September was an uneventful month on the economic front, as the dollar continued to strengthen, and many ‘risk assets’ drifted lower with concerns about slowing global growth. In hindsight this action was a precursor to the wild ride in equities we’ve seen thus far in October.

September was an uneventful month on the economic front, as the dollar continued to strengthen, and many ‘risk assets’ drifted lower with concerns about slowing global growth. In hindsight this action was a precursor to the wild ride in equities we’ve seen thus far in October.

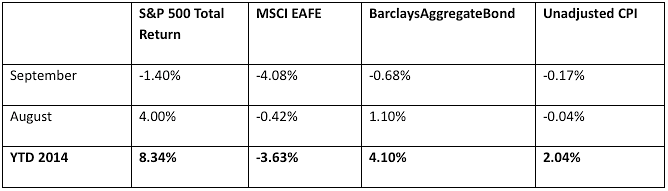

Here’s what happened in the financial markets in September, by the numbers:

Stocks & Bonds

After a rally in August, September saw minor declines in the S&P 500. Small cap and international stocks saw larger losses in a ‘risk off’ environment. And this action spilled over into early October.

Inflation stayed soft and bonds declined slightly as well.

Commodities & Currencies

NYMEX Crude Oil lost 4.34% in September, down to $90.27 per barrel. This ugly action has carried over into October, with Crude dropping down near $80 per barrel thus far. Gold declined 5.9% to a close of $1,211.60 per ounce, but has since rallied a bit in October. The U.S. Dollar index gained 3.85% in September, an almost unheard-of gain in such a short amount of time. It’s spent much of October catching its breath. For the year, the Dollar index is up 7.36% (through September). Commodities have seen broadly declining prices this year, and the Dollar often moves inversely to the direction of commodity prices.

Economy

The Bureau of Economic Analysis reported that 2nd quarter GDP expanded at 4.6%, an upward revision to its first two estimates, and much stronger than the 2.1% decline of the 1st quarter. Meanwhile the Labor Department reported that the CPI declined 0.2% in August, and is up 1.7% year-to-date. The Labor Department also reported that the unemployment rate fell to 5.9% in September, from 6.1% in August. So far, global and domestic disinflation has not derailed the recovery in U.S. employment and GDP. If anything, it’s hit financial markets like Europe the hardest.

The Institute for Supply Management reported that September’s manufacturing PMI was 56.6, which still indicated healthy expansion, but still down from August’s reading of 59.

The National Association of Realtors (NAR) reported that the annual rate of existing-home sales in September declined by 1.8% from September 2013. National median prices rose from the prior year by 4.8% to $219,800. Foreclosures and short-sales, as a percentage of overall sales, continued to drop, and were at 8% of overall sales.

Summary

The recent strength of the U.S. Dollar has been a headline grabber in the financial markets recently. Many market commentators have been used to a weakening dollar, as the last decade saw large trade deficits and expanding government debt which both tend to weaken a currency. However, due in part to the recent ‘energy revolution’ in the U.S., our trade deficit is shrinking. In addition, the CBO most recently announced that the federal deficit for fiscal 2014 was $486 billion, a third smaller than 2013 and down dramatically from the $1.4 trillion of mid-crisis 2009.

As the U.S. Dollar strengthens, foreign investments tend to suffer in relative terms. Commodities that are priced in dollars, and most are, also suffer as they become more expensive for other nations to purchase. So we are seeing falling commodity prices around the world, combined with a lack of inflation and worries of deflation. U.S. Treasuries have been top performers this year, with long-term treasuries returning double-digits year-to-date.

Notably, at the end of this month, the Fed will officially stop printing money. It is possible that this will lead to even more Dollar strength in the near-term, as many other currencies are continuing or commencing their own quantitative easing programs. This should add a new wrinkle to the financial markets. Thanks for reading.

This material was prepared by Greg Naylor, and does not necessarily represent the views of Woodbury Financial or its affiliates. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- https://data.bls.gov/timeseries/LNS11300000 – Labor participation data

- https://www.bea.gov/newsreleases/national/pi/pinewsrelease.htm – PCE reference numbers

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.