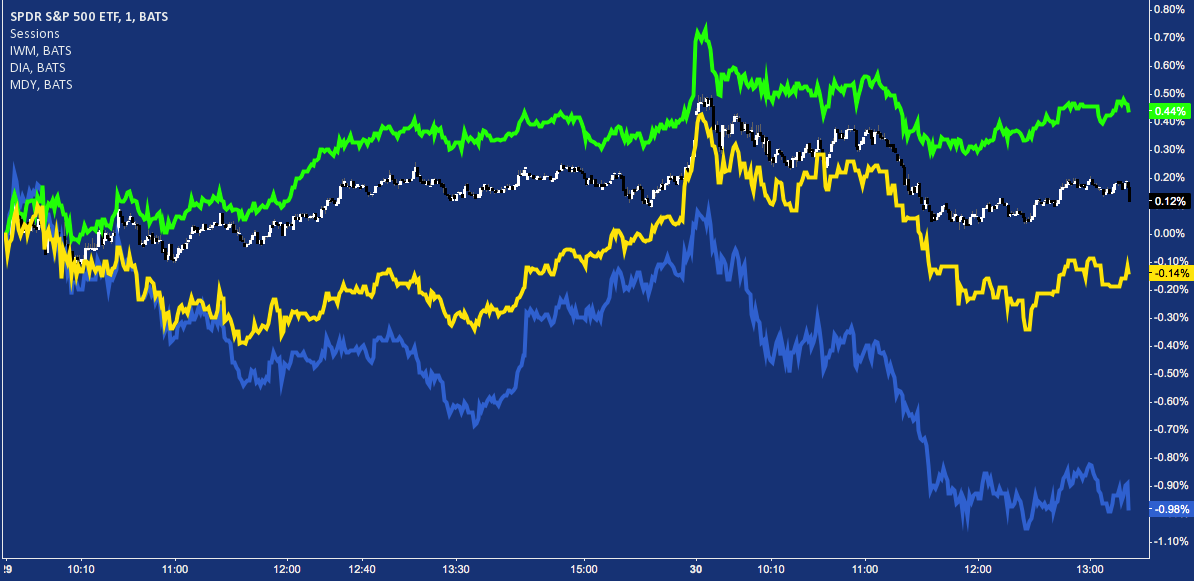

After an opening gap-up on Fed day, US stock indices are trading off their AM highs in a bottom-up decline, as the Russell 2000 (IWM) leads the way down, now off over 1% to 110.25 last. In contrast, the S&P 500 (SPY) is flat, while the Dow Industrials remains green, still +0.44% on the day.

After an opening gap-up on Fed day, US stock indices are trading off their AM highs in a bottom-up decline, as the Russell 2000 (IWM) leads the way down, now off over 1% to 110.25 last. In contrast, the S&P 500 (SPY) is flat, while the Dow Industrials remains green, still +0.44% on the day.

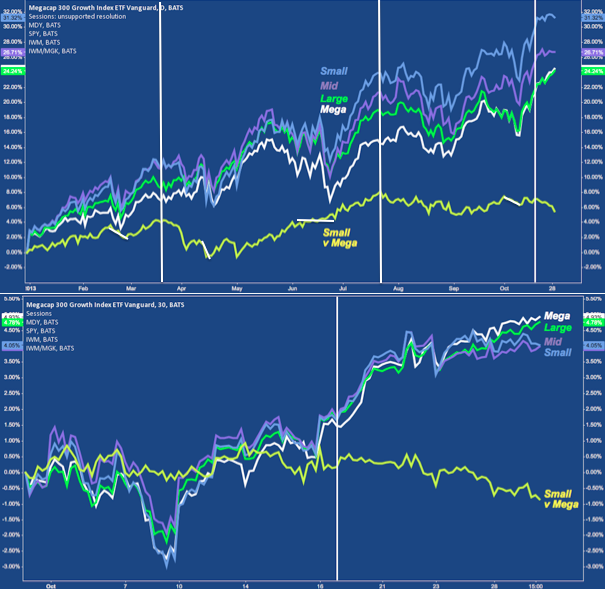

This continues a theme that noted on See It Market earlier this week (here, and here) of the role reversal of leadership between small caps and large caps that has been underway since mid-October.

Keep in mind 2013 has not weathered this kind of transition well where large caps have pressed, visible here:

Twitter: @andrewunknown and @seeitmarket

Author holds net short exposure to Russell 2000 at time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.