Yes the banks are important. And yes energy is important.

Both of these sectors provide insights into the economy and potentially effect forward earnings.

But a lot of things have changed in 2020. And some could argue the changes were playing out slowly over the past several years and coronavirus fast-forwarded them.

Banks and energy stink… and so does the economy. But stocks are higher… as equities begin to gain preference as an asset class and tech titans (and technology in general) take a big leadership role. Because of these changes, investors need to be selective. And this means following the leaders, especially if one wants to identify if a correction is nigh. Today we look at 3 sector leaders: technology, consumer discretionary, and health care.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

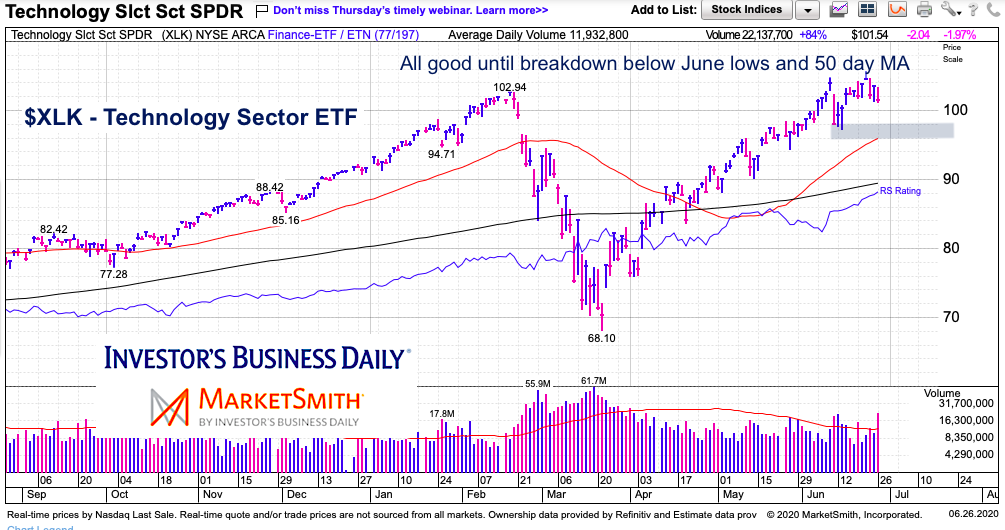

$XLK Technology Sector Chart

Tech stocks are at the forefront of the recovery rally and the economy. Investors need to watch the June lows and 50 day moving average.

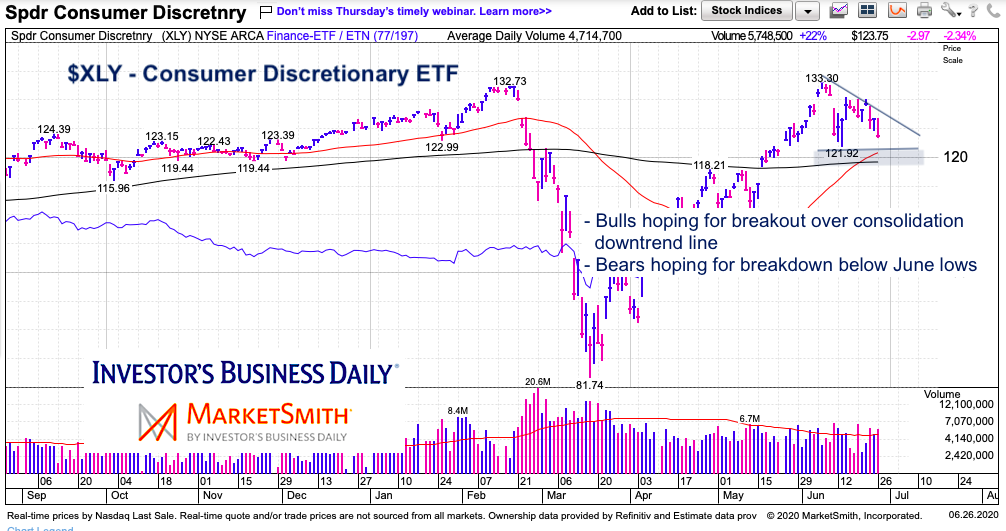

$XLY Consumer Discretionary Sector Chart

This key consumer ETF tested its annual highs before consolidating/pulling back. Eyes on the downtrend line… as well as the moving average convergence with June lows.

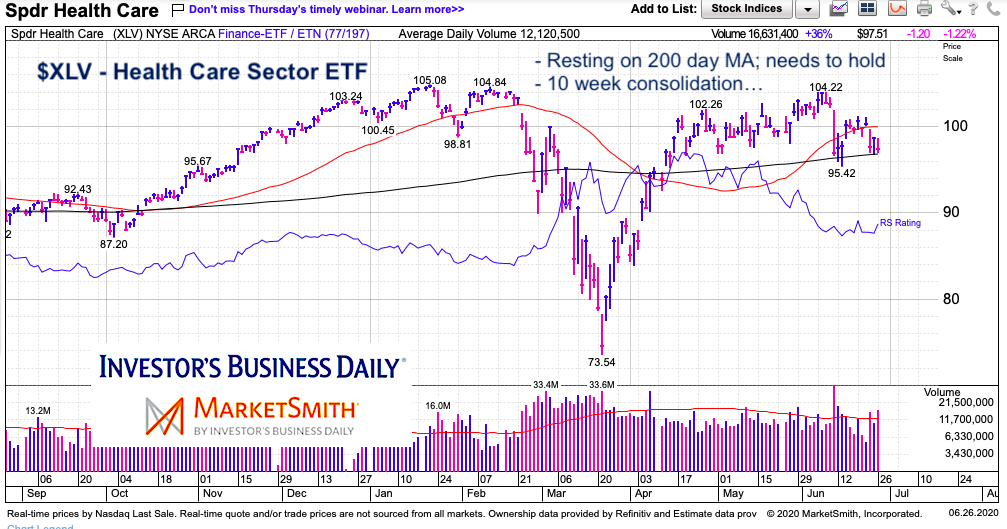

$XLV Health Care Sector Chart

Health care stocks have cooled off for a couple months now… but this sector was a leader of the recovery rally and needs to be respected here. Watch the 200 day moving average.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.