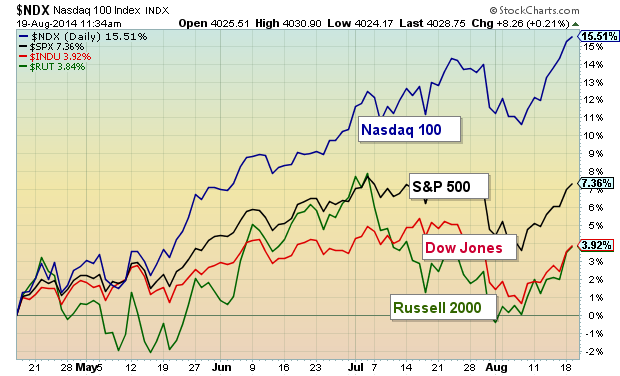

There have been two important stock market lows this year and both came early on. The first low came in February and ultimately could mark the low for 2014. The second one came in April and I would argue that it was the more important of the two. Let me explain: The April low saw a full retest of the February lows for the Nasdaq 100 (NDX) and Russell 2000 (RUT). Since that time, the Russell 2000 has continued to lag (a common theme in 2014), but the Nasdaq 100 has re-emerged as the leader.

There have been two important stock market lows this year and both came early on. The first low came in February and ultimately could mark the low for 2014. The second one came in April and I would argue that it was the more important of the two. Let me explain: The April low saw a full retest of the February lows for the Nasdaq 100 (NDX) and Russell 2000 (RUT). Since that time, the Russell 2000 has continued to lag (a common theme in 2014), but the Nasdaq 100 has re-emerged as the leader.

And this is exactly what trend followers want to see.

Check out the Nasdaq 100 outperformance since the April lows:

This isn’t a new theme for investors. Last month I covered the Nasdaq 100 leadership, highlighting two important factors: 1) a warning on how it was near-term overbought (before the 4% pullback) and 2) highlighting why it’s always good to follow market leadership.

Well, when the NDX dipped last month, everyone else followed. And now that the NDX is charging higher, it’s carrying the market on its back. Check out the recent price breakout in the chart below:

Now before we get too short-term bullish, it is important to realize that this breakout still requires confirmation. This can come in one of two ways: 1) The S&P 500 is still trading under its July highs, so new bulls want to see that index push to new highs. 2) The breakout level (3990/4000) will need to hold on any sort of retest / pullback. Failure to do so would be a near-term warning.

However, should the breakout hold, two potential Nasdaq 100 price targets include 4092 (1.618 Fibonacci Extension) and 4150 (a mirrored move higher). See the chart below.

Lastly, let’s look at a weekly chart for some perspective. The Nasdaq 100 is reaching up into overbought territory again and pushing along the upper rail of its longer-term channel. If you’ve been in this business long enough, you know that overbought can stay overbought for some time. That said, I would watch this breakout closely and stay focused on market internals, as the risk/reward will deteriorate with each tick higher. Trade safe.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.