We believe there are going to be three key macro drivers of stock market and economy in 2021.

The biggest driver of the financial markets is the path of the pandemic/vaccine, followed by the pace and trajectory of government stimulus, and China.

1. Light at the end of the pandemic – The path of the pandemic, lockdowns and vaccine will likely be the driving force for markets in 2021

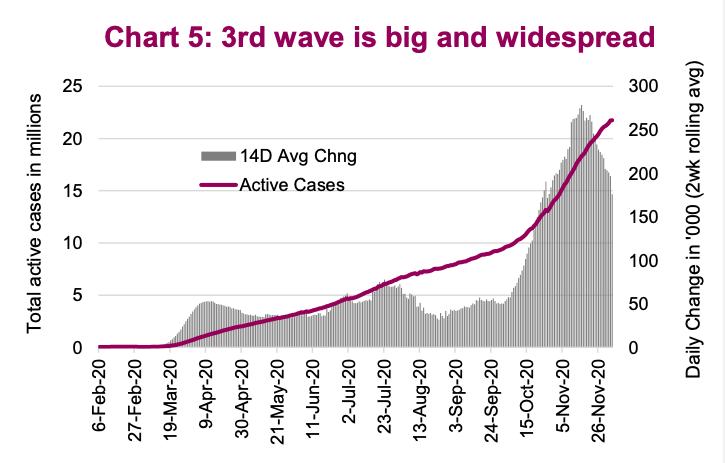

The COVID-19 global pandemic has taken a turn for the worse in the late months of 2020, resulting in a wave of infections materially bigger than any previous months (Chart 5). This wave is widespread, not just focused on a few countries or states as with previous waves, putting tremendous strain on health care infrastructure. This is triggering pockets of increased lockdowns, slowing the re-opening process but not derailing.

There is good news though, treatments, better protocols and knowledge of which population cohorts are most at risk of the virus have improved materially over the past months. This has helped reduce the mortality rate and educated most that it is our social proximity to others that puts all of us at risk. As citizens we have a job to do: stay apart to avoid becoming a strain on the health care system and wait for a vaccine.

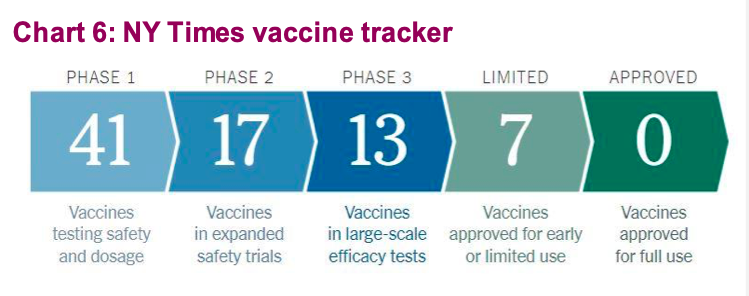

The vaccine news, especially in the final months of 2020, has been very encouraging (Chart 6). There are 13 vaccines in final testing and 7 that have been approved for limited use. The efficacy, success rate, has been much higher than most forecasts. Of course, the logistics of deployment will be challenging, but if Amazon can deliver laundry detergent to your door in a couple of hours, we are confident the logistics will be handled.

The trajectory of new cases and vaccine rollout will largely dictate the speed at which the hardest-hit industries, such as travel & leisure, will recover. As these industries recover, employment will improve as will consumer and business sentiment, aggregate demand and capital spending. This could easily set the stage for a stronger recovery than consensus. There is a lot of pent-up demand to do things and spend savings.

This won’t be a straight line and there are likely to be advances and stalls along the way. As we move towards the “new normal” of vaccines, rapid testing, quicker tracing, the rest of the economy will likely quickly come back to life. These are service industries mainly, and they can be turned back on very quickly. As this happens, many of the mega trends over the past nine months will, at the very least, partially revert closer to normal.

2. But for now, it is up to government / monetary stimulus

While the vaccine news is positive and the market is partially looking past today towards tomorrow, the economy (people and businesses) still need the support from government stimulus to bridge the gap. Given portions of the economy are unable to operate, support is needed to reduce the long-term economic damage.

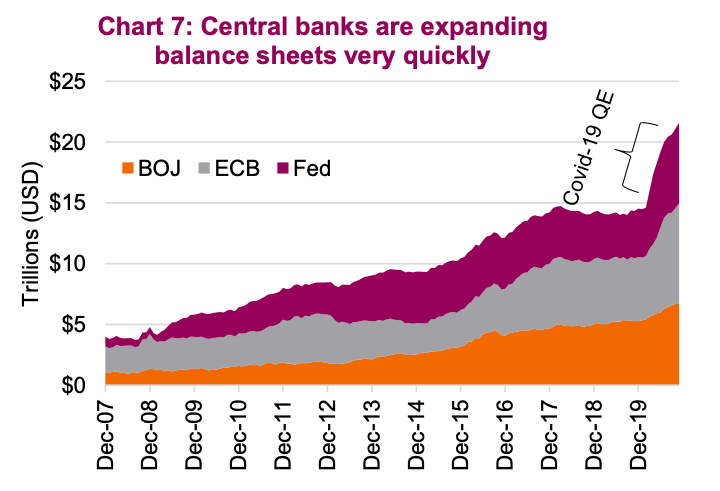

Stimulus will likely remain in place and robust for longer, based on the indications from both central banks and most governments. This does have longer-term implications but for now it appears to be the best path through this. It is worth noting that most developed nations now have debt-to-GDP levels over 100%. In fact, over 50% of all government bonds are owned by the Bank of Japan; for the U.S., the number is 30% owned by the Fed.

There is risk of a taper tantrum in 2021. The markets are now very sensitive to changes in liquidity and removal of liquidity, even if driven by improving economic fundamentals, may result in a repeat of the 2013 taper tantrum. It was a few years ago, so for those who don’t recall, bond yields rose about 100bps which weighed on not just the bond market but equities as well. The world and this rally has become hooked on liquidity – reducing or even slowing it will likely have sizable consequences.

3. China–this does look familiar

Trade tensions between the U.S. and China (and others for that matter), were a central theme over the past few years. This isn’t going away but under the Biden administration, we are likely to see a less impulsive approach which will be welcomed by capital markets. One thing markets dislike the most is sudden change.

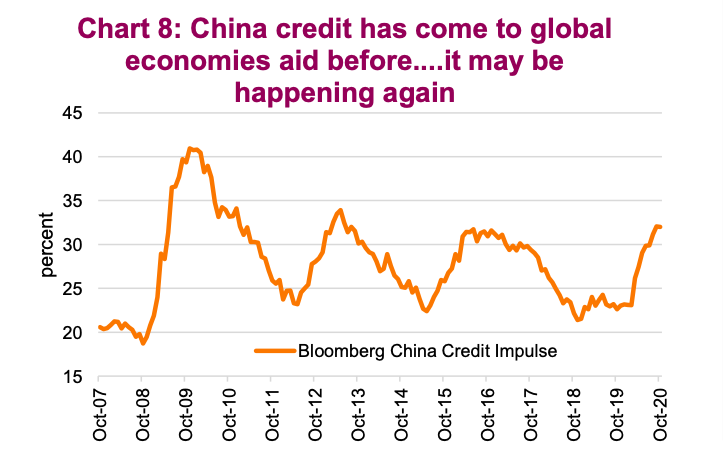

Even more encouraging is that China appears to be turning on more credit (Chart 8). This is a familiar playbook. Coming out of the 2008 financial crisis, China increased credit growth which stimulated demand domestically and globally. If the same approach is being used today, this would be a positive for global economic growth and commodities.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.