Over the past few months, I’ve been highlighting stocks and etfs that show strong seasonality trends. The posts have continued to get great feedback, so I’ve decided to highlight some more stocks and etfs for the month of April. I will also be adding a bit of a spin to this April seasonality post by highlighting stocks and ETFs that show weak April seasonality trends as well.

Over the past few months, I’ve been highlighting stocks and etfs that show strong seasonality trends. The posts have continued to get great feedback, so I’ve decided to highlight some more stocks and etfs for the month of April. I will also be adding a bit of a spin to this April seasonality post by highlighting stocks and ETFs that show weak April seasonality trends as well.

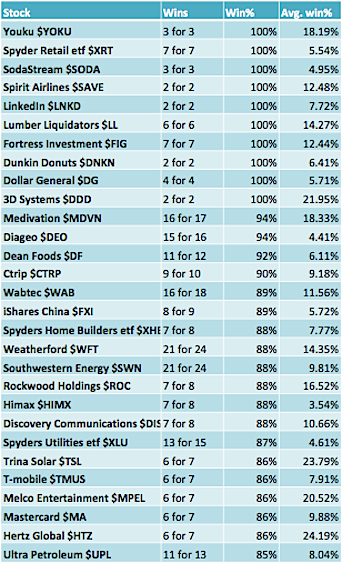

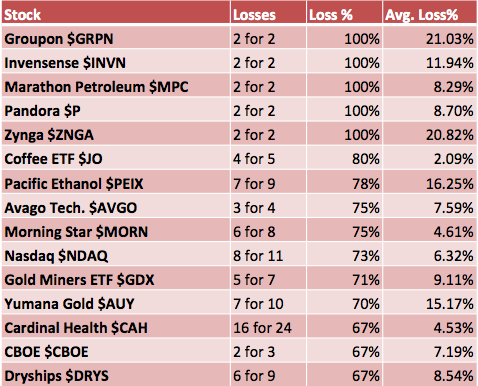

Let’s take a look at the findings below:

Data sourced from paststat.com

A couple of items worth noting: Energy names Weatherford (WFT) and Southwestern (SWN) have produced positive gains in 21 out of 24 occurrences in the month of April. The average win% for Weatherford has been 14.35% and 9.81% for Southwestern – now that’s some strong April seasonality! As well, the Retail Index (XRT) has not had a losing April in its young history (7 ofr 7).

A couple of things worth noting: Stocks like The Nasdaq OMX Group (NDAQ) and Pacific Ethanol (PEIX) have shown consistent weakness in the month of April. NDAQ has been lower on 8 of 11 occurrences in the month of April, with an average loss of 6.32%. Pacific Ethanol has been lower on 7 of 9 occurrences in April, with an average loss of 16.25%. I also noticed that some technology names like Zynga (ZNGA) , Groupon (GRPN) and Pandora (P) have yet to record a positive gain in the month of April (note just 2 occurences each).

The past is not necessarily a predictor of the future, so there should definitely be more due diligence done. This post was simply intended to generate some ideas for further vetting for the month of April. Thanks for reading.

Author is long MPEL via stock at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.