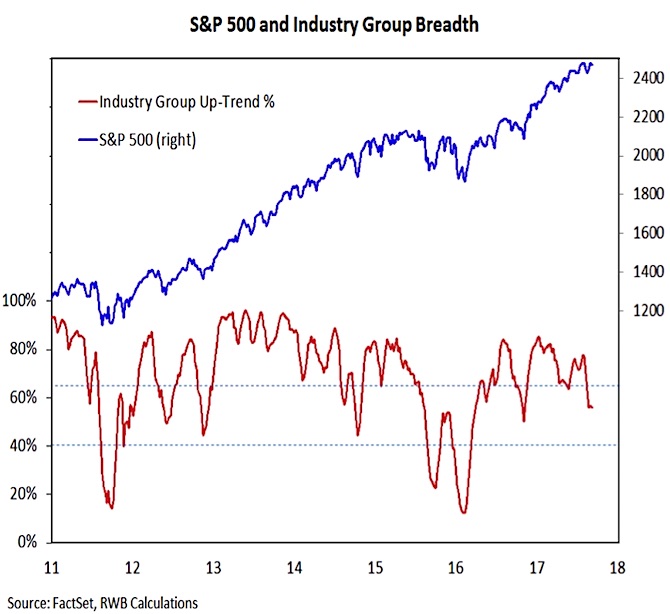

Additionally, when market breadth has been strong coming into this seasonal weak period, weakness has been muted and existing uptrends have largely remained intact.

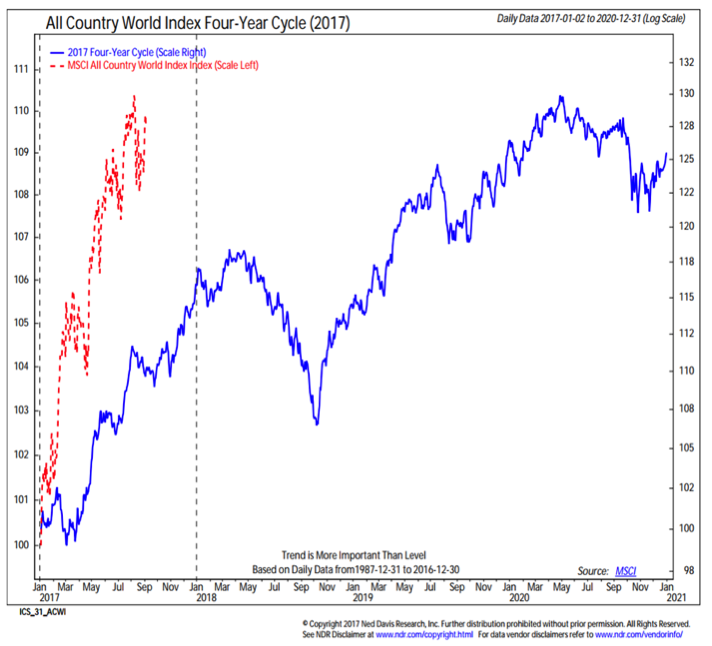

While the S&P 500 is now in its longest stretch without at least a 5% pullback in the past 20 years (arguing that some degree of weakness is overdue) we do not see evidence suggesting that we are in store for a deeper correction (at least not now). Rather than focusing on the cycle composite, perhaps the 4-year cycle may be a more appropriate guideline. This suggests limited near-term weakness followed by a year-end rally, but a more treacherous path in 2018 in advance of mid-term elections.

Breadth has managed to stay bullish, for now. The broad market has seen significant deterioration since early summer. While that deterioration has stalled (the percentage of industry groups in up-trends has held steady near 55% for three weeks), the new highs being tested at the index-level put addition pressure on the measures of broad market health. A failure now to confirm the highs in the indexes would represent negative divergences and cast some doubt on the continued support of the broad market. This is not yet the case, but something to keep an eye on as we move toward the fourth quarter.

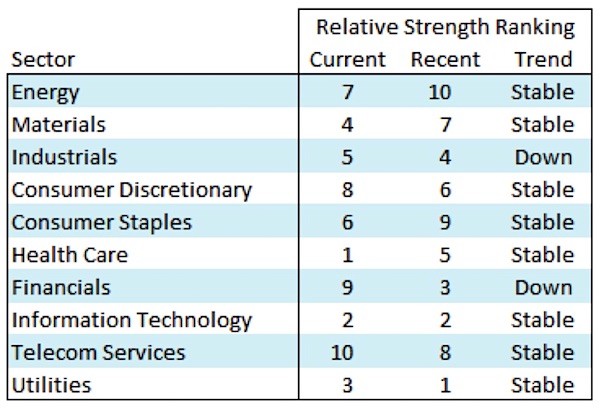

While the weight of the evidence argues for caution there are still opportunities to look for leadership within the stock market. Current leadership in the U.S. comes from large-caps stocks, while sector leadership is with Health Care, Technology, Utilities, and Materials.

From a global perspective, better opportunities may exist overseas than at home for U.S. investors. Both developed markets and emerging markets have gained relative strength versus U.S. stocks in 2017, ending a protracted period of U.S. outperformance. Emerging markets bottomed relative to their developed counterparts in early 2016 and have continued to move higher in 2017.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.