Microsoft (MSFT), like most of the tech sector, has been a strong performer recently with the stock rising from 132.15 to a recent high of 198.52.

The recent high broke the stock out to a 12-month high with the prior high being set in early February at 189.65.

Microsoft’s latest earnings were released on April 29th with the company reporting earnings of $1.40 per share on revenue of $35.0 billion. The consensus earnings estimate was $1.27 per share on revenue of $34.1 billion.

Here are three option trade ideas on MSFT stock:

BULLISH TRADE

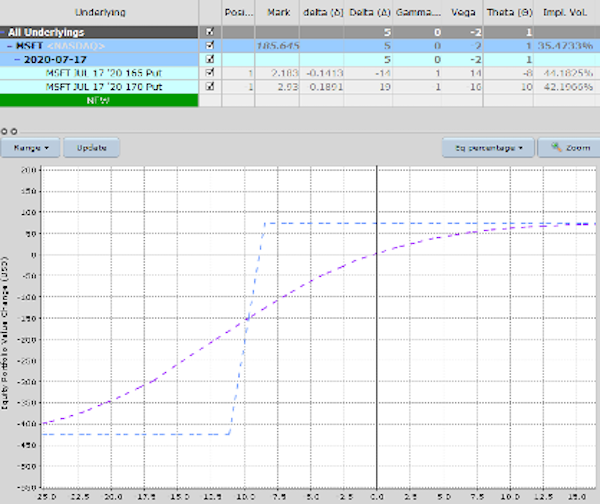

For bullish traders, a bull put spread can achieve a nice return in a short space of time.

Selling a July 17th put spread at 170-165 can generate around $80 in premium with risk of $420 for a potential return of 19.05%.

For a trade like this I would set a stop loss if the stock falls below the 50-day moving average currently sitting at around 178.

NEUTRAL TRADE

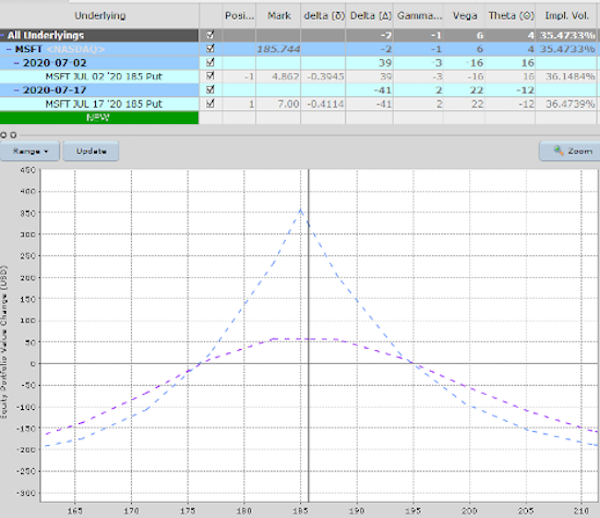

For traders that think the stock will stay flat for the next few weeks a calendar spread is a nice neutral trade this will also benefit from a rise in volatility.

With the stock trading around 187, placing a calendar spread at 185 makes sense.

Selling a July 2nd 185 put and buying a July 17th 185 put would cost around $215 per spread. With a maximum potential gain of around $350.

For a trade like this, I would set a profit target of 30% and a stop loss of 20%.

BEARISH TRADE

For traders that think MSFT is unlikely to take out the $200 level in the next month, a bear call spread could be a good idea.

A July 210-220 bear call spread would generate around $75 in premium with risk of $925 for a potential return of 8.11%.

For a trade like this I would set a stop loss if MSFT stock hits 200.

CONCLUSION

No matter what your opinion is on Microsoft stock over the next month, there is an option trade to suit. Hopefully these three trade ideas give you some food for thought.

Remember that options are risky and you can lose 100% of your investment.

If you have any questions, feel free to reach out. Happy trading!

Twitter: @OptiontradinIQ

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.