Happy New Year! We hope everyone is doing amazing.

As we close out the year we had another good one here at Avory and expect more over the coming years. More on this in our annual letter coming out soon.

While markets were broadly higher in 2024 not all areas benefited.

Small caps and the equal-weighted S&P 500 both finished barely in double digits. The “Magnificent 7” contributed over 60% of the total gain for markets, and four sectors finished flat to single digits. Some weakness at the end of the year will likely help 2025 be a broader and better year, as investors focus on rate cuts, but more importantly, rate stability.

Here’s the supporting data:

- 60% of S&P gains from 7 stocks in 2025.

- Holiday shopping was a success overall.

- Brick-and-mortar remains dominant.

#1 60% of S&P Gains Came From 7 Companies in 2025

In 2025 over 60% of S&P 500 gains came from the magnificent 7. While other companies performed, this likely suggests both risks and opportunities.

The markets remain highly concentrated in their returns, with 60% of the S&P’s 2025 gains coming from just seven companies. This trend highlights how narrow leadership has been, but it doesn’t eliminate opportunities elsewhere.

For instance, we outperformed both the equal-weight and cap-weighted indices while holding just one of the “Magnificent 7.” Looking ahead, 2025 may deliver broader gains, especially as investors start focusing on absolute and relative value. Small and mid-caps currently trade at a massive discount to large-cap peers, which is a historical anomaly. Over time, we anticipate some normalization in this valuation gap, creating opportunities in these overlooked segments.

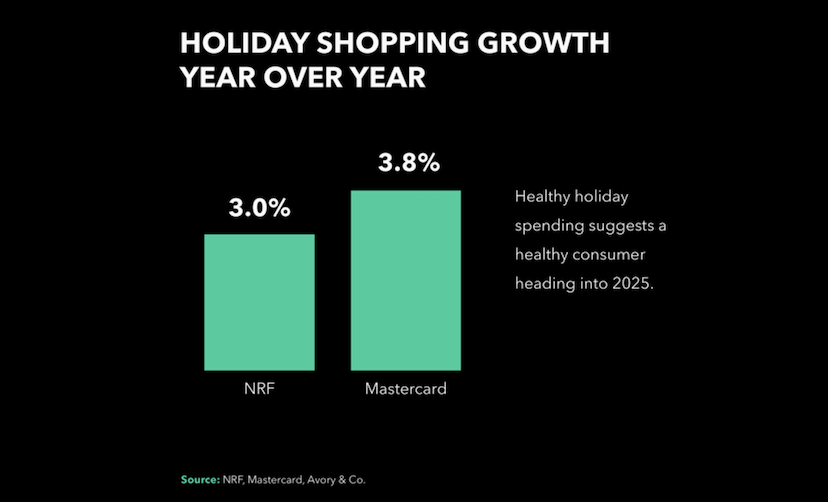

#2 Holiday Shopping Sees 3.8% Growth, According to Mastercard

The holiday season often serves as a strong barometer of consumer health. This year’s 3.8% growth in holiday sales, as reported by Mastercard, provides some valuable insights. Importantly, the growth was driven by increased product volume rather than price inflation, as discretionary inflation rates remain flat to negative.

Higher-end households showed robust spending growth, while lower-end households remained flat. This bifurcation suggests stability in consumer spending but highlights potential challenges for businesses targeting lower-income demographics. Overall, the data supports the idea that the consumer remains resilient, albeit with nuanced spending patterns across income levels.

#3 Brick-and-Mortar Shopping Still Dominates: 77% of Holiday Sales Done In-Person

Despite the rapid growth of e-commerce, 77% of holiday sales were completed in physical stores, compared to just 23% online. This highlights the dominance of brick-and-mortar shopping while signaling areas of opportunity for both physical and digital retailers.

For brick-and-mortar venues, creating compelling experiences remains a winning strategy. Concepts like TJX’s “treasure hunt” tactics continue to drive foot traffic, as consumers seek value and enjoyment in the shopping process. On the flip side, online players have significant room to grow by addressing the unique advantages of physical retail—such as experiential elements—while improving key aspects like fit, browsing ease, and seamless returns.

This divide presents long-term opportunities for both sides, as offline and online adapt to meet shifting consumer preferences.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.