Up 12 of the last 13 days at mid-day, equities are cutting through some rarely-tread waters today with the June S&P 500 E-mini futures contract (ES) battling to close >75 on it’s daily RSI amidst redlining momentum.

This “overbought” reading (defined as anything >70) is commonly regarded as sign of an imminent bearish reversal: something a glance at ES affirms with few exceptions. But, anyone who has attempted to use RSI to time entries and exits knows it can be dangerous to do so without other corroborating technical factors and some well-defined risk parameters.

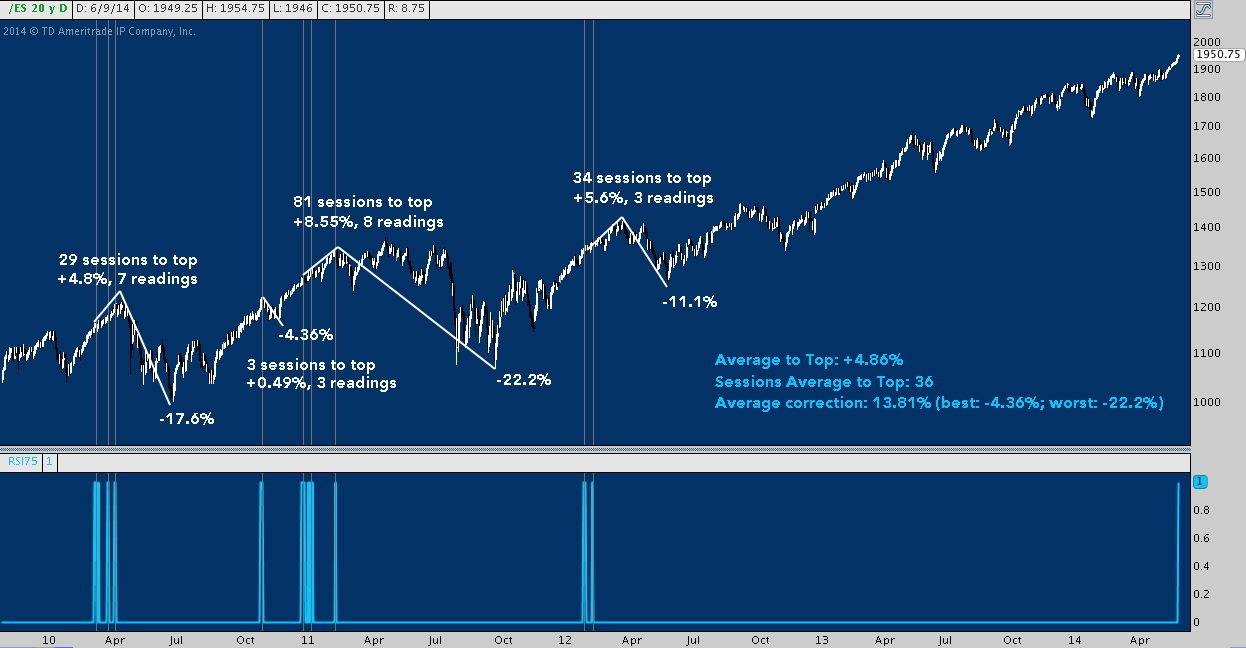

Before any of that, though, it’s helpful to understand what an overbought daily RSI exceeding 75 has actually meant, in practice. Looking back at occurrences over the last ~5 years, here are several key points:

- From the beginning of 2010 to last Friday, ES traded on 1117 days; of them, 21 or 1.87% closed with an RSI greater than 75.

- These 21 occurrences took place in 4 general clusters: Spring 2010, Fall 2010, Spring/Summer 2011 and Spring 2012.

- Drawing from the first close in each cluster featuring an RSI over 75 (so N=4), ES advances +4.86% on average before installing a local top (defined as a high that preceded a selloff that bottomed beneath the first “RSI >75” close).

- No occurrence/cluster failed to entirely retrace the ground covered between this first close and it’s subsequent local top.

- These advances lasted 36 trading days or almost 2 months, on average (shortest: 3 days; longest: 81 days).

- The average subsequent correction is -13.81% (best: -4.36%; worst: -22.2%).

Here is the time frame and set of occurrences referenced above (click image to zoom):

With that data (a longer sample space never hurts, but try to balance statistical significance with market relevance) and the context of the primary up-trend in mind, the raw material for devising a solid risk-managed counttrend trade is present.

Trade ’em well.

Twitter: @andrewunknown and @seeitmarket

Author has no exposure to instruments mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity. Tachometer image courtesy thetruthaboutcars.com