Markets rejoiced last week over the joint announcements by the Bank of Japan (BoJ) that QQE (and it’s penchant for buying ETFs/stocks) will expand considerably along with a massive reallocation favoring equities in Japan’s largest pension fund (GPIF).

But what’s actually going to happen?

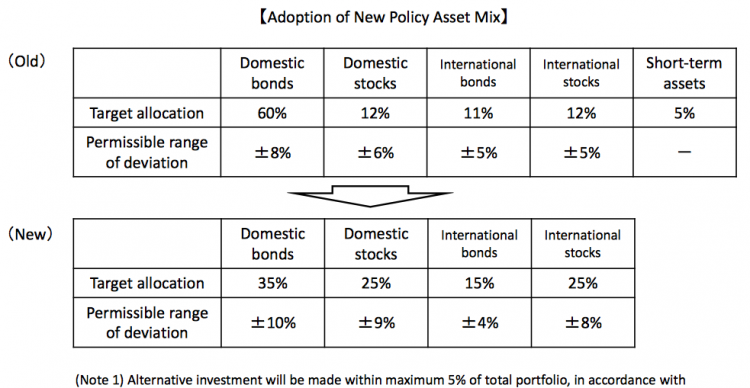

Here’s how the GPIF breaks down the changes that will begin occurring in their $1.12 Trillion portfolio beginning in April 2015:

Let’s put a finer point on those numbers:

Current GPIF Policy Asset Mix with $1.117Tln (through Q1 FY2014):

- 60% Domestic Bonds ($670 Billion)

- 11% International Bonds ($123 Billion)

- 12% Domestic Stocks ($134 Billion)

- 12% International Stocks ($134 Billion)

As of 06/30/2014, the GPIF had:

- 53.3% Domestic Bonds ($595.4 Billion)

- 17.3% International Bonds ($193.2 Billion)

- 16% Domestic Stocks ($179 Billion)

- 11.1% International Stocks ($124 Billion)

- 2.3% cash ($25.7 Billion)

New GPIF Policy Asset Mix (Net Change From Actual In Parentheses):

- 35% Domestic Bonds (-18.3% or -$204.4 Billion to $390 Billion)

- 15% International Bonds (-2.3% or -$25.7 Billion to $167.5 Billion)

- 25% Domestic Stocks (+9% or +$100.5 Billion to $279.5 Billion)

- 25% International Stocks (+13.9% or +$155.25 Billion to 279.5 Billion)

So How Much GPIF Money Is Going Into US Stocks?

GPIF investment performance for it’s “International Stocks” component now tracks the World Equity (MSCI ACWI) ex Japan which holds 59.89% of assets (as of 10/21/2014) in the S&P 500 (SPX).

As a result, $93 Billion will be allocated to US stocks (specifically, the S&P 500) over the transition period.

When Will This Happen?

Per GPIF’s 10/31’s “Adoption of New Policy Asset Mix“: “Adjustment to the new targets would be pursued with the goal of minimizing the GPIF’s market impact”.

Assuming a transition period of 2 years, $3.9 billion/month into S&P 500. The new targets would not become active until the beginning of the 3rd Medium-Term Plan in April 2015.

And What About the Bank of Japan?

Stocks: In it’s own right, the BoJ has committed to triple their annual purchase of domestic and international ETFs from $88.5 to $265.5 Billion (USD/JPY = 113), or additional $14.75 Billion/month. BoJ has not divulged the domestic/international allocation breakdown, though the total divided between two pecuniary trusts offered here. Assuming the GPIF’s percentage of US stock purchases for the BoJ for the sake of argument, the BoJ would purchase $4.4 Billion/month.

REITS/CP/Corporate Bonds: The BoJ also ramped up REITs purchases, while held steady on CP and Corp Bonds; and pushed it’s annual JGB purchases out to ¥80 Trillion, or $708 Billion (USD/JPY = 113). By comparison, the total of QE2 in the US was $600 Billion.

JGBs: The pace at which GPIF works will be largely contingent on the BoJ. When GPIF releases $205 Billion in JGBs onto the secondary market, will there be a willing buyer? Yes: but only one that has more than a rounding error of a balance sheet: the BoJ, which currently purchases in excess of 70% of all new JGBs coming to market amid a moribund market that occasionally doesn’t trade at all. As a result, the bulk of the just-announced increase in QQE will go toward neutralizing the steady stream of JGB supply coming from GPIF, though just how much will depend on the GPIF’s transition period.

The net result: a back-of-the-napkin, somewhat simplified calculation puts the bid under US stocks from the GPIF and BOJ at roughly $8 Billion/month. Once the GPIF has fully transitioned, this slips to $4.4 Billion/month.

These are admittedly preliminary (but sourced) figures that are subject to potential revision as other data comes in. If you have additional clarification on the impact GPIF reallocation and BoJ’s added purchases will have, please leave a note in the comments below.

Twitter: @andrewunknown

Kassen holds no exposure to securities/instruments mentioned at the time of publication. Commentary provided above is for educational purposes only and in no way constitutes trading or investment advice.