As the stock market rally begins to run out of steam, some traders may look for “short” entries or better entries on stocks they like.

The three stocks we cover today are setting up for a pullback / correction and can be played accordingly (with a stop).

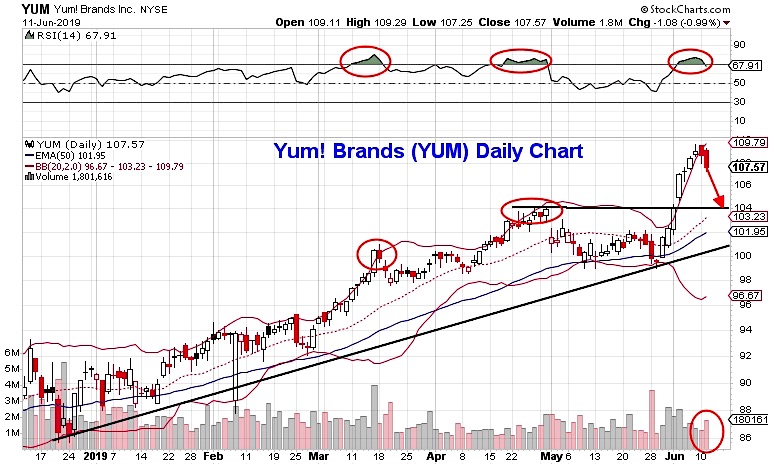

$YUM – Yum Brands

Yum Brands (NYSE: YUM) had a nice rally from $100 to $110, but momentum is now stalling out as it comes back into the Bollinger Bands and RSI moves below 70.

I’m looking for a retest of the $104 breakout level in the next couple of weeks. Consider opening the July 19 2019 $110/$115 bear call spread for a $1.05 credit or better. The options are fairly priced relative to historical volatility; the delta of the $110 call implies about a 35% chance of the stock hitting $110 by options expiration.

A pullback should offer a better entry for longs.

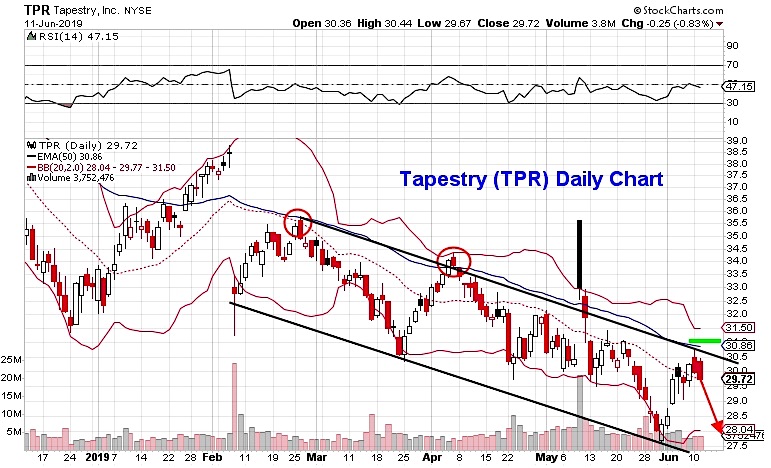

$TPR – Tapestry

Shares of Tapestry (NYSE: TPR) are seeing follow through from yesterday’s failed retest of the 50-day EMA and the top of the downtrending channel (RSI also peaking near the 50 reading once again).

I’m looking for a retest of the May low near $27.50 in the intermediate-term.

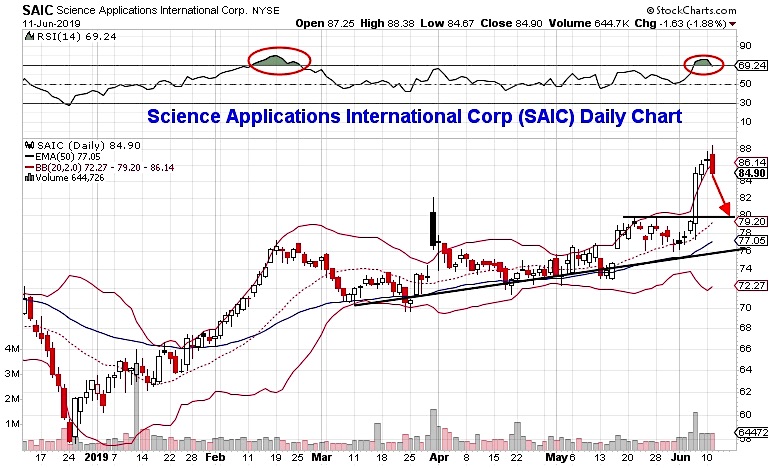

$SAIC – Science Applications International

Science Applications International Corp (NYSE: SAIC) is finally starting to see some exhaustion from buyers as the stock snapped a 7 day winning streak. The stock’s RSI indicator is also peaking close to the 80 level similar to the February top.

I’m looking for a pullback to the high $70’s, low $80’s in the coming weeks. That could be a good long entry point.

Good luck out there!

Twitter: @MitchellKWarren

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.