Analyzing the U.S. economy and broader economic landscape for developed countries is a bit complicated right now.

Every economic cycle is different so there is no simple road map to follow.

However, the biggest question that will differentiate between investment success and failure (on a relative basis of course) is whether this is the start of a new cycle or if we are still in the late stages of the cycle that began in 2009. Spoiler alert: nobody knows.

Early in a new cycle

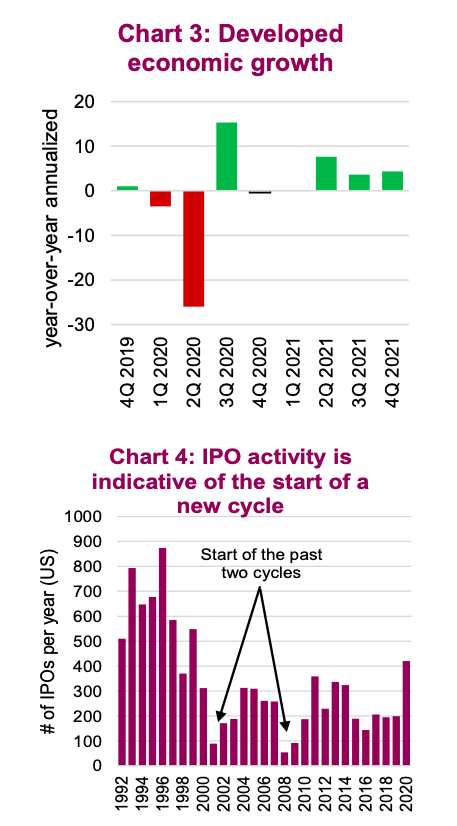

2020 does check several important boxes for the end of a cycle. There was a bear market, with global equities falling about 35%. There was, and still is, a recession with the global economy expected to have posted a -3.8% growth rate for 2020 (developed economies). This included negative GDP in Q1 (-3%) and Q2 (-26%) with a snap back in Q3 (+15%). Q4 and Q1 of 2021 are expected to be flat.

The U.S. economy saw unemployment peak at 15%, Canada at 14%. These have subsequently recovered to 7% and 9%, respectively.

No question this was a very different recession that really impacted services and didn’t have to burn through any excesses such as housing (2008) or tech spending (2000). With aggressive ‘proactive’ stimulus on both the fiscal and monetary front, the economic damage has been limited. And the recovery will gain even more speed when the vaccine enables industries negatively impacted by social distancing to return closer to pre-pandemic levels of activity.

It is this scenario that the equity markets appear to be increasingly pricing in.

Late cycle still

The pandemic was an exogenous shock that triggered a technical bear market and recession but did not end the current cycle. From a market perspective, some similarities can be drawn to 1987 or 1998.

Before the pandemic, the global economy did not appear to have any excesses, the economy was not running too hot, central banks were not tightening.

There did not appear to be widespread speculation or silly individual investor behaviour during the bull run from 2009 until the pandemic. However, over the past year the silly behaviour has come, big time. There were 480 IPOs in 2020, and retail option trading increased 8x 2019 levels.

Monetary policy and high liquidity have lifted asset prices. If the economic recovery isn’t a sure thing, there could be an air-pocket ahead. Perhaps when things do get back to more normal thanks to vaccines, the market may realize how much economic damage has been done.

We are not convinced one way or the other. However, there are more bubbles today than a year or two ago which is concerning and not indicative of a new cycle. That doesn’t mean it won’t keep going. From our perspective, the strategy is to trade into some of the lagging or less expansive assets or markets. This should help protect on the downside, and if this is the start of a new cycle, this approach should also benefit from the steady global economic recovery back to ‘normal’.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.