There have been a couple of developments in the Japanese markets that traders are (or should be) monitoring. In the equity markets, there is a bullish consolidation pattern developing that active investors with an intermediate-term horizon may benefit from. Yet, at the same time, Japanese equities investors will need to keep an eye on the currency market with a focus on the impact of a weakening trend in the Japanese Yen’s value to the US Dollar.

Let’s break down these two emerging themes and look at a few exchange traded funds (ETFs) that are available to traders who want exposure to Japanese equities.

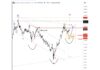

Below is a weekly chart of Nikkei 225 Futures continuous contract. Price ran sharply from late 2012 to a peak in May 2013. From there a period of wide swings began. This has been off-putting because if you ended up on the wrong side of the market in the near term, you likely got run over by a bus. But stepping back, it’s key to understand that the price structure since May 2013 appears to be playing the role of a pause within a larger uptrend that has further to go. While there’s a good chance we’ll see more near-term swings in the coming months, ultimately this sideways trend should resolve up. Clearing a ceiling at 16,350 would confirm a breakout from an ascending triangle and place the market in an air pocket (an absence of an technical resistance in the case of a rising trend) until 19,035, based on the highs in 2007.

Nikkei 225 Futures Weekly Chart

Now take a look at the weekly chart of the USD/JPY, highlighting the dollar’s value to the yen. The strengthening trend in the greenback versus the yen since late 2012 has been explosive. In the first half of this year, price pulled back and traced out a base defined by a clean floor around 101. In the past month, price has rallied past a prior high, affirming the uptrend.

USD/JPY Weekly Chart

Yen weakness is a blessing and a curse when it comes to investing in Japanese stocks. To start, it’s a significant contributing factor driving upside in Japanese equities, particularly those of exporters that make up a substantial portion of the components in the Nikkei 225 Average (a weaker yen makes Japanese products more attractively priced on overseas markets, which can lift demand for them and support revenue growth as a result). At the same time, though, popular exchange traded funds such as iShares MSCI Japan (EWJ) and MAXIS Nikkei 225 Index (NKY) see gain potential mitigated by the currency translation. These ETFs are priced in dollars and don’t hedge foreign exchange risk. If the yen is weaker now than it was when you bought one of these ETFs two months ago, for example, when you take a profit the currency translation means you’ll get fewer dollars back than you might expect.

A piece by MoriningStar in 2012 highlights the benefits of WisdomTree Japan Hedged Equity (DXJ). This fund hedges currency risk. So if the weakening trend in the yen accelerates, the hit to gain potential in this ETF will be less than it is to EWJ and NKY. Keep in mind, it tracks a dividend-weighted index and is biased toward value. So if, say, the yen’s value is stable for a time and the Nikkei 225 goes through the roof, DXJ won’t match the gains in NKY. This means that ETF investors looking to allocate capital towards the Japanese markets should consider allocating some capital to EWJ or NKY and some in DXJ. This way you have some capital geared toward the higher beta of Nikkei stocks and some that is hedged against currency risk. Have a great weekend everyone.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.