I’ve been posting some collaborations with Arun Chopra, a good friend who holds a CFA and CMT. Together, we have been blending longer-term fundamental indicators with technical indicators. Today, we look at Tesla (TSLA) and its future prospects after offering to swallow up SolarCity (SCTY).

Tesla’s recent buyout offer of SolarCity has created a lot of buzz. And it has many analysts wondering if the Tesla SolarCity deal is really “Electric”.

Our opinion is that it’s not.

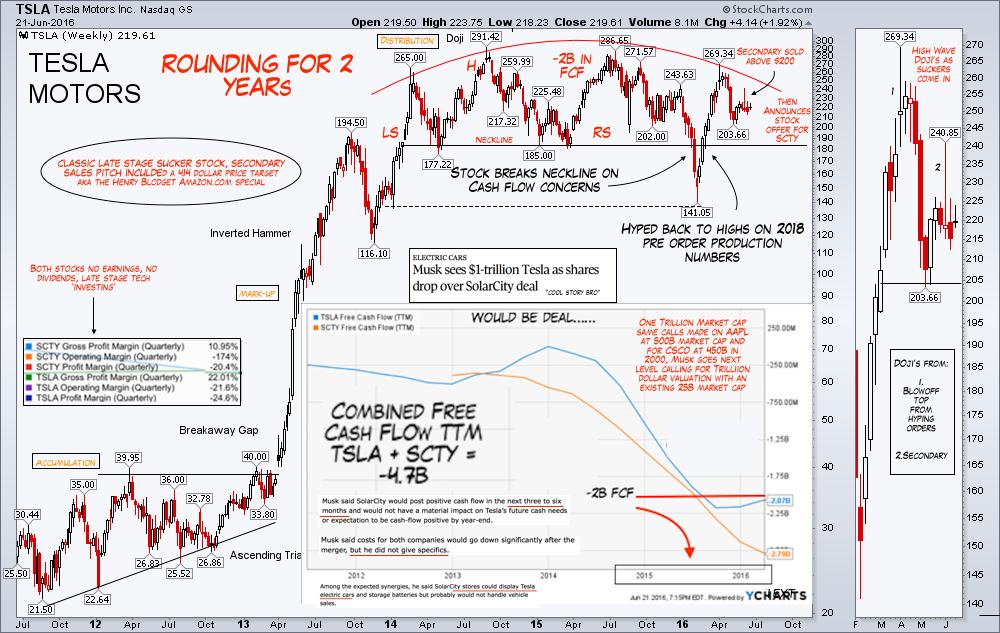

Here are a few reasons why we remain unenthused about the Tesla SolarCity deal. See chart below for visuals.

- Technicals: Tesla two year rounding top with neckline violation followed by to high wave dojis on sales order hype/secondary.

- One week after Microsoft buys LinkedIn, Tesla buys sister Solar City with Elon Musk seeing $1T market cap.

- Fundamentals: By our estimations, the combined company would have -$4.7B TTM free cash flow, but Musk assures synergies and potential SolarCity cash flow positive by end of year.

In Tech 2.0, Tesla has a $400+ price target on “sales orders”, hemorrhaging cash…is an electric slide coming?

Thanks for reading.

Further Reading: Once & Future Kings: Stocks Teeter On TSLA, FB, And AMZN

Twitter: @JBL73

The authors may have positions in mentioned securities by the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.