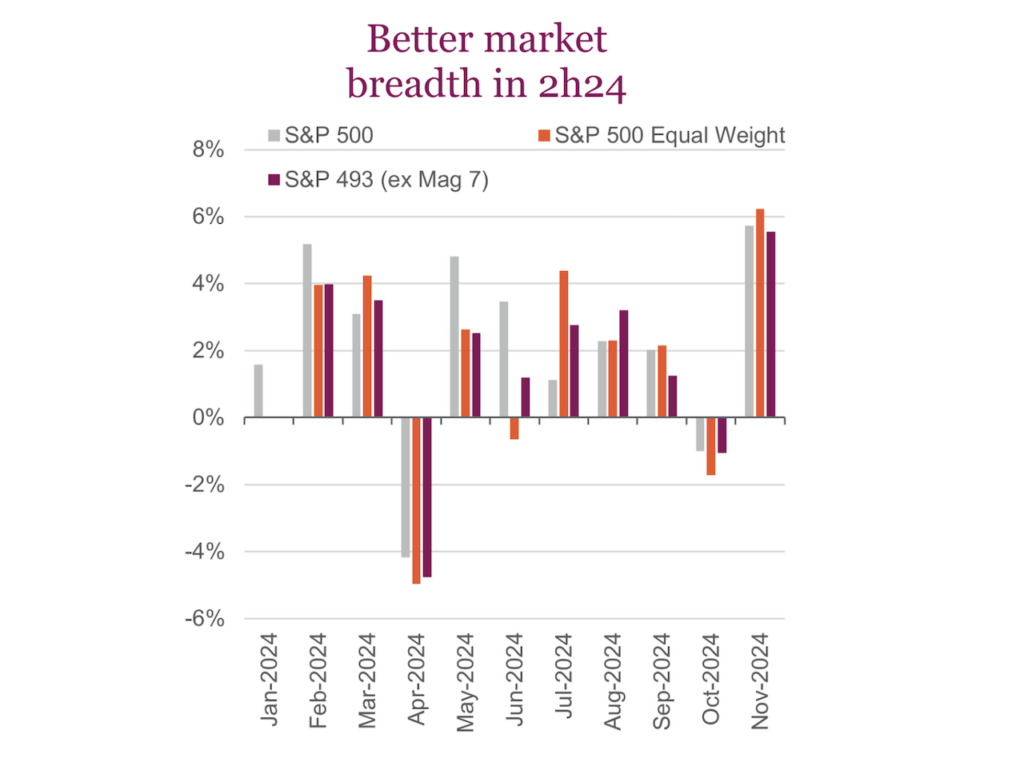

Equities were riding high in November, thanks to the post-election rally following Donald Trump’s win and a decent earnings season. What was more encouraging about November’s gains was that returns have broadened out from the Magnificent Seven, which drove most of the gains in the first half of 2024.

November was the best month of 2024 for the S&P 500, Dow, and TSX all closing at record highs, and posting total returns of 5.9%, 7.7%, and 6.4% respectively. And bulls hope this brings a strong 2025 stock market outlook.

Small-cap stocks were the clear winner last month, as investors saw the group benefiting from Trump’s potential tax cuts. The Russell 2000 also rose almost 11% in the month, notching its biggest monthly gain of the year.

Although investors were optimistic following the U.S. election, not all concerns were abated. A Trump win is not without its complexities, and investors have already been forced to navigate what the new landscape will look like for the next four years. And this has to factor into any 2025 stock market outlook.

Trump threw down the gauntlet in November, declaring his intention to apply a 25% tariff on all products coming to the U.S. from Canada and Mexico on his first day in office. Trump vowed the tariffs would be upheld until issues such as border protection and preventing the illegal flow of drugs into the U.S, were resolved.

Despite the concerns surrounding what trade will look like, Trump’s nomination of Scott Bessent as Treasury secretary encouraged investors. The market viewed the pick favourably and sees the hedge fund manager as someone who will be supportive of the equity market and may help mitigate some of Trump’s most extreme protectionist policies.

The Fed has also faced persistent inflation, with the Core Personal Consumption Expenditures Price Index rising 2.8% y/y in October and 0.3% from the previous month. Consumer spending edged up slightly, driven by services like healthcare, while disposable incomes saw strong growth, supported by higher wages. A surge in service prices, partly tied to stock market gains, contributed to the inflation rise. The data underscores the Fed’s cautious approach to interest rate adjustments, balancing inflation pressures against resilient economic growth.

Still, bond yields were able to come down towards the second half of the month thanks to some Trump administration picks and encouraging economic data, with the U.S. Aggregate Bond index finishing 1.06% higher for the month.

Good 2023 and 2024, three in a row for 2025?

Before we jump into our thoughts and analysis for our 2025 stock market outlook, let’s give a big round of applause for 2024! It has been a great year so far for markets – just about all markets, in fact. With one month left to go, global equities are up about 18%. Led once again by American exceptionalism, with the S&P up about 26%, followed by Canada at 21%, then Asia at 15% and finally Europe at 5%. A strong equity market that was complemented by a quieter bond market, albeit up. Canadian and U.S. bonds are up about 3%, with greater gains depending credit. Once again, nobody is complaining about the positive correlation between equities and bonds when they both go up.

The biggest drivers of these returns were better economic growth than widely expected and continued progress on inflation. A year ago, expectations were for a modest 2.6% global economic growth, which now looks to be coming in closer to 3.1%. The U.S. economy led this improvement, but most regions enjoyed better growth than originally expected.

Not saying it was smooth sailing from an economic perspective though. Ongoing geopolitical wars weighed on Europe; there was the ‘carrymageddon’ as the yen carry trade unwound briefly, and China has continued to grind out the impacts of their real estate bust. The U.S., too, experienced a bit of a soft patch in the summer as concerns about higher rates and inflation would start to show up in less hiring. We will talk 2025 shortly.

The other big positive? Inflation. Make no mistake, prices have not come down if you haven’t noticed it in your day-to-day life, but the pace of inflation has slowed substantially. Improving economic growth plus slowing inflation is a very strong combination for risk assets, namely equities.

Moving into 2025, things certainly get a bit more challenging albeit with some positive aspects as well. Based on current consensus forecasts, you can see from the chart above that economic growth is set to broaden. The U.S. and China are expected to decelerate somewhat, but Japan, Europe and Canada tick higher. There are some big wildcards for 2025. The U.S. consumer has remained resilient even with higher rates and inflation. While some cracks are evident, they are not material at this point. The European consumer is actually pretty healthy and could play some catchup on spending, trying to keep up with the Joneses (Joneses being the U.S. consumer). China’s stimulus plans are also variable. The optimistic view is more stimulus in 2025.

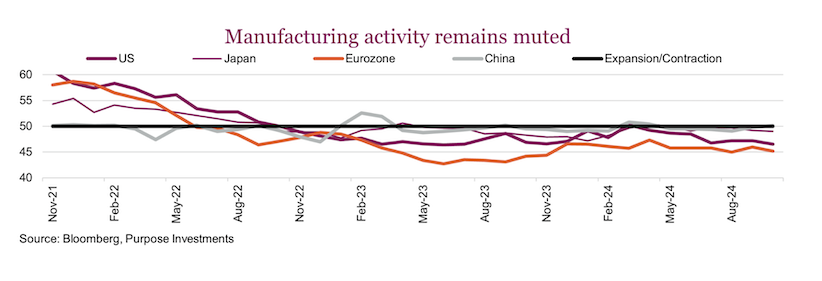

Tariffs could prove to be a negative but don’t get too excited just yet. It is all talk at this point, and time will tell if threats become policy and what retaliation would ensue. The first round of tariffs a few years ago occurred when global trade was growing at a faster pace. Today, it’s rather lacklustre which could mean tariffs will have a bigger economic impact. Even ignoring the tariff narrative, global manufacturing has remained rather muted based on PMI survey data. Combine this with rising inventories, and a positive growth surprise may be harder to come by in 2025.

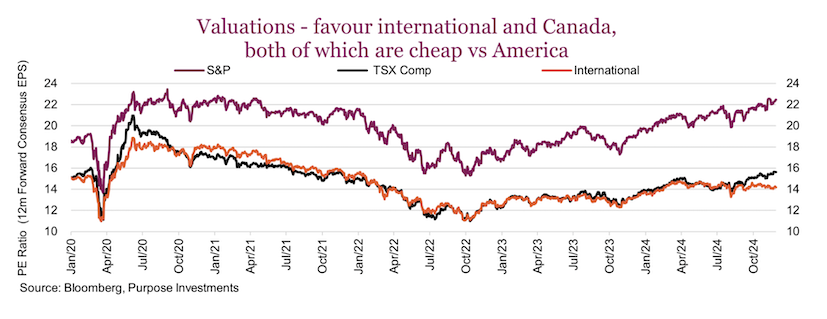

Finally, valuations. Let’s first acknowledge that valuations by themselves only tell a part of the story. As you likely know, the U.S. market has been on the high side of the valuation spectrum for a number of years, yet posted great gains. This is because higher valuations have to be looked at in relation to earnings growth. The S&P 500 can easily trade at 22x earnings as long as those earnings are growing at a good pace, which has been the case.

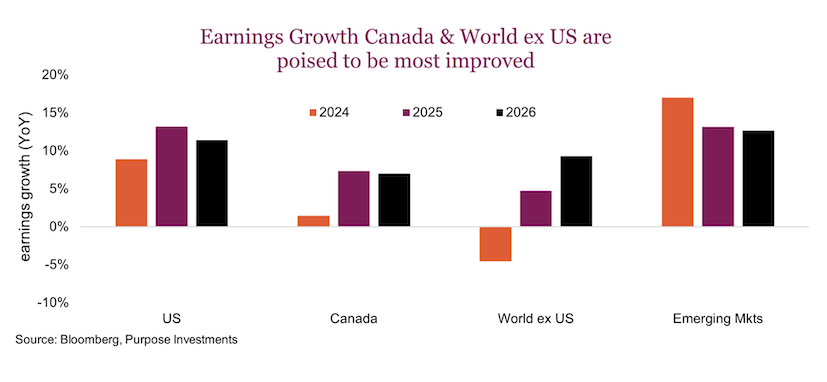

For the past few years, it has been much more important to focus on where the earnings growth is compared with valuation levels. 2025 poses a potential rotation, though. The U.S. market still enjoys stronger earnings growth, but one could argue that this is priced at 22.5x multiple. Canada, though, at 15.5x, is expected to move from near-anemic earnings growth to almost 10%. And world ex U.S. is by far most improved, from negative earnings growth to solid mid-single digits.

Overall, we expect both economic activity and earnings growth to go more global than just a U.S. story. This should help broaden market leadership. Of course, revisions to both economic growth and earnings expectations will be crucial, and they may be impacted by tariff talks. Inflation, too, will be critical. There are some signs inflation is starting to pick up again in the U.S., Canada and the UK. If this occurs, the market may be disappointed in the number of rate cuts in 2025. Things are rather well balanced, though – sorry that isn’t very exciting.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.