April continued the theme of uncertainty in the marketplace. Investors continued to cling to “risk-on”, but found a different type of risk to grab ahold of: strong brands with solid balance sheets, dividend payers, and blue chips.

April continued the theme of uncertainty in the marketplace. Investors continued to cling to “risk-on”, but found a different type of risk to grab ahold of: strong brands with solid balance sheets, dividend payers, and blue chips.

From Andrew Kassen’s posts on why the market is playing defense at all-time highs to Chris Ciovacco’s post on risk tolerance waning to Korey Bauer’s post on why high interest rates are on pause, several See It Market contributors were ahead of the curve, alerting investors to this change in behavior.

I also covered off this simmering of uncertainty in my latest S&P 500 technical update:

As the market chop continues, so does the uncertainty. This isn’t necessarily a bad thing (nor a good thing). It just means that market participants are trying to figure out how to rotate/invest their capital. In my humble opinion, the market still have room to the upside and the downside. Which comes first will depend on whether the trend breaks down, or re-emerges. And this depends on how well the technical levels hold up.

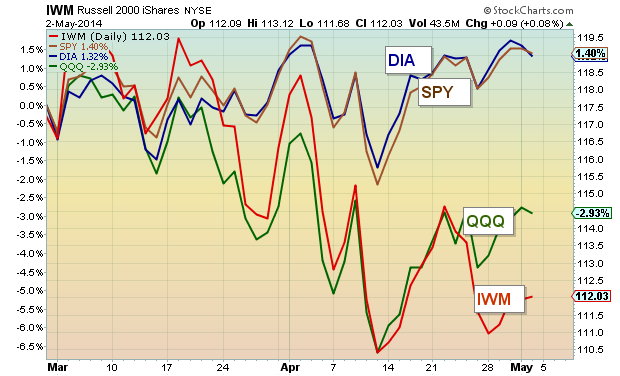

Looking at the chart to the right, it’s clear that investors have been taking a more defensive posture in the market place, albeit at all-time highs. And Bonds (not shown) continue to tick higher. BUT, the markets are still near all-time highs and that long-awaited 10 percent correction is still on hold… for the moment. Will May bring more volatility? TBD.

Okay, let’s get on with it. It’s time to reflect on the best blogs for the month of April in the latest installment of The Best of See It Market. Hope you all found our research to be beneficial to your active investing regimen. As always, thank you for your readership and support.

THE BEST OF SEE IT MARKET – April 2014

INVESTING

The Value Of A Multi-Disciplinary Approach To Investing by Jesse Felder

Meaningless Market Noise (And The Signal It’s Giving Right Now) by Andrew Kassen

April Seasonality: Strong and Weak Trending Stocks and ETFs by Robert Lesnicki

Identifying Strong Bases For Explosive Trades by J.C. Parets

Five Charts For Gold Investors: Follow The Yellow Brick Road by Andrew Nyquist

Two Charts That Show Risk Tolerance Is Waning by Chris Ciovacco

Interview With Greg B Davies, Head Of Barclays Behavioural Finance by Allan Millar

How Standing On Your Head Can Reduce Investor Bias by Chris Kimble

Why Is The Market Playing Defense At All-Time Highs? by Andrew Kassen

Managing Risk With Trend Following by David Fabian

Wage Growth And The Retail Sector: One Year Later by Maria Rinehart

2013 Cash Reserves Ranking: Apple, U.S. Corporates Lead Way by Joshua Schroeder

CHARTOLOGY

Semiconductor Sector On Watch: Short-Term Pressure Mounts by Robert Lesnicki

S&P 500 Weekend Update: Uncertainty Keeps Markets Choppy by Andrew Nyquist

Beyond the NASDAQ Head and Shoulders Pattern by Andrew Kassen

3 Charts Highlighting Importance Of US Dollar 80 Level by Robert Lesnicki

Look for another installment of “The Best of See It Market” next month.

Twitter: @andrewnyquist and @seeitmarket