Cyclicals historically lead early in a bull market, and are among the first to show signs of trouble later in the cycle. Representative of cyclicals and America’s great love and pastime are the auto stocks and automobile sector. And the tie-in to the US consumer makes auto stocks a reliable barometer of consumer health and a signal for where the general market may be headed.

Cyclicals historically lead early in a bull market, and are among the first to show signs of trouble later in the cycle. Representative of cyclicals and America’s great love and pastime are the auto stocks and automobile sector. And the tie-in to the US consumer makes auto stocks a reliable barometer of consumer health and a signal for where the general market may be headed.

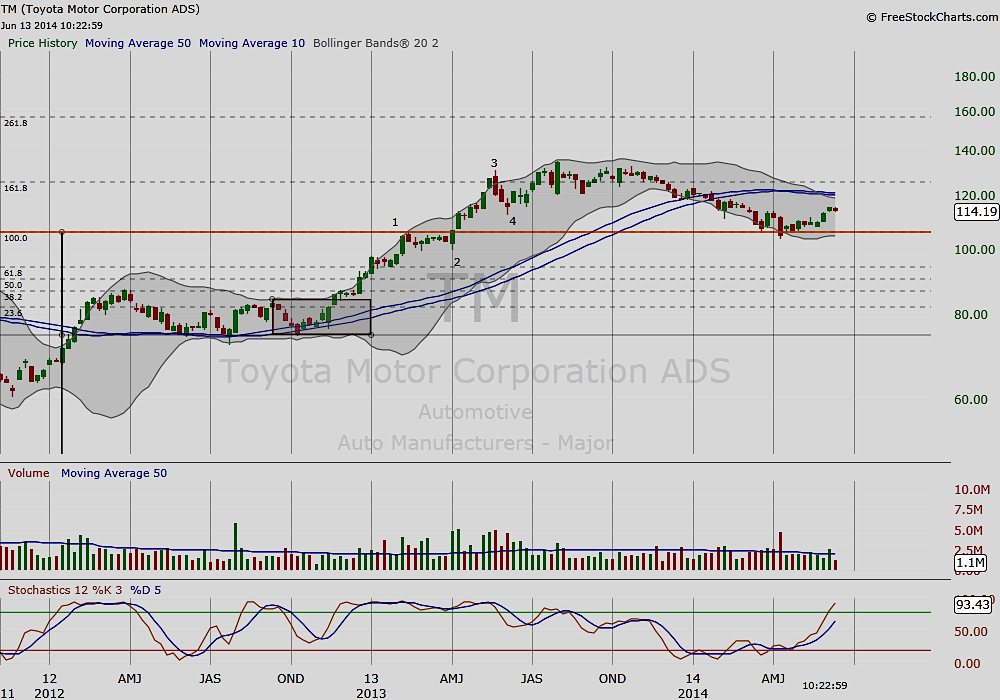

In December of 2012, the autos were among the first to break out of early stage bases after having peaked in early 2011. Top auto stocks, General Motors Co. (GM), Ford Motor Co. (F), and Toyota Motors Corp. (TM) lead the way to a new bull market cycle. And in April of 2013, Tesla Motors Inc. (TSLA) broke out of its years long base, creating further excitement for the bull market, but also for the future of these automakers.

By the end of 2013, F, TM, and GM had reached intermediate peaks. However, futuristic carmaker TSLA would not be easily deterred and would make another run higher, peaking again in March. Today, all 4 of these auto stocks are near their respective 10/50 week moving averages. For intermediate term traders and investors, the 10/50 week moving average is an important technical crossroads.

Whether a bull or bear, following the autos is a good gauge of the health of the American business cycle. It also can provide some indication of where the market may be headed next. Note my write up on Ford last fall on Trader Planet, when it appeared from a price and volume study that the last breakout attempt had failed. Once again, key auto stocks are at a critical juncture of time and price. See charts below.

Ford Motor Co (F) Weekly Chart

General Motors Co. (GM) Weekly Chart

Toyota Motor Corp. (TM) Weekly Chart

Tesla Motors Inc. (TSLA) Weekly Chart

Thank you for reading.

Follow Maria on Twitter: @RinehartMaria

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.