Make 10% per month!! Sounds great doesn’t it? That’s what a lot of option trading websites are claiming these days. Are they false claims? No, you can actually make 10% per month with iron condors. What they don’t tell you about, though, are the risks.

A typical iron condor trade will bring in around 10% income for a month, if successful. But, in order to make 10% on your entire account, you would need to risk ALL your capital on that one trade.

Trading that way, you will stay in business for 6, maybe 12 months.

Don’t get me wrong iron condors are great, and form the core of my trading strategy, but you need to be smart about it and not get sucked in by the lure of 120% per year returns.

Here’s how you can protect yourself and trade iron condors in a smarter, more risk controlled manner.

1. Pay attention to volatility

Iron condors are a short Vega trade. In fact, they are very short Vega. So it makes sense that you enter these trades when volatility is HIGH and expected to FALL. Don’t go allocating too much of your capital to iron condors when the VIX is down at 12.

2. Add some extra protection

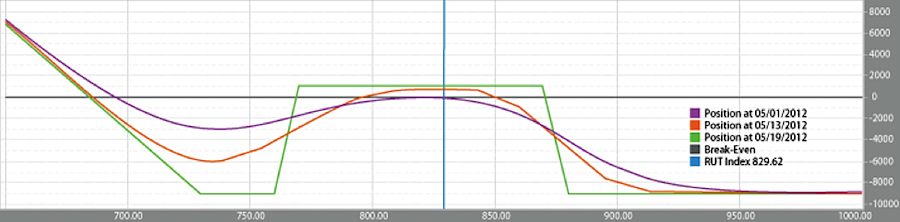

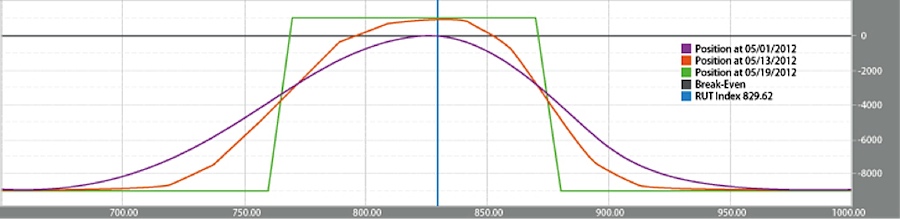

Iron condors make money in markets that are flat, rise slightly or fall slightly. What hurts these trades is a swift and severe move Up OR down. For example, during the Flash Crash, iron condors would have been KILLED. So it makes sense to add some downside protection via extra long puts or out-of-the-money calendar spreads. In the two diagrams below, you can see how adding some extra puts can dramatically change the payoff diagram. Click to enlarge

Standard Iron Condor Iron Condor With Extra Puts

Iron Condor With Extra Puts

Similarly a strong move higher will cause problems for the call side of an iron condor. You can protect against this by adding some extra long calls, placing a debit spread just below your short calls or adding a diagonal.

Keep in mind that having extra protection will help avoid large losses, but will generally reduce the income potential of the trade.

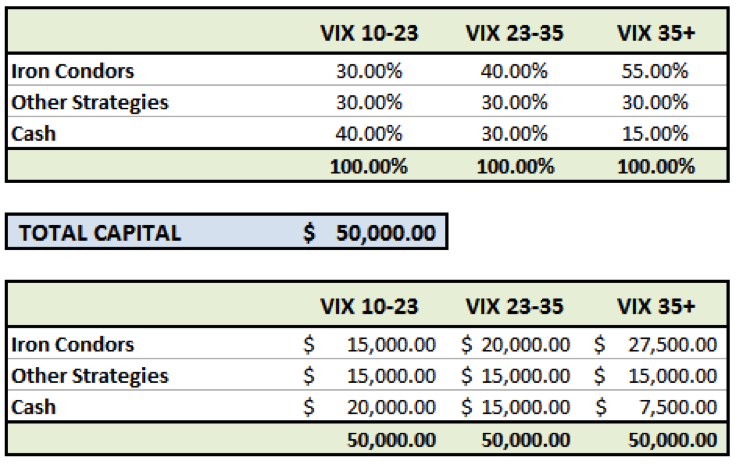

3. Sensible portfolio allocation

As mentioned above, allocation 100% of your capital to iron condors would be crazy. For starters, you need to keep some cash on hand in order to make adjustments… and you will need to make adjustments.

As iron condors are a good trade when implied volatility is high and expected to fall it makes sense to allocate more to this strategy when volatility is high. Here is how you could look at setting up your allocations. Click to enlarge

4. Trade Indexes, not stocks.

Iron condors on individual stocks can be risky. There is always the chance of a large gap up or down due to an earnings announcement or news release.

Indexes are generally safer and less volatile for this trading strategy. The other advantage of indexes is that they are European settled meaning there is no risk of early assignment.

So, by all means try an iron condor, they are a fantastic strategy, but keep your expectations in check and be careful not to lose your shirt.

To learn more about iron condors, visit my blog at www.optionstradingiq.com or check out my Kindle book “Bullsh*t Free Guide To Iron Condors” which is available in the Kindle store.

**Note that any products mentioned in this article are not endorsed by See It Market – review at your own discretion.

Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.