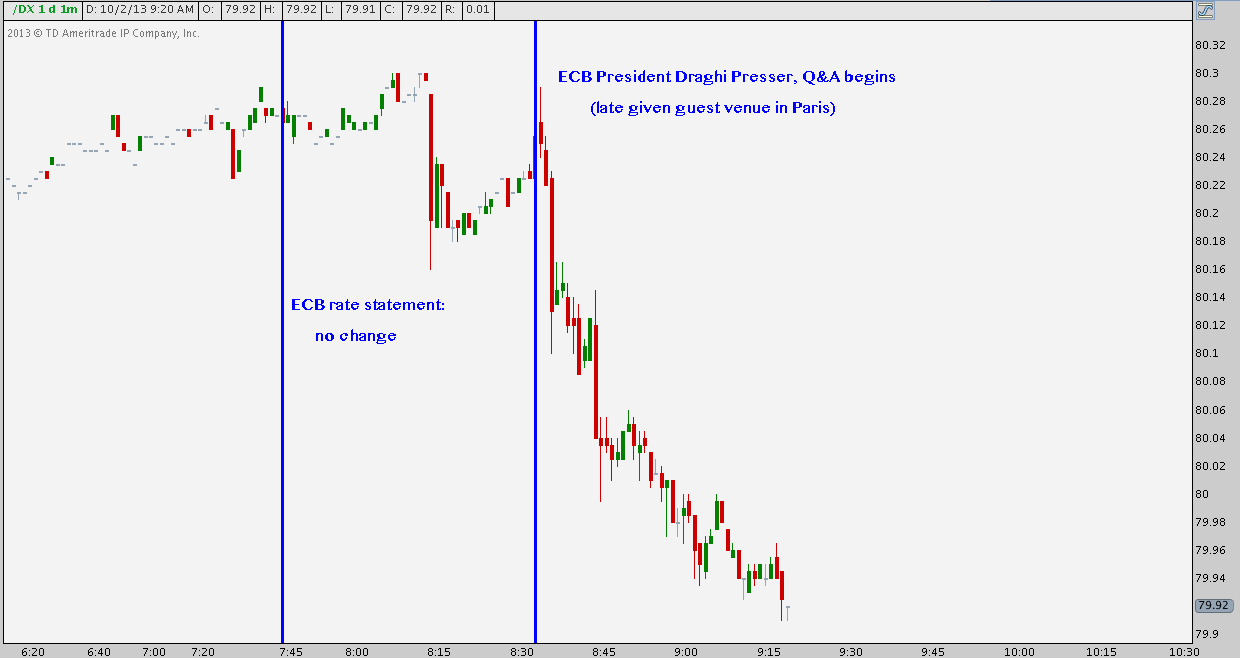

The US Dollar (DX, UUP, USDX) broke down heavily this morning following ECB President Mario Draghi’s more balanced (i.e. less dovish) comments regarding Euro Area inflation, growth and recovery.

The US Dollar (DX, UUP, USDX) broke down heavily this morning following ECB President Mario Draghi’s more balanced (i.e. less dovish) comments regarding Euro Area inflation, growth and recovery.

Now sinking below 80, the Greenback is printing at its lowest levels since early February.

US Dollar Index (DX) – 1-Minute: US Dollar Falls Following Draghi Comments

This -0.5% hit to the USD is noteworthy by itself; but as follow-through to the downside in its larger context, today’s breakdown is highly significant:

US Dollar Index (DX) – Monthly: US Dollar Falls Further Below Rising Wedge Support

The USD broke below 2.5 year rising wedge (blue) support late last month following the FOMC’s “no taper” decision. Shortly after that announcement on 09/18, volatility mostly disappeared – until this morning. Now the Greenback is showing follow-through on this break below wedge support.

A recovery of the wedge with a move above 81 would change the Dollar’s long-term technical picture; but in the absence of a reversal, the path of least resistance for the Greenback is down with a major floor respected throughout 2012 coming in at 78.50-79.

Twitter: @andrewunknown and @seeitmarket

Author holds no positions in instruments mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.