The bull market has been resilient in 2019, fighting back from corrections and deep pullbacks.

Just when the stock market appears to be in a more meaningful correction, major indexes like the S&P 500 Index INDEXSP: .INX reverse higher.

The latest rally has taken the market to new all-time highs. So what comes next? Here are 3 themes to watch:

1. The Stock market rally is gaining support.

Stocks continued to rally last week, with the S&P 500 posting its fifth consecutive weekly gain and finishing the week at a new record high.

These gains have been accompanied by an improving market breadth backdrop both in the US and overseas. Our industry group trend indicator has broken out to the upside and last week 40% of the 49 markets that are represented in the all-country world index traded at new 63-day (three-month) highs.

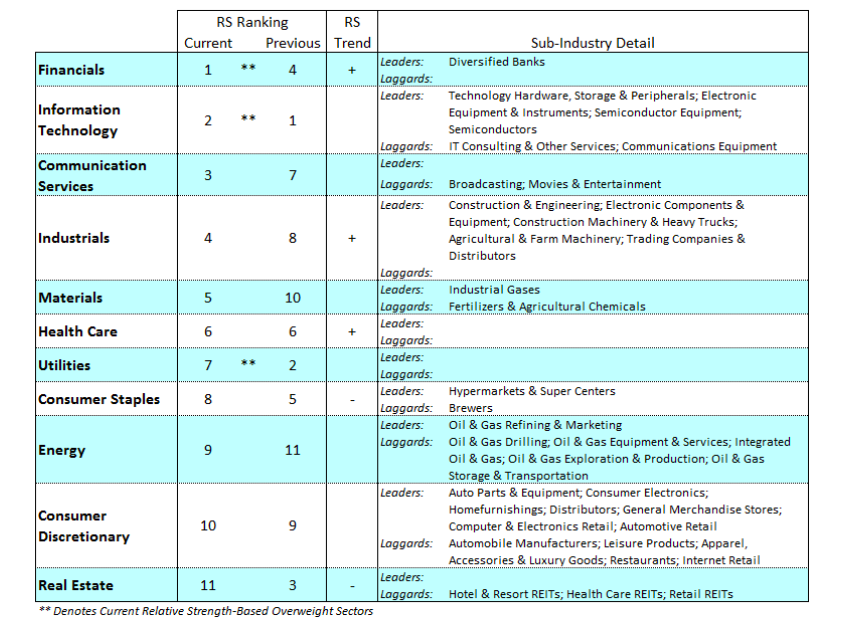

In fact, both the small-cap S&P 600 and the all-country world index have a higher percentage of stocks trading above their 50-day averages than does the S&P 500. Sector leadership continues to shift towards cyclical areas like Financials, Materials & Industrials and away from more defensive groups like Consumer Staples, Utilities and Real Estate.

2. The stock market rally is generating interest.

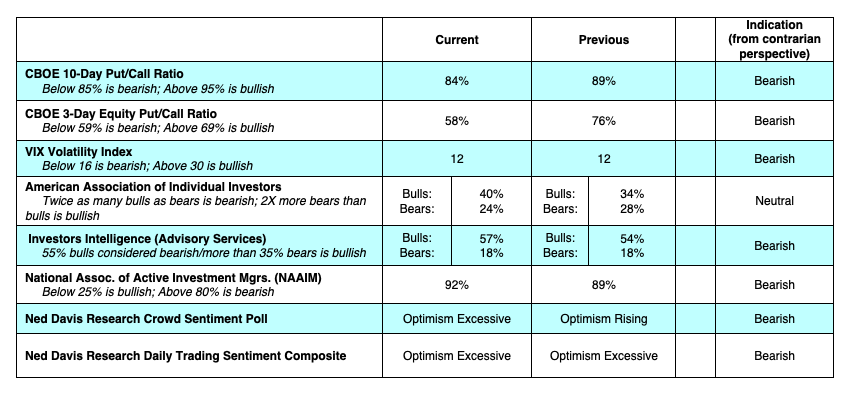

Accompanying the rally to new highs has been gathering evidence that investors have turned more bullish. As the table below shows, a majority of our near-term sentiment indicators are showing excessive levels of optimism (which from a contrarian perspective is bearish for stocks).

While it is not surprising for new stock market highs to be accompanied by increased investor optimism, it does increase the risk that an unexpected development could provide a negative shock for stocks. Even with these elevated levels of near-term optimism, however, there are still some pockets of caution. Fund flow data show that over the past four weeks, equity funds have seen more outflows than inflows.

3. The big picture murkiness may be slow to settle.

The macro backdrop remains a mixed bag of uncertainty and unevenness. While earnings data has been surpassing expectations, economic data has been more mixed. Third-quarter productivity data last week showed a smaller-than-expected gain in productivity and a larger-than-expected gain in unit labor costs (i.e., inflation).

One positive development from last week that should not be too quickly overlooked was the ability for stocks to shrug off less than encouraging trade headlines and rally to a positive close on Friday. The stock market moving beyond the will they/won’t they drama of US-China trade negotiations is a healthy and encouraging development. This week could provide a similar test from a monetary policy perspective with Fed Chair Powell scheduled to testify before Congress. From an economic data perspective, Wednesday’s CPI report and Friday’s retail sales data are likely to generate the most interest.

The Bottom line: Increased investor optimism could leave stocks vulnerable to negative news reactions, but broad rally participation could provide support. A continued ability to see through near-term headlines would be welcome evidence that underlying trends are improving.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.