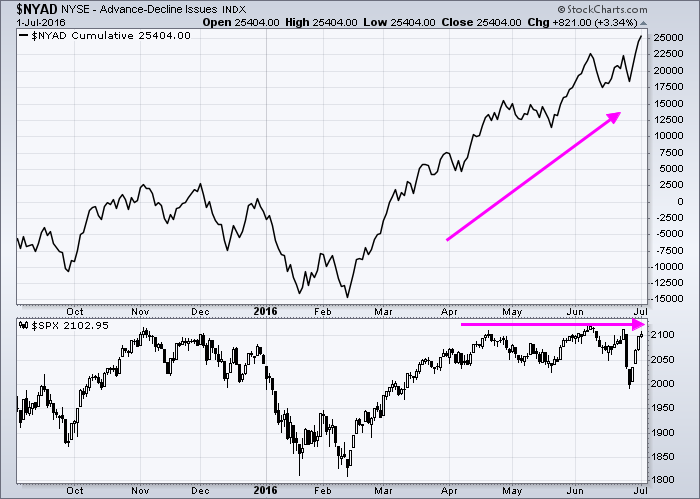

Last week saw an impressive turnaround on the S&P 500 Index (INDEXSP:.INX). After a steep decline, the index rallied over 4% from Monday’s lows all the way back to the upper end of their multi-year range. And momentum has quickly shifted back into the bulls favor.

This price action has put several breakout stocks on my radar, while creating several trading setups for trend traders.

Once again we find ourselves less than 2% away from all time highs. And more importantly we’re seeing market breadth indicators like the cumulative advance-decline line trending to new highs. This is traditionally a bullish signal and a suggestion of what’s to come in markets.

Just like the NYSE Advance-Decline is trending to new highs, there are more and more stocks emerging to new all time or 52 week highs. And it’s these market leaders that you’ll want to pay attention to, especially if the S&P 500 Index does in fact go on to breakout to new highs.

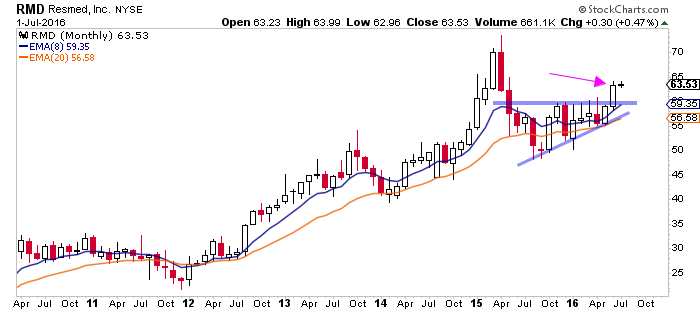

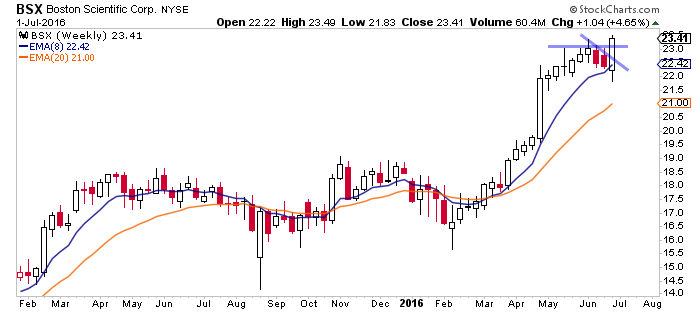

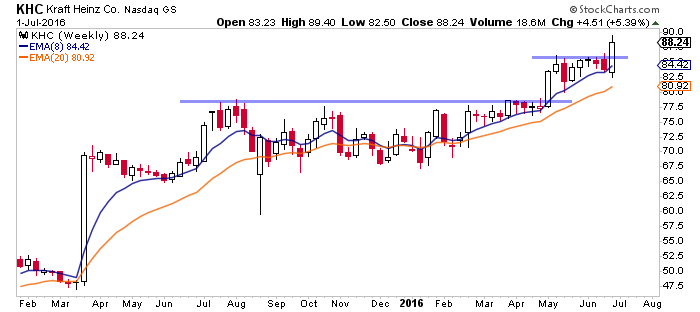

The following 5 breakout stocks are some of my favorite which have just emerged from actionable ranges and could have more fuel in the tank to trend higher. I’ll leave you to check out the charts for yourself, but feel free to reach out if you have questions.

ResMed Inc. (NYSE:RMD)

Boston Scientific Corporation (NYSE:BSX)

Kraft Heinz Co. (NASDAQ:KHC)

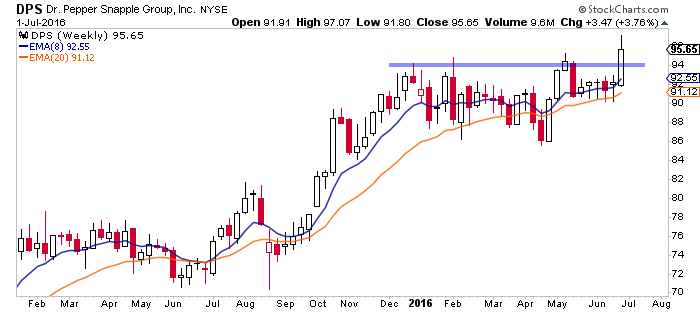

Dr Pepper Snapple Group Inc (NYSE:DPS)

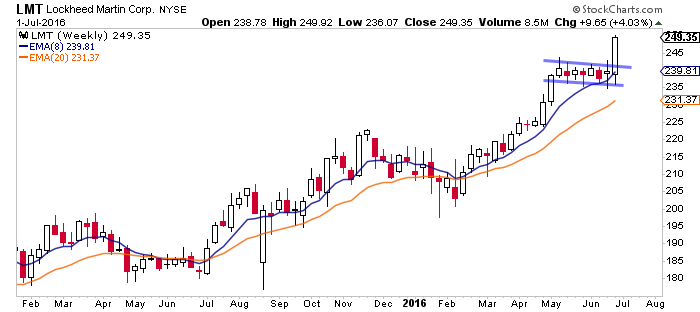

Lockheed Martin Corporation (NYSE:LMT)

Thanks for reading.

Twitter: @EvanMedeiros

The author is long RMD at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.