? Well, because both currencies have made strong moves in opposite directions over the past 6 months. And, if you take a few steps back and look at a long term chart of each currency, you’ll notice that they are at the same price point they were at 11 years ago. Yep, both have traded sideways in a “wide” range over the past decade. BUT, nonetheless they are back at a critical support (EURO) and resistance (DOLLAR).

And Jason from Sentiment Trader, shows how sentiment towards both currencies is at extremes. Will this slow King Dollar’s move?

Should the US DOLLAR break through resistance, it could be a portfolio “game changer!”

What happens at this critical juncture (breakout or failed breakout) could well become the most important currency event in a decade. What these two major currencies do going forward will provide investors with insights into whether deflation has run its course or is just getting going. And this will likely have an effect on portfolio management in regards to asset classes such as commodities (Gold, Silver & Miners). Stay tuned and thanks for reading.

Read more from Chris on his Blog. Follow Chris on Twitter: @KimbleCharting

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.