Today was a big day for China stocks and ETFs.

The PBOC cut its reserve requirement ratio to the lowest level in 4 years, as well as trimmed its main short-term interest rate.

The package included measures to lower overall mortgage costs and a de-stocking program that eased rules for second-home purchases

It also gave a boost to commodities as China consumes a lot of them.

It also sent the US dollar lower while US equities were mainly green.

Today’s action by China spurred reversals in some other country ETFs.

We have 2 others to look at besides FXI, the China ETF.

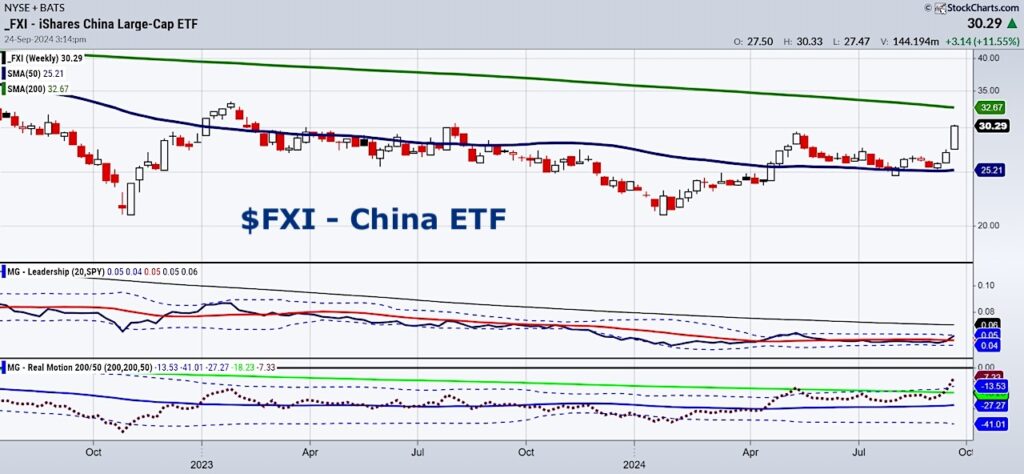

FXI chart is weekly. I did that for perspective after the huge rally.

The 200-week moving average in green, shows resistance at 32.67 although the momentum right now, is in the favor of more upside.

January 2023 turned out a peak in FXI a bit higher at 33.38.

Nonetheless, we will hope for some consolidation after today.

Vietnam VNM ETF as also declined this year.

However now, VNM has been consolidating between the 50- and 200-day moving averages. (Daily chart above).

Perhaps my favorite part of this chart is our Real Motion indicator showing a very substantial bullish divergence in momentum.

The daily chart of the Mexico ETF EWW is another one that has our attention.

This daily chart shows the price action clearing the 50-DMA today.

Plus, EWW now outperforms the SPY on the Leadership chart.

This could be an excellent time to look outside the US for investing.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.