Tech stocks have played a major role in leading the broader market higher in 2014. Especially of late. Consider this: The Nasdaq Composite was the first major index to break out to near 2014 highs after the summer pullback. Soon thereafter, the S&P 500 and Dow Jones Industrials confirmed the breakout, making new highs as well. Today I’d like to focus on the popular Nasdaq 100 ETF, the Powershares QQQ Trust (QQQ) and the recent QQQ breakout to new highs.

Tech stocks have played a major role in leading the broader market higher in 2014. Especially of late. Consider this: The Nasdaq Composite was the first major index to break out to near 2014 highs after the summer pullback. Soon thereafter, the S&P 500 and Dow Jones Industrials confirmed the breakout, making new highs as well. Today I’d like to focus on the popular Nasdaq 100 ETF, the Powershares QQQ Trust (QQQ) and the recent QQQ breakout to new highs.

On August 19, I covered the tech breakout providing some targets and possible scenarios. So let’s take a look at where tech is at now and where it may go.

Below is a daily chart of the QQQ breakout. As you can see, the Power QQQ’s have made a clean breakout, thrusting to new highs.

QQQ Daily Stock Chart

But if we want to get a better understanding of what to expect near-term, we’ll need to zoom in a bit (see chart below). The July pullback and subsequent August bottom was set up by an RSI divergence. But the 50 day moving average held and QQQ pivoted higher, eventually breaking out to new highs. Using Fibonacci extensions, we can provide some possible QQQ breakout targets: 99.75, 101.13, and 103.38.

The most common (and immediate) breakout move is to the 1.618 Fibonacci extension (99.75). Note that the QQQ’s hit 99.68 on Monday. This may be good enough, or perhaps it wants a bit higher. But, either way, tagging this level often sets the stage for a pullback and some sort of retest of the breakout. It’s also worth considering that the RSI is back above 70, cautioning that the QQQ’s are getting overbought.

And since the Tech Sector has been a market leader, it will be important to watch how the QQQ’s handle the next pullback/retest. A break back below 97.50 would be a red flag, whereas a successful retest may put higher price targets in play.

QQQ Daily Chart – ZOOMED

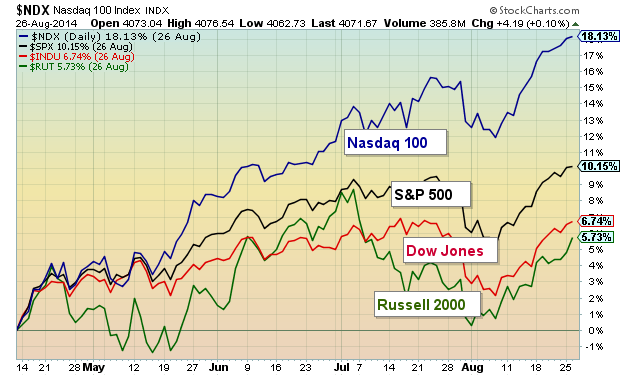

I’ll leave you with an updated performance chart that clearly highlights the Nasdaq 100’s market leadership since the April low. Considering the Tech Sector is in a leadership position, all pullbacks and price action must be monitored accordingly, as it will likely have broader implications. Trade safe.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.