Activist Investor Bill Ackman is feeling the heat these days. He has a large stake in highly scrutinized Valeant Pharmaceuticals (VRX) and may be facing billions in losses.

A confluence of factors has changed Valeant from one of the greatest momentum stocks of the last decade to one of the most hated, bidless stocks in the market.

Although, we’re all not running billion dollar hedge funds with other people’s money, there are plenty of investing lessons to be learned from this situation – especially from a smaller investor’s point of view. We absolutely have to do everything in our power to avoid owning a stock like VRX during a 60% drawdown from its high.

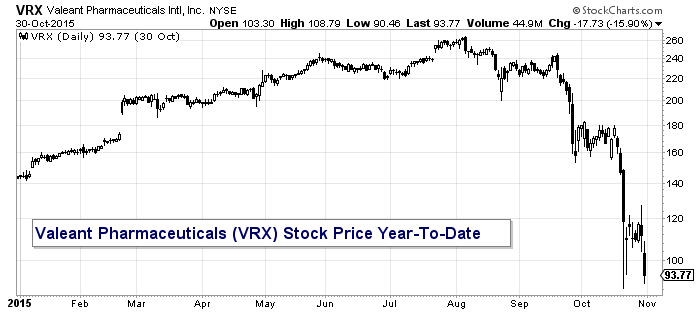

Here’s a look at Valeant’s stock price in 2015:

Valeant is a ‘roll-up’ OR more simply put a company that has grown via continuous acquisitions. Valeant has acquired more than 100 companies since 2010 while amassing 30 billion in debt, which is roughly the company’s current market capitalization.

Key lessons we can learn from this situation:

Know when you’re being pitched. Friday, Bill Ackman held a 4 hour conference call. Yes, four hours. Most strong investments theses are relatively short, based on logic and understandable. What’s interesting is Bill went to incredible lengths to defend the company, often going off the main topic to place Valeant in a positive light.

He made plenty of broad aggressive statements, such as suggesting Pfizer buy Valeant Pharmaceuticals. He even went as far as comparing himself to Warren Buffett in the American Express Salad Oil Swindle of 1963. That initially comes across as a baseless comparison.

We see this all the time in the investment research industry. There are so many poor and flawed ideas in the world, but a talented presenter can frame them positively. When studying any topic it’s critical to be able to identify substance from ‘oohs and ahhs’.

Stay humble. No matter how far you go in the investing business, you have to keep your ego in check. Ackman’s fund posted a 40% return in 2014. He really trounced his competition.

It’s easy to go from the top to the bottom. We need to fight just as hard to stay at the top of our investing game as we did to get there. After periods of success, we’re naturally more vulnerable to overconfidence. And that can loosen up our focus and make us susceptible to losses (i.e. the potential for significant drawdowns).

Investing in ‘Roll Ups’ can be a lucrative, yet dangerous game. These companies are largely frowned upon by the value investment community as their growth is manufactured. This type of company makes for the greatest of momentum stocks. That said, they also are a breeding ground for potential accounting nightmares. You have to know when to get out. This includes being mentally fit to close your position significantly off the highs.

Know when trends supporting your thesis have changed. A trademark of Valeant’s strategy has been to constantly buy new drugs, then raise their prices.

Now with ever increasing scrutiny of drug prices, that becomes increasingly difficult (and ushers in scrutiny of Valeant’s business model). Also, with shares down 60+% from their highs, it is much harder for the over-levered company to finance new deals.

Fight or Flight. When positions turn against us, we choose to exit at a certain point. For traders, that’s a stop level. For investors, that could be when your thesis is no longer valid.

It can be difficult to know when your thesis has run it’s course, as that may not be clear until it’s too late. If we get emotionally caught up in a position, we are more likely to have a biased view of the facts and fight an emerging downtrend.

There is never just one cockroach. With all of the excess money floating through the healthcare system over the last few years, questionable behavior was bound to follow. My guess is that the latest inquiries into Valeant are likely to bring greater scrutiny to the industry. So investors should be aware that there may be others to follow.

The ideas I’ve shared here are not perfect and they are easier said than executed upon. Investing is very hard. That said, a focus on these factors can help us avoid a haymaker drawdown like we’ve seen in Valeant Pharmaceutical (VRX) shares.

Thanks for reading!

Sources:

Twitter: @ATMcharts

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.