The weakness in the bond market this year has been primarily centered on Treasury and investment grade corporate debt, which has the highest sensitivity to interest rates. This of course has filtered down to indexes that are heavily overweight quality U.S. bonds.

As an example, the iShares Core U.S. Aggregate Bond ETF (AGG) is essentially flat so far this year and erased one-third of its gains in the last 12-months (with dividends included). AGG has over 38% of its holdings in Treasuries and an effective duration of just over 5 years. I’m personally not a fan of owning aggregate bond index ETFs – read more about that here.

But not all bond market ETFs have experienced declines. And with interest rates rising over the last several months, it’s time to look at other areas of the bond market that have held up well or been able to generate continued positive momentum.

That said, here are 3 bond market ETFs to put on your radar:

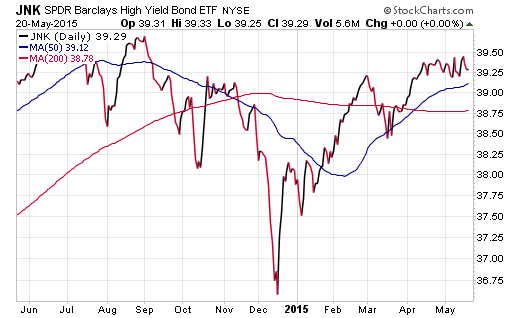

1. SPDR Barclays High Yield Bond ETF (JNK)

JNK invests in a diversified portfolio of below-investment grade quality corporate debt – i.e. junk bonds. This ETF has over 800 individual securities and a 30-day SEC yield of 5.56%. So far this year, JNK has been able to maintain relatively solid headway and continues to jostle sideways despite the weakness in higher quality credit.

The price action of JNK is going to be more closely correlated with the health of stocks rather than interest rates. Junk bonds are more sensitive to credit-related activity than traditional flight to quality instruments. If the stock market continues its low volatility grind higher, then JNK may do the same.

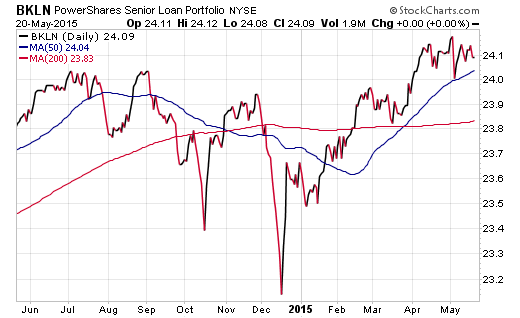

2. PowerShares Senior Loan Portfolio (BKLN)

Close cousins of high yield debt, bank loans or senior loans are floating rate instruments with very little sensitivity to interest rates. BKLN currently has over $5.7 billion invested in 115 securities and has a 30-day SEC yield of 4.06%. So far this year, BKLN has gained 1.80% and has decoupled from the volatility that AGG has experienced as a result of its underlying holdings.

Bank loans have traditionally been known as a solid investment to own in a rising rate environment because they have very low durations as a result of the coupons being tied to LIBOR rates that reset on a regular basis. Nevertheless, it’s important to remember that senior loans are susceptible to credit cycles similar to JNK.

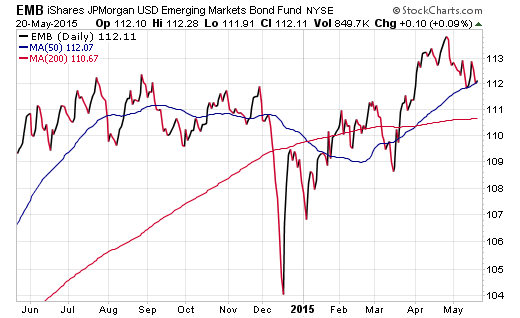

3. iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB)

Emerging market bonds are another corner of the fixed-income market that has been a solid performer this year. EMB holds sovereign bonds of over 30 emerging market nations such as Turkey, Russia, and Brazil. This ETF has over $5.2 billion in total assets and a 30-day SEC yield of 4.35%.

So far this year, EMB has gained 3.60% and decoupled from the traditional pull of U.S. interest rates. I have owned this ETF for my income-oriented clients for some time now as a solid option to diversify a portion of the portfolio overseas.

The Bottom Line

Monitoring areas of strength and weakness across the bond market can help provide insight into how your existing positions are performing. In addition, this analysis can often shed light on areas of opportunity or risk depending on how you perceive these themes. Moving forward, I will be monitoring how interest rates react to areas of additional support and whether or not these credit-sensitive ETFs can retain their current momentum.

Follow Dave on Twitter: @fabiancapital

The author holds positions for his clients in EMB at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.