Why is Productivity Falling?

The question of why U.S. productivity growth is so weak has been a topic of much debate. Explanations include employer and worker behavior patterns, the influence of a rising service sector economy and the most commonly cited excuse, measurement error. The disparity of explanations implies that most economists do not have a sound diagnosis for this “economic mystery” as Neil Irwin of The New York Times recently called it. One thing is certain to economists – to the extent that productivity is in fact weak and even potentially in decline, a continuation of this trend will have important implications for U.S. and developed world economic growth and, of course, asset prices whose returns are predicated on growth.

No Economic Mystery

Dear experts,

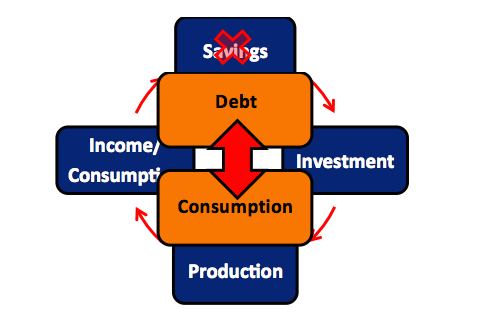

The solution to the mystery is straight-forward. Rising productivity depends upon the perpetuation of evolving complex production which hinges upon saving, otherwise known as consumption deferred. The accumulation of, and refinements to, physical capital through savings and investment provides the cornerstone for the advancement of labor and technology. In other words, productivity requires savings to feed the Virtuous Cycle.

That is, simply enough, the answer to this great economic mystery.

The Un-Virtuous Cycle

Since the financial crisis, a growing number of people are beginning to question the foundation upon which our economic prosperity rests. Our ability and willingness to transact does not appear to have changed but we seem to harbor more doubts. Stagnant growth and incomes aggravate this view. Inflation is reported as worryingly low but the cost of many high expense items such as healthcare, tuition and rents are rising significantly faster than wages. A dwindling middle class is most acutely suffering the consequences resulting from this squeeze.

Maybe the success of Bernie Sanders and Donald Trump are reflective of the erosion in confidence and trust. Perhaps current generations have realized they are not likely to be wealthier than their parents. Certainly the secular decline in our economic and productivity growth offers clues. Whatever the reasons, the system on which our affluence was built has been quietly dismantled. The doubts and frustrations reflected in all various forms by the general population are among its manifestations. Finding a culprit is also part of the problem because it appears no one can quite put their finger on how we got here. Equity and housing market bubbles are often-cited villains but those and other financial irregularities are the symptoms not the causes.

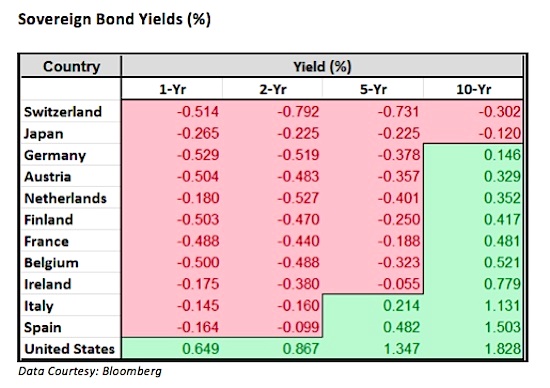

In a world where governments and central banks of the most affluent countries are manipulating interest rates to zero or even negative yields, the Virtuous Cycle, which depends upon saving and investment, is conspicuously neglected. In its place, the natural order of economic output has been rearranged for political expediency and at times as a reaction to numerous financial crises. A durable, time-tested model of prosperity, Savings-Investment-Production-Income, has been hi-jacked by a model focused solely on consumption, requiring ever increasing levels of debt to grow. It is an impatient, undisciplined model. Not only is such a model unsustainable, it is destructive.

In their textbook Macroeconomics, Rudiger Dornbusch and current Federal Reserve Vice-Chairman Stanley Fischer state, “When the return on savings becomes negative, one of three things happens: Households sharply reduce their saving or they shift their saving abroad (which we call capital flight) or they accumulate their saving in unproductive assets, such as gold. One way or another, the financial environment for saving is an important factor in mobilizing resources for capital formation and in channeling them from households, via financial intermediaries, to investing firms.” To paraphrase their point: When the financial environment discourages savings, the investment and production components of the virtuous cycle suffer which also negatively affects productivity and income. That is precisely what we are seeing.

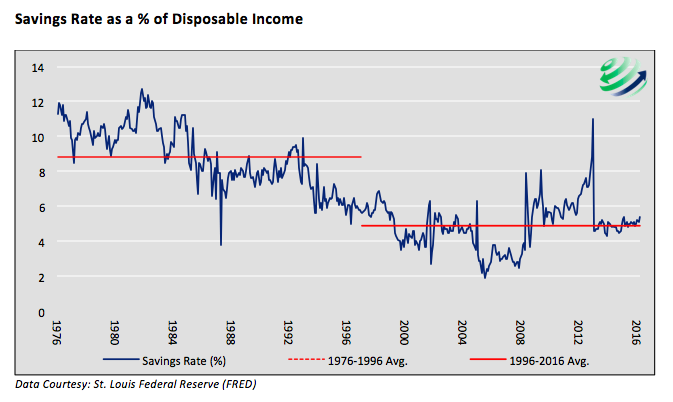

Some may argue that the recent rise in the national savings rate invalidates this perspective. On the contrary, policies that incentivize consumption over savings have been in effect for decades. It is myopic to observe the savings rate over the last few months in an effort to invalidate what is best described as a secular, policy-driven change. The cumulative effects of these policies are quietly corrosive. The savings rate (expressed as a percentage of disposable income) as shown below, averaged 8.9% from 1976 to 1996. Over the most recent 20 years the average is 4.9%.

The subordination of saving to consumption was born in earnest in 1971 when President Nixon closed the gold window and eliminated any form of discipline imposed on the value of our currency. It was further advanced in the Greenspan, Bernanke, and Yellen eras at the Federal Reserve through so-called “pre-emptive” monetary policy and more recently quantitative easing. Those efforts allowed citizens and lawmakers to shirk their fiscal responsibilities and as a result, the size of the national debt is now seen as a major security risk.

Further proof of this behavior can be seen in the record low yields, and rash of negative yields in the global bond markets. As evidenced by the bond yields in the table below, the incentive to save and fuel the Virtuous Cycle is nil.

Summary

The organic economic structure that made western economies uniquely successful and prosperous has been altered. The virtues of discipline, patience and work ethic have been mortgaged away, traded in for quick growth schemes that yield far less than promised. The Virtuous Cycle of savings, investment, production and income which delivered unparalleled prosperity and opportunity for centuries has been tossed aside by those charged with shepherding this durable but fragile gift.

The nation’s economic illness and her citizens’ growing intolerance is testimony. The developmental effects of this economic subversion has taken decades to emerge. The economy is sick but leaders refuse to acknowledge it, offering only weak reassurances because the implications are deeply troubling. The fact that the Fed and other central bankers were blindsided by asset bubbles and have so wrongly predicted economic activity highlights their lack of understanding of the principles of the Virtuous Cycle.

Unfortunately, ignoring or not understanding the facts does not change them, and if repairable at this late stage, fixing the problem will be very painful. At the same time, and even more importantly, repairing America’s economic foundation first requires proper diagnosis and understanding of the cause as has been presented here.

720 Global would like to thank Sapere Wealth Management for their meaningful contributions to this article.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.