By Jeff Wilson

By Jeff Wilson

If you’re reading this, chances are this is the Nth article on AAPL options trading ideas and/or earnings that you’ve read. And if you’re one of the few who haven’t, below are a few more articles on See It Market regarding Apple earnings and AAPL options trading ideas and stock valuations. But before I proceed, I want to make something clear. I’m no mobile device channel check expert nor a consumer tech aficionado. However, it does seem that this Apple earnings report will be watched closer than recent reports, as their once invincible earnings reputation is now in question. And this is one of the main reasons the stock has lost close to 30% in market value since September.

- Apple Options Trading Idea Into Earnings, by Brad Tompkins

- Putting a Price Tag on Apple, by Alex Salomon

- Dissecting Apple Earnings Estimates for Q1 2013, by Alex Salomon

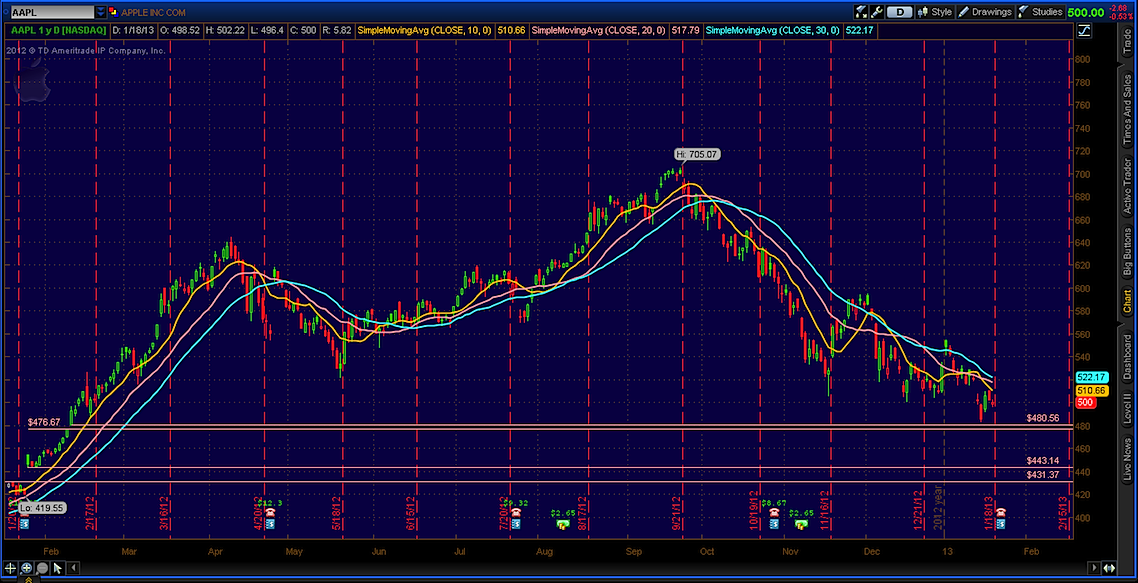

For starters, let’s take a quick look at some AAPL charts from different time frames in order to establish possible support and resistance levels to better refine an earnings play structure.

Here is a 10 year monthly chart showing its volume profile. Volume profile is a chart showing the amount of volume that traded at a price level over some length of time.

A few quick notes on this chart:

a) 10 period SMA

- Downward sloping 10 period SMA

- 2 consecutive monthly candles closing below it which hasn’t happened since 2008

b) 20 period SMA

- Still upward trending with roughly 10 trading days left in the month

- Stock is currently trading below

c) 30 period SMA

- Still upward trending

You can see I highlighted a price area where I think the stock can go if the reaction to the earnings report or conference call is negative. This $480 to $430 range is an area of confluence where:

- the 50% retracement of the late 2009/early 2010 breakout from consolidation to all time high resides

- the volume profile shows an area where very light trading volume occurred and in the age of electronic trading, an area where price can quickly knife through

The green horizontal lines note this price range and in the daily chart (further below), we can see there is a dearth of volume that traded here and why price might want to come back, build volume and serve as support for any sustained move higher from there.

The weekly chart doesn’t differ too much from the monthly chart except that the 20 and 30 period moving averages are both sloping downward whereas the 10 period, while still exhibiting a negative slope is could be flattening out. The price action the next 2-3 weeks could help dictate whether the 10 period MA will flatten out of continue to point downward.

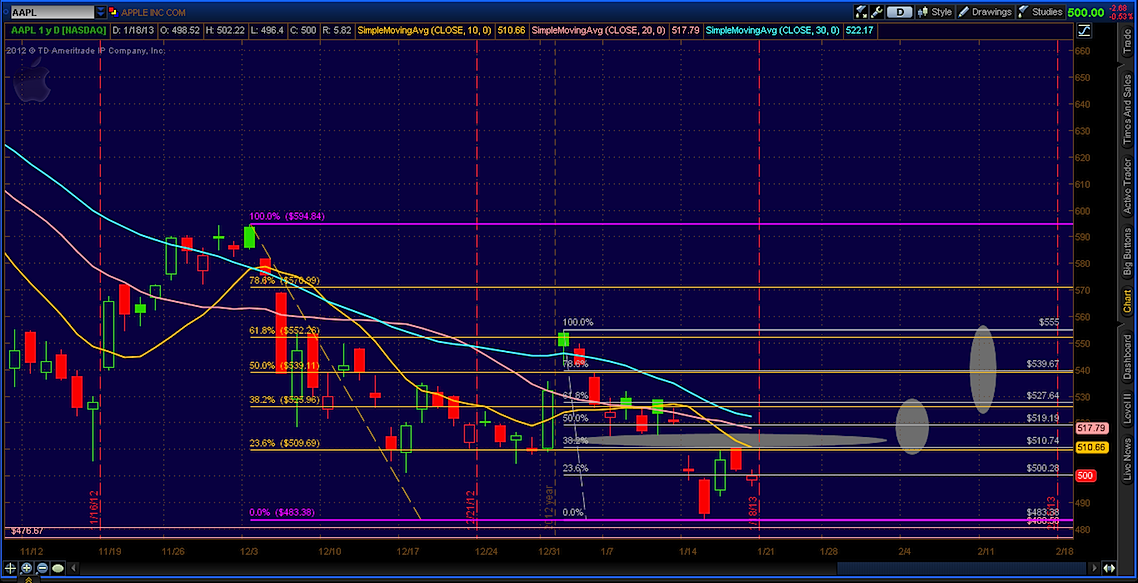

The daily chart shows areas where gaps have occurred. Interestingly enough, the gap around the $443-$430 range was created due to the price reaction after last year’s earnings report. You can see how these gaps explain the “hollow” area on the volume profile of the monthly chart.

The moving averages are all sloping downward albeit the space between them is narrow showing that the stock is trying to find a base despite negative bias on the price action.

Near term upside resistance areas reside initially in the $510 to $516 range where a gap is present and around where the 38.2% fib retracement from the 2013 high and low range can be found. You can expand this range up to the $525 level as this would encompass up to the 61.8% retracement of the same time frame as well as the 38.2% retracement from December 2012 highs to January lows. Above these levels and the next area of resistance is around the $555 level.

Now that I’ve laid out some price levels on the stock, here are a few structures to possibly play it either as a starter position or a supplemental position using options or stock/option combo.

Here are a few potential AAPL options trading ideas depending on your directional bias and time horizon. (Please note that the charts attached reflect AAPL price prior to the weekend whereas the ideas below are as of market close on 1/22/2013

Playing AAPL options for the upside – AAPL Options Trading Ideas #1:

I. Proactive investment type of position.

a) In a long stock position of at least 100 shares initiated within the past 7 trading days with an avg. cost of $500 and looking for a 25% (excl. dividends) return

-Sell to open Jan ‘14 $570 call(s) for about $31.60. You can get called away at $570 regardless how much higher than $570 the stock is trading at. However, you took in $31.60 in premium so $570+$31.60=$601.60 is the actual value you sold your shares for which achieves your investment objective (20.32% return excl. commissions). This premium also provides a cushion worth the same amount to the downside which is $468.40 ($500-$31.60). One can choose where to put a stop loss on the stock depending on risk tolerance. Weekly and monthly charts provide some insight on some important levels.

b) In a long stock position of at least 100 shares initiated within the past 7 trading days with an avg. cost of $500 and looking for a 15% return (excl. dividends) return but want outright protection to the downside below $475 on any earnings miss. However if stock trades at $430-$400 level, would consider buying down there again

– Go long Feb 1 weekly $475/$430 put vertical for $6.90 or better. Short April $575 call for $9.65 or better. You take in a total premium of $2.75. In this scenario, you can get called away at $575 by April for a 15.5% return ($575 + $2.75 of premium taken in). Take note that the insurance in the form of the put spread only covers you until Feb. 1. Hopefully, you’ll have enough time after they report to do your homework and assess the price action and stock fundamentals

II. Swing trader. Bought stock at about $490 AH upon hearing of Tom’s Demark call on CNBC where he said it can go 20% higher from where it was trading at that time (roughly $485). I think it can go up after earnings but hesitant to stay in the long position and put protection seems too expensive. Don’t mind getting back in at $450 if it gets there.

a) Sell stock at $507.77 (using AH pricing) and book the $17.77/share profit. Go long April $550/$600 call vertical and short the April 450 put for a net credit of about $3.25. The call vertical give you upside exposure should Tom Demark’s +20% move happens within 80 days or so. The short put allows you to finance the cost of that call vertical at a strike that you are willing to go long shares at. You take in $3.25 in credit for your time as well.

b) Sell stock at $507.77 (using AH pricing) and book the $17.77/share profit. Go long March $525/$555 call vertical and short the March $450 put for a total cost of about .10. Similar concept to a) with differences being in the price AAPL stock needs to trade at before position starts to be profitable and time for the thesis to occur.

III. Straight up long. Willing to risk all that I put in.

a) With the IV inflated due to the earnings event, one of the better ways to reduce the risks of buying inflated premium is by selling another highly inflated options contract. Thus, buying a call vertical helps mitigate having to just buy juiced up contracts. Right now the options market is pricing in a $35 move which is roughly a 7% move in either direction. This week’s $525/$540 call vertical can be bought for $4.35. This provides a better than 1:3 risk to reward if AAPL closes Friday over $540. With this strategy, you are playing the earnings and reaction to it up to 2 trading days after.

b) Long Feb 1 $540/$555 call vertical for about $3.10. This is a play for AAPL stock to move up into 2013 highs.

Playing for the downside – AAPL Options Trading Ideas #2:

I. Mildly bearish: If reaction to earnings is negative, expecting at least $480 this week (as highlighted on weekly and monthly charts)

a) Long this week’s $490/$480 vertical put spread for about $3.70.

b) More complex structure: As mentioned above, market is pricing in a $35 move. Assuming stock is trading at roughly $505, downside expectation is $470. Long $485/$470/$455 put butterfly for about $2. Good risk to reward but do know that butterflies are low probability trades. For more info on this structure, click here https://www.theoptionsguide.com/long-put-butterfly.aspx

II. More bearish: If reaction to earnings is negative, not only will it be trading around $480 this week, will also be expecting it to trade in that $480-$430 range and high probability that it trades to $450 by next week(as highlighted on weekly and monthly charts)

a) Long Feb 1 $475/$450 put vertical for about $5.05.

III. Uber Bearish

a) I.a) or I.b) under this downside section combined with a short call vertical. Choose 2 strikes over the implied move PLUS current stock price as the short strike. Assuming AAPL trades at this $505 level and implied move is $35, shorting this week’s $550/$560 call vertical for a $1 credit would be the supplement to the vertical or butterfly put spread. The risk profile changes though. While the $1 credit reduces the outlay for the vertical or butterfly spread, there is an additional risk taken on in the form of being short the $10 wide spread. Should AAPL stock pop and makes a move into that $550-$560 range before close this Friday, that sold spread for a credit will begin to lose money.

Sideways – AAPL Options Trading Ideas #3:

I. Can’t really pick a direction but I expect the levels to be respected on both sides. Will look at the upside and downside levels and combine them with implied move to choose strikes.

a) With stock trading at $505 and implied move at $35, expecting $470 and $540 as extremes. Allowing for a little wiggle room and using levels on chart as a guide, going short this week’s $545/$550 call vertical and the $465/$460 put vertical for a net credit of about $1.45. This provides a 29% return on risk ($5) should $AAPL trade within the $465-$545 range.

b) Let’s assume that you think that the options market if overestimating the post earning move. Instead of the implied move of $35, you think it moves only $15. With this in mind, selling this week’s $525/$530 call vertical and the $490/$485 put vertical for a $3.35 credit.

Up or Down, I don’t care. Just want to take advantage of the volatility skew

When there is a binary event such as earnings report, front dated options gets inflated relative to back month dated contracts. This is reflected in the Implied volatility(IV) readings on the contracts. At the moment, this week’s at the money strikes on AAPL has an IV of about 83% whereas next week’s have an IV of about 57.5%. Without talking too much about the technicality of IV, what this means is that while AAPL options are being marked due to an event, this week’s options are being marked up so much more. Let’s take the $505 call for example. This week’s contracts are being priced at $17.40. With 3 trading days into expiration, it’s basically being priced at about $5.80 per day ($17.40 divided by 3). Next week’s $505 calls are going for about $19.80. With 8 trading days until next week’s expiration, those contracts those contracts are being priced at about $2.48 per day. You can see how inflated IV changes the premium picture.

One can pick a direction and take advantage of such volatility skews. One way of doing this is through calendar spreads. Let’s work again with the $35 implied move and have as the trade thesis that it will not be violated. Just in case, the structure will again allow for some breathing room for the structure.

a) Call side (Long bias): Short this week’s $545 call, long next week’s $545 call for about $2.25. The idea here is for AAPL stock to move up but not too high where it trades above $545. The best case scenario is for AAPL to get to $545 but expires right below it on Friday. The call you sold for this week will expire worthless whereas the long call you own for next week have so much premium left. There risk here is twofold: 1) that it overshoots the strike price during the week that the front dated contract expires on and 2) it moves down a lot that any premium left on the back dated contract becomes worthless

b) Put side (Short bias): Short this week’s $465 put, long next week’s $465 put for about $2.25. Similar concept to a) above.

c) One can play the volatility crush on both sides using both calls and puts. This structure is known as the double calendar spread. One would want a move within the parameters set by the short strike to occur. It doesn’t matter whether it’s to the upside or downside as long as a move close to the implied move occurs.

For more info on calendar spreads and double calendar spreads click here https://www.optiongenius.com/CalendarSpread.html

Let me know if you have any questions. Hope this helps a few of the readers with AAPL options trading ideas, as Apple stock is one of the more popular stocks to own.

Twitter: @cerebraltrades and @seeitmarket

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.