Top-performing names like Super Micro Computer (SMCI) and Nvidia (NVDA) are currently well off their all-time highs, and deteriorating breadth conditions indicate continued skepticism as we enter one of the seasonally strongest months of the year.

Today we’ll highlight the three leading mega-cap names, the “MAG stocks”, that you should watch to gauge the upside potential in this continued bull market phase.

Despite experiencing a meaningful pullback in April, the S&P 500 finished Q2 within a rounding error of all-time highs, dominated by a few key growth stocks. Looking at the performance data, Super Micro Computer is up almost 200% year to date, while Nvidia is up around 150%.

However, many of these top-performing names, including both NVDA and SMCI, have experienced significant pullbacks from their highs, adding an air of uncertainty to their future performance.

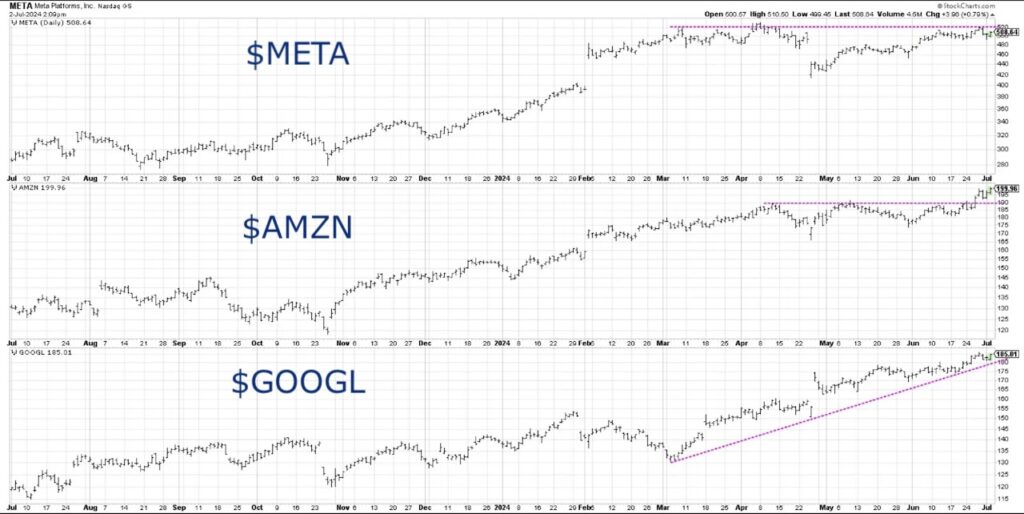

As we move into July, breadth conditions appear mixed, with around 70% of S&P 500 members above their 200-day moving average while less than 50% remain above their 50-day moving average. Therefore, investors should focus on the key mega-cap stocks such as Meta Platforms (META), Amazon (AMZN), and Alphabet (GOOGL), as their performance could very well define the market’s direction. Meta’s critical level is breaking above $525, Amazon’s challenge is to hold above $190, and Alphabet needs to continue its consistent pattern of higher highs and higher lows.

- Can Meta break above $525 and continue onward to further upside?

- Will Amazon hold its recent breakout level of $190 and attract more willing buyers?

- Can Alphabet continue making higher highs and higher lows, signifying a consistent uptrend?

Video: Here are the 3 Stocks to Watch This Quarter

$META $AMZN $GOOGL Stock Price Performance Chart

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.