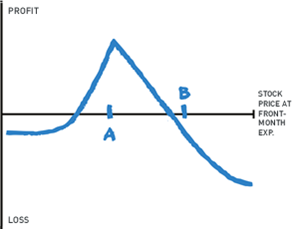

I would like to continue my discussion of spreading time by describing diagonal calendar spread options. This spread, unlike the horizontal calendar spread, uses different strikes. It is a slightly bullish or bearish trade and when done properly can create free, or nearly so, options. Bullish or bearish, free options are nice to have.

I would like to continue my discussion of spreading time by describing diagonal calendar spread options. This spread, unlike the horizontal calendar spread, uses different strikes. It is a slightly bullish or bearish trade and when done properly can create free, or nearly so, options. Bullish or bearish, free options are nice to have.

Read more from Randall Liss on “Spreading Time” via horizontal calendar spread options.

Let’s take a look at some real life (July 15, 10:00 CDT) examples of a diagonal calendar spread options trade. Let’s say I think Facebook (FB) will be flat this summer and then rally. With FB at 25.80 you can sell the August 26 call options at 1.20 and buy the September 27 call options for 1.20. In trader’s parlance we call this doing the trade for even money. If the August call expires worthless you have the September call for free! The trade does bear watching, however, because you do not want the short 26 call to expire in the money and turn into short stock.

Let’s say you think the rally will peter out soon and the market will turn lower. In that case, put diagonal options are a good trade. Using the S&P 500 ETF (SPY), now trading at 168, you can sell the August 166 put at 2.25 and buy the September 163 put at 2, for a .25 credit.

To paraphrase the Dire Straits song, “Money for nothing and the options for free”!

A diagonal calendar spread is a bit riskier than a horizontal time spread but the payoff is potentially greater.

So, as you can see, whether horizontal or diagonal, time is very spreadable! You can catch me every day at The Liss Report.

Thanks for reading this installment on diagonal calendar spreads.

Twitter: @RandallLiss

No positions in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.