When it comes to return assumptions for equities, very often numbers such as 8% are thrown around or used in long-term assumptions. Which is fair, as over many of the longest histories available, high single-digit returns for equities has been the norm.

And given nobody knows the future, relying on a very long-term history is certainly appropriate.

However, there are times when near-term return assumptions should be a bit tempered. This could very well be one of those times. Returns have been well above the historical norm over the past year as the S&P 500 Index is up roughly 28%, TSX Index is up 28% and the Euro Stoxx 50 up 21% in local currency terms, including dividends.

But it is not as simple as implying high returns are followed by more muted returns. Here are 3 factors that will likely prove to be a headwind on near-term market performance.

1) Valuations – The U.S. equity market, measured by the popular S&P 500 Index, is trading over 21 times forward earnings. That is high on a historical basis, and yet it was even high a year ago when the index went on a strong double-digit advance. Mega-cap stocks, mainly in technology, are partly the cause of these higher valuations, and are skewing the valuation multiple higher given their weight in the index and relative high valuation. Yet the equal weighted S&P 500 Index is also historically pricey at 19 times forward earnings.

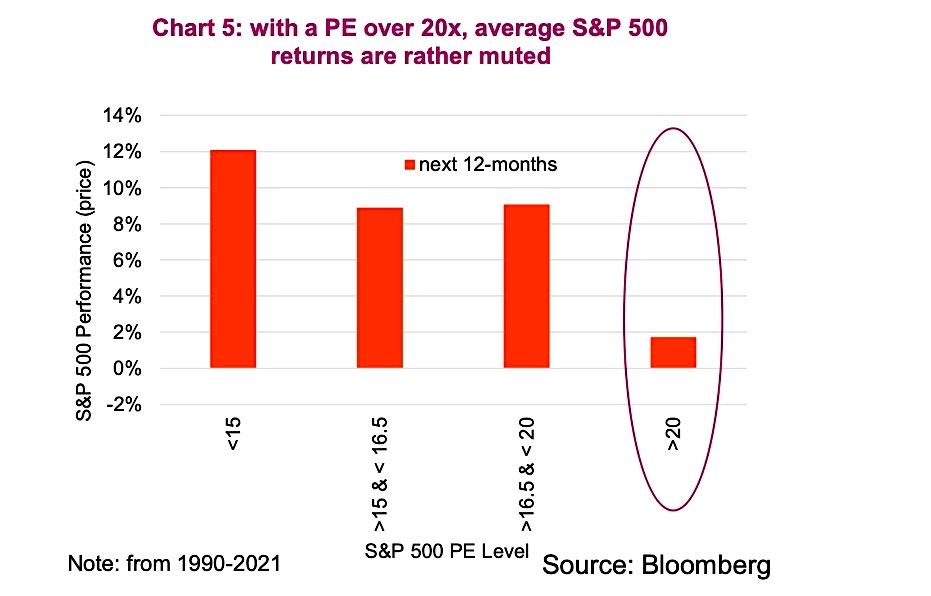

All things being equal, these valuations imply a muted forward return expectation. Over the past 30 years, when the S&P 500 Index was trading over 20x, the subsequent one-year price return has been pretty much flat, on average. Canada is a bit more constructive, with the TSX Composite currently valued at 16x forward earnings. Similarly, Europe’s Stoxx 50 Index is 16.8x. This provides further supporting evidence that investors may find this a good time to look to Canada or overseas markets at the expense of their U.S. equity allocation. But it’s not just valuations.

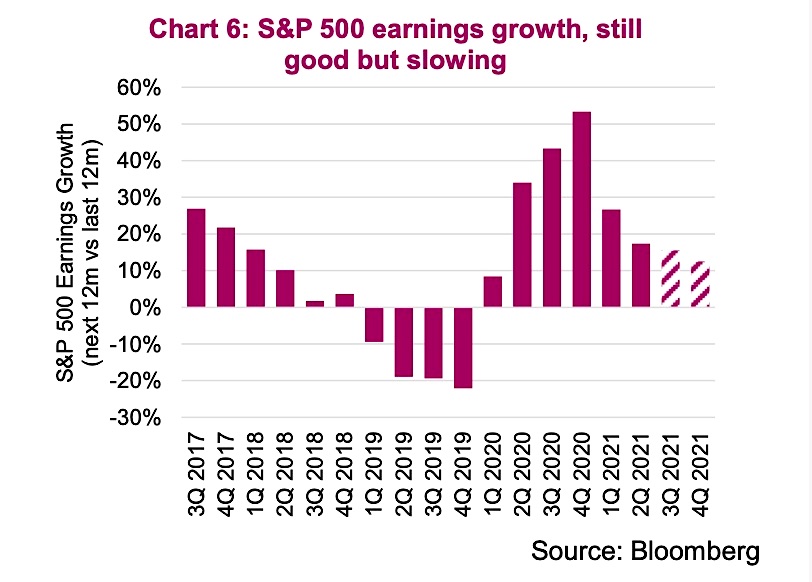

2) Earnings – The Q2 earning season, the lifeblood of companies and markets, just finished and was stellar. Revenue growth was strong, helping alleviate any pressure from rising costs to maintain historically elevated margins. But that was peak growth. Earnings are expected to continued expanding, with a slowing pace. A year ago, before the S&P 500 Index was about to go on its 30% advance, earnings were poised to grow by 34%. Fast forward to today and forecasted consensus earnings growth is now half that at 17%. This is still a good news story, albeit less so than in quarters past.

3) Optimism – Have you heard the phrase, ‘the market climbs a wall of worry’? This saying is based on the history that many market advances occur as the uncertainty surrounding a dire event begins to fade. The dire event doesn’t need to fade, just the uncertainty of the path forward. During the past year the pandemic has not ended, but the path through has become clearer. Monetary and fiscal stimulus became clearer and more certain, as did the economic recovery, all helping the market advance. But today, the wall has largely been climbed. Fear has dissipated as measurements such as credit spreads and the VIX Volatility Index sit at or near historical lows.

The market may continue to climb but it will be harder to find levers to pull or net new reasons for optimism. In that environment, investors may want to reduce their near-term expectations, or even lean a bit more to defense, lower valuations, quality strategies.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.